3 Minutes

Hashprice slide pushes smaller miners toward shutdown

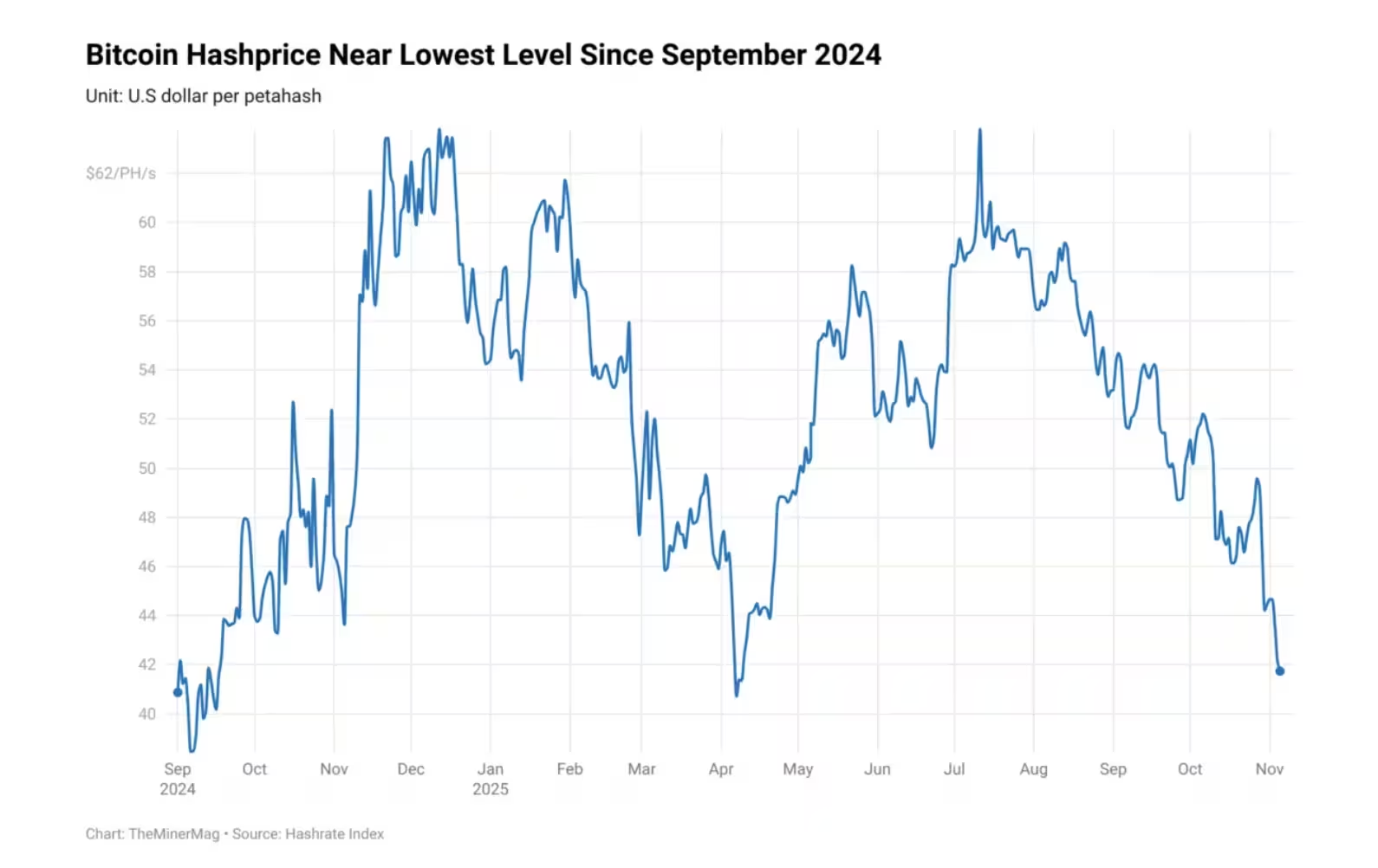

Bitcoin's mining sector is under renewed stress as the industry metric known as hash price falls toward the critical $40-per-PH/s mark. Hash price, which estimates daily revenue per petahash per second, has declined from a July peak above $62 per PH/s to roughly $42 per PH/s today. That drop squeezes already thin profit margins and forces many smaller operations to reassess whether to keep rigs online.

Hash price influences every step of the mining supply chain. As operators see returns shrink, hardware orders are slowing and manufacturers are adjusting strategies to recover lost sales. TheMinerMag reports miners are considering shutdowns, while suppliers face reduced demand and additional BTC-denominated losses after the October market slump.

Hash price plummets and nears a critical level

Supply-chain impact and manufacturers' response

Mining equipment vendors are reporting softer order books. Some public companies have moved to self-mining or stockpiling capacity to offset weaker machine sales. For instance, manufacturers such as Bitdeer have expanded their in-house mining operations to monetize excess inventory and stabilize revenue streams in the absence of robust hardware purchases.

Rising costs, capex and energy

High capital expenditure on ASIC upgrades, increasing energy costs, and the competitive pressure from a rising network hashrate have all contributed to compressed miner margins. For many operators, the economics of Bitcoin mining are increasingly marginal unless electricity contracts are highly favorable or machines operate at top efficiency.

Hashrate growth and halving effects

Meanwhile, Bitcoin's network hashrate keeps climbing, recently passing the 1 ZH/s milestone as specialized ASIC farms expand capacity. Higher hashrate increases competition for block rewards, while the April 2024 halving lowered the block reward to 3.125 BTC — continuing a long-term trend in which miners must process more work for fewer coins.

The Bitcoin network hashrate continues to climb and has broken past 1 zetahash per second (ZH/s)

Historical context and technological necessity

In Bitcoin's early years, individual nodes and CPUs could mine blocks. Today, ASICs are mandatory to be competitive. The combination of diminishing block rewards and relentless hashrate growth means many smaller miners face a binary choice: invest heavily in next-gen ASICs or power down.

Miners pivot to AI and compute contracts

To diversify revenue, several miners have expanded into AI compute and high-performance data center services. This pivot can offset the volatility of mining income and leverage existing data center infrastructure. Major examples include Cipher Mining's recent $5.5 billion, 15-year compute agreement with Amazon Web Services, and IREN's $9.7 billion GPU compute deal with Microsoft. These contracts illustrate how mining firms are monetizing excess power and rack space by providing GPU and specialized compute capacity for AI workloads.

As the industry adapts, market participants will watch hash price and Bitcoin price trends closely. Continued weakness in either could prompt further consolidation, while sustained price recovery or efficiency gains could stabilize mining profitability and restore demand for new mining hardware.

Source: cointelegraph

Leave a Comment