3 Minutes

Spot Bitcoin ETFs reverse six-day outflow streak

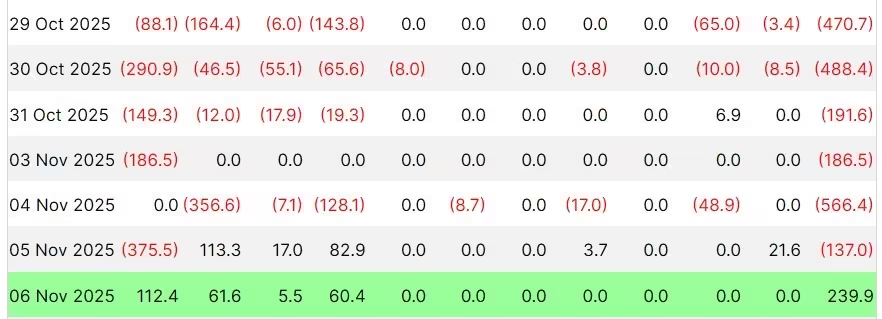

United States spot Bitcoin exchange-traded funds (ETFs) recorded a $239.9 million net inflow on Thursday, snapping a six-day run of redemptions that drained nearly $1.4 billion from the market. The shift suggests renewed institutional demand for Bitcoin (BTC) after a week dominated by profit-taking and macroeconomic uncertainty.

Spot Bitcoin ETF flows from Oct. 29 to Thursday

Flows led by BlackRock and Fidelity

Data from Farside Investors shows the largest contribution came from asset manager BlackRock, which added $112.4 million to its iShares Bitcoin Trust (IBIT). Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed with $61.6 million in inflows, while the ARK 21Shares Bitcoin ETF (ARKB) attracted $60.4 million. Grayscale’s GBTC, which had faced steady outflows since mid-October, showed no net change on the day.

The six-day sell-off represented one of the steepest pullbacks since U.S. spot Bitcoin ETFs began trading in January. The rebound on Thursday eased short-term selling pressure and highlighted how ETF products remain a central channel for institutional Bitcoin investments and liquidity.

Ether and Solana ETFs: mixed but resilient

Spot Ether (ETH) ETFs experienced a similar though smaller six-day outflow period. SoSoValue reports that ETH-based exchange-traded products saw about $837 million withdrawn before reversing course on Thursday with modest inflows of $12.51 million. This indicates that Ether-linked investment vehicles remain sensitive to the same macro drivers affecting Bitcoin ETFs.

Spot Ether ETFs data from Oct. 29 to Thursday

By contrast, spot Solana (SOL) ETFs have enjoyed strong demand since their Oct. 28 launch. SoSoValue data indicates Solana-based products have accumulated roughly $322 million in inflows and have not posted a day of net outflows since debuting, underlining investor appetite for altcoin exposure in ETF format.

ETFs' role in crypto market liquidity

Market makers and liquidity providers view ETFs as one of the main pillars supporting crypto market liquidity. In a recent blog post, crypto market-maker Wintermute identified stablecoins, ETFs, and corporate digital asset treasuries as the three primary channels fueling liquidity cycles — often exerting more influence on price action than protocol-level upgrades.

A survey from Schwab Asset Management reinforces institutional interest: 52% of respondents said they plan to invest in ETFs, and 45% expressed interest in crypto-linked ETF products. As ETF inflows ebb and flow, their impact on market depth and price discovery will remain a focal point for traders, asset managers, and institutions considering crypto exposure.

What this means for investors

The return of inflows to spot Bitcoin ETFs signals that institutional buyers are ready to re-enter after short-term profit-taking. For market participants, monitoring ETF flows — alongside stablecoin movements and treasury allocations — provides a practical gauge of liquidity and institutional sentiment in the crypto markets.

Source: cointelegraph

Leave a Comment