5 Minutes

BNB Chain overtakes TRON as the busiest stablecoin network

BNB Chain has quietly climbed past TRON to become the most active blockchain for stablecoin interactions, driven by surging decentralized exchange (DEX) volume and spillover from Binance-backed trading incentives. Analysts at ARK Invest highlight how on-chain trading, memecoin activity, and targeted incentives helped shift retail and speculative flows toward BNB Chain — even as Ethereum and its Layer 2 networks remain dominant for institutional settlement.

Key numbers and market context

ARK Invest’s recent The DeFi Quarterly report estimates that roughly 192 million addresses have interacted with stablecoins since they first appeared. Tether (USDT) still leads adoption with around 115 million addresses, the now-defunct Binance USD (BUSD) is associated with roughly 35 million addresses, and USD Coin (USDC) tracks at about 31 million.

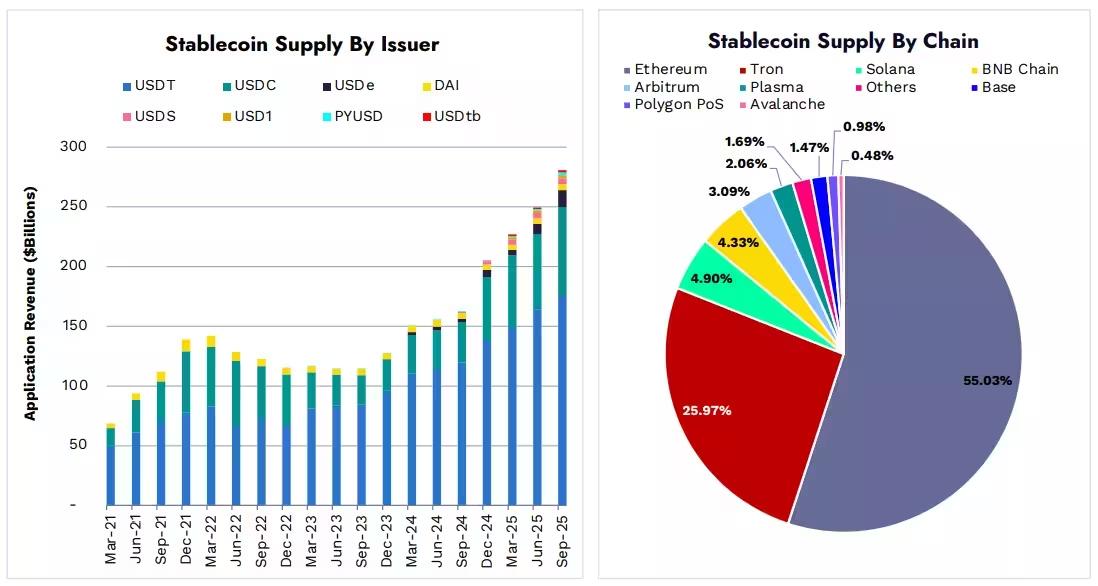

Stablecoins by issuer and chains

The same report shows quarterly stablecoin adjusted transaction volume grew about 43% year-to-date, approaching $9 trillion in the third quarter of 2025. That acceleration implies faster circulation and greater multi-chain distribution of dollar-pegged tokens than ever before.

Shifting network shares and user engagement

Ethereum remains central to dollar-denominated settlement, particularly when Layer 2 chains like Base and Arbitrum are included. Together, Ethereum and its Layer 2s account for approximately 48% of stablecoin transactions. But the share dynamics have changed: ARK’s data shows Ethereum’s share of stablecoin supply rose from 51% to 55%, while TRON’s slipped from 32% to 26% as newer networks captured activity.

