3 Minutes

China’s smartphone market hit a minor slowdown in Q3 2025, according to fresh IDC figures. Shipments in the mainland totaled 68.46 million units, a slight 0.5% decline year-on-year. The quarter’s softness reflects seasonal patterns and a cautious consumer mood.

Q3 slowdown: seasonal lull meets cautious buyers

IDC notes that the third quarter is typically quieter for phone sales, and 2025 followed that trend. Fewer high-profile launches and lower government subsidy activity left some buyers postponing upgrades. Add to that broader economic uncertainty, and spending momentum cooled.

Still, there are signs the market could rebound. Several brands pulled forward flagship launches — Xiaomi unveiled the Xiaomi 17 series earlier than usual in September — which may lift demand in the final quarter. Major shopping events like Double Eleven (November 11) could also spur purchases, although IDC analyst Arthur Guo warns the festival is "unlikely to spark significant additional consumer demand amid economic uncertainty."

How the top brands performed — a close race

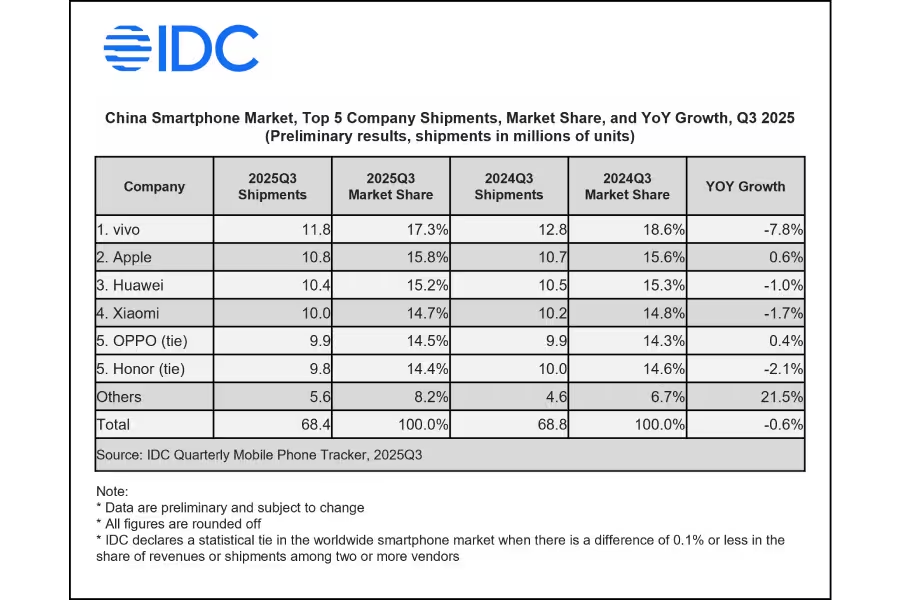

The leaderboard remained tightly contested, with tiny share shifts across major players. Here’s the brand breakdown from IDC’s Q3 snapshot:

- vivo: 11.8 million units shipped — 17.2% market share (down 7.8% YoY)

- Apple: 10.8 million units — 15.8% share (up 0.6% YoY)

- Huawei: 10.4 million units — 15.2% share (down 1.0% YoY)

- Xiaomi: 10.0 million units — 14.7% share (down 1.7% YoY)

- Oppo: 9.9 million units — 14.5% share (up 0.4% YoY)

- Honor: 9.9 million units — 14.4% share (share dipped 1.5% YoY)

vivo kept the top spot despite a notable year-on-year drop, while Apple eked out a modest gain. Huawei remains competitive, and Oppo showed slight recovery after earlier weakness. Honor matched Oppo in shipment volume but saw a marginal share decline.

What this means for consumers and brands

For consumers, the lull means more time to consider upgrades and compare prices and features. For brands, Q3’s flat performance underscores the importance of timing for new models and promotional pushes — especially ahead of big retail events.

Looking ahead, the market’s near-term trajectory will hinge on the success of late-year flagship launches, holiday promotions, and whether economic headwinds ease. If brands can stimulate interest with compelling devices and attractive offers, Q4 could reverse Q3’s slight dip.

Source: gizmochina

Leave a Comment