4 Minutes

Metaplanet taps $100 million credit line secured by Bitcoin

Tokyo-listed Bitcoin treasury firm Metaplanet has drawn down a $100 million loan backed by its Bitcoin holdings to fund additional BTC purchases and a share buyback program. The financing, disclosed in a company filing, was executed on Oct. 31 under a credit agreement that uses the firm’s Bitcoin as collateral and carries a benchmark U.S. dollar rate plus a spread.

Loan purpose and repayment flexibility

Metaplanet did not identify the lender in the filing but emphasized the facility is short-term and repayable at any time. Proceeds from the credit line can be deployed for multiple purposes depending on market conditions: to buy more Bitcoin, to support Metaplanet’s options-based Bitcoin income strategies (where BTC is used to generate option premiums), and to repurchase outstanding shares.

Strong collateral coverage amid market swings

The company characterized the loan as conservative, pointing to its substantial Bitcoin treasury. Metaplanet reported holding 30,823 BTC — roughly $3.5 billion at the end of October — a balance the firm says provides comfortable collateral coverage even if BTC volatility pushes prices lower. Management added it expects only a minor impact from the $100 million draw on fiscal 2025 results and pledged to disclose any material changes promptly.

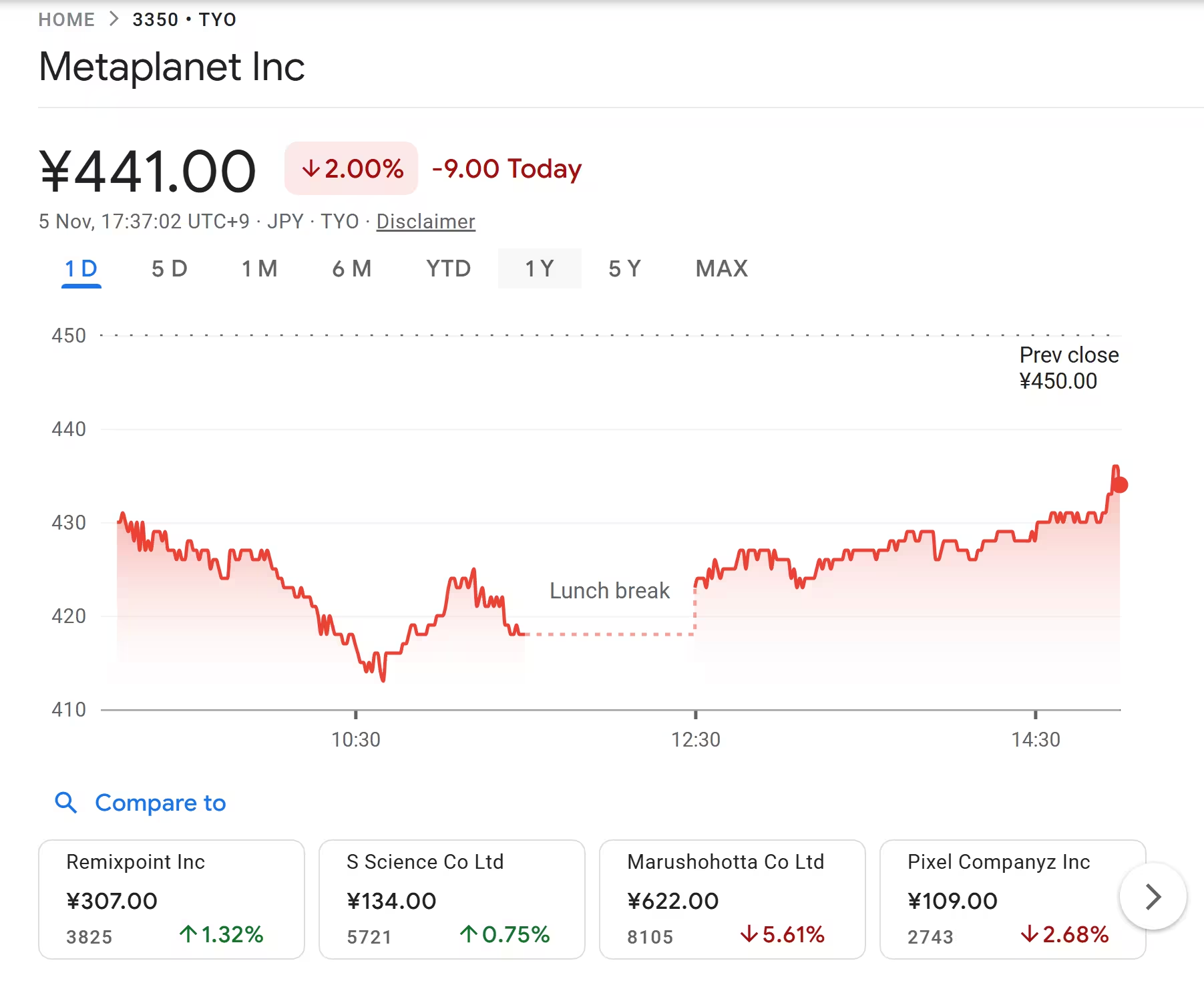

Metaplanet shares dropped 2% today

$500M buyback backed by Bitcoin financing

Days before announcing the $100 million draw, Metaplanet unveiled a 75 billion yen (about $500 million) share buyback plan financed with Bitcoin-collateralized borrowing. The buyback is aimed at restoring investor confidence after the company’s market-based net asset value (mNAV) briefly fell below parity.

mNAV dip, pause in BTC purchases and long-term targets

The company’s market-based NAV — a ratio comparing the firm’s market value to the worth of its Bitcoin holdings — slipped to 0.88 in the recent downturn before recovering above 1.0. Metaplanet temporarily paused new BTC acquisitions during that decline but reiterated its long-term target to hold 210,000 BTC by 2027, signaling continued commitment to a Bitcoin-heavy treasury strategy.

Industry context: ratings and criticism of crypto treasury models

In the wider sector, credit ratings and research reports have put the Bitcoin treasury model under scrutiny. S&P Global assigned a speculative-grade “B-” rating to Michael Saylor’s Bitcoin treasury vehicle, Strategy, highlighting concentrated Bitcoin exposure, limited liquidity, and narrow business diversification as vulnerabilities.

Analysts at 10x Research have argued that several listed Bitcoin treasury companies issued shares at lofty premiums relative to their underlying BTC, and that those premiums have largely evaporated — inflicting sizable paper losses on retail investors even as firms accumulated actual Bitcoin.

What this means for investors

Metaplanet’s use of Bitcoin-backed borrowing and a sizable buyback reflects an effort to shore up market sentiment while leveraging its BTC reserves. For investors, the situation underscores both the potential benefits and risks of crypto-treasury strategies: access to financing and income generation on one hand, and concentrated exposure to Bitcoin price swings and liquidity constraints on the other.

Overall, Metaplanet’s move to secure a $100 million Bitcoin-backed loan while rolling out a $500 million buyback shows how listed crypto treasuries are using their BTC balance sheets to manage capital structure and investor confidence amid volatile markets.

Source: cointelegraph

Leave a Comment