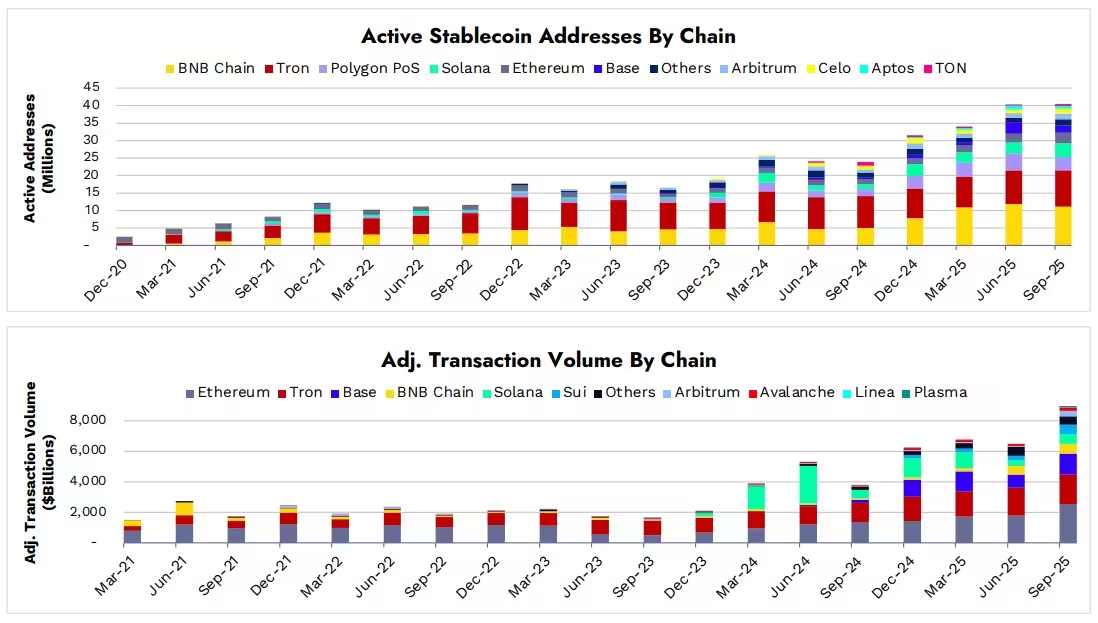

Active stablecoin addresses by chain

BNB Chain picked up much of the reallocated activity as Solana’s share eroded and spot DEX trading migrated. BNB’s gains are most visible in user engagement and DEX volume, where it now commands a significant portion of activity that historically flowed elsewhere.

DEX surge: from Solana to BNB Chain

Decentralized trading activity has expanded rapidly. Since late 2024, total DEX volume climbed roughly 61%, from about $1 trillion to $1.7 trillion. During that shift, Solana’s share plunged from 47% to 19% while BNB Chain’s share surged from 11% to 47%.

What fueled BNB Chain’s growth?

ARK Invest points to Binance’s zero-fee trading program as a major catalyst. The program redirected memecoin and retail trading toward BNB Chain, boosting PancakeSwap volume and creating attractive trading flows for retail participants connected to Binance. That alignment of incentives and user base helped accelerate BNB Chain’s DEX activity.

Beyond incentives, BNB Chain shows high trading efficiency. In Q3 2025, BNB Chain posted the highest ratio of spot DEX volume to total value locked (TVL) — roughly 94.7x — compared with Ethereum’s ~3.83x. This indicates higher turnover and a greater concentration of speculative and retail liquidity on BNB Chain versus Ethereum’s deeper, longer-term capital.

Fragmentation, new stablecoins, and liquidity routing challenges

The broader stablecoin market is fragmenting. USDT and USDC still dominate, but their combined market share edged down from 93% to 89% as newer issuers gained traction. Ethena Labs’ USDe rose about 68% to nearly $14 billion, while PayPal’s PYUSD surged roughly 135% to around $2.4 billion — with most new liquidity appearing on Ethereum.

As on-chain trading has grown relative to centralized venues, the DEX-to-CEX ratio also shifted sharply: ARK reports the ratio rose about 192% in 2024, reflecting a structural move toward decentralized settlement and trading.

What this means for traders, institutions, and developers

For traders and retail users, BNB Chain currently offers higher turnover, lower friction for certain memecoin and retail strategies, and attractive DEX liquidity. For institutions, Ethereum and its L2 ecosystem remain the primary hub for dollar-denominated custody and settlement due to deeper liquidity and established counterparty frameworks.

The fragmentation across chains introduces routing and liquidity challenges. Liquidity is now spread across multiple blockchains and venues, increasing the complexity of best-execution routing and cross-chain swaps. At the same time, fragmentation creates opportunities for networks to specialize: some focus on high-frequency retail flows and memecoins, others on institutional settlement and stable long-term capital.

Outlook: specialization and coexistence

BNB Chain’s rise in active stablecoin users and DEX market share underlines how incentives, user behavior, and exchange-linked programs can reshape on-chain activity rapidly. While BNB Chain is unlikely to supplant Ethereum as the primary institutional settlement layer, it has claimed the crown for active retail engagement and DEX-led trading.

Moving forward, expect the market to remain multi-chain with specialized roles: Ethereum and L2s for institutional and settlement-grade flows, BNB Chain for high-turnover retail and memecoin activity, and other chains like Solana potentially refocusing to leverage strengths where they still hold product-market fit.

For traders, liquidity providers, and protocol designers, the imperative is clear: build efficient cross-chain routing, improve liquidity aggregation, and design incentives that align with the network’s intended user base and risk profile.

Source: crypto

Comments

Armin

Is this even true? stats look crazy, but liquidity routing headaches seem underplayed. Who wins when liquidity fragments... quick thought

coinpilot

Whoa BNB flipping TRON for stablecoin activity? wild. Binance incentives really move retail flows, memecoin mania, but can it last lol

Leave a Comment