3 Minutes

Italian banks endorse digital euro but want staggered costs

Italian banks have publicly supported the European Central Bank’s digital euro initiative, endorsing the goal of digital sovereignty while urging the ECB and EU legislators to smooth implementation costs over several years. Marco Elio Rottigni, General Manager of the Italian Banking Association (ABI), said the industry sees value in a central bank digital currency (CBDC) but highlighted the heavy capital expenditure burden on commercial lenders.

Why banks favor the digital euro — with caveats

“We're in favour of the digital euro because it embodies a concept of digital sovereignty,” Rottigni said during a press seminar in Florence, according to Reuters. Italian banks are supportive of the principle that Europe should control a secure, public digital payment instrument. At the same time, they caution that development, integration, and compliance costs are significant and should be amortized across multiple years to avoid straining bank balance sheets.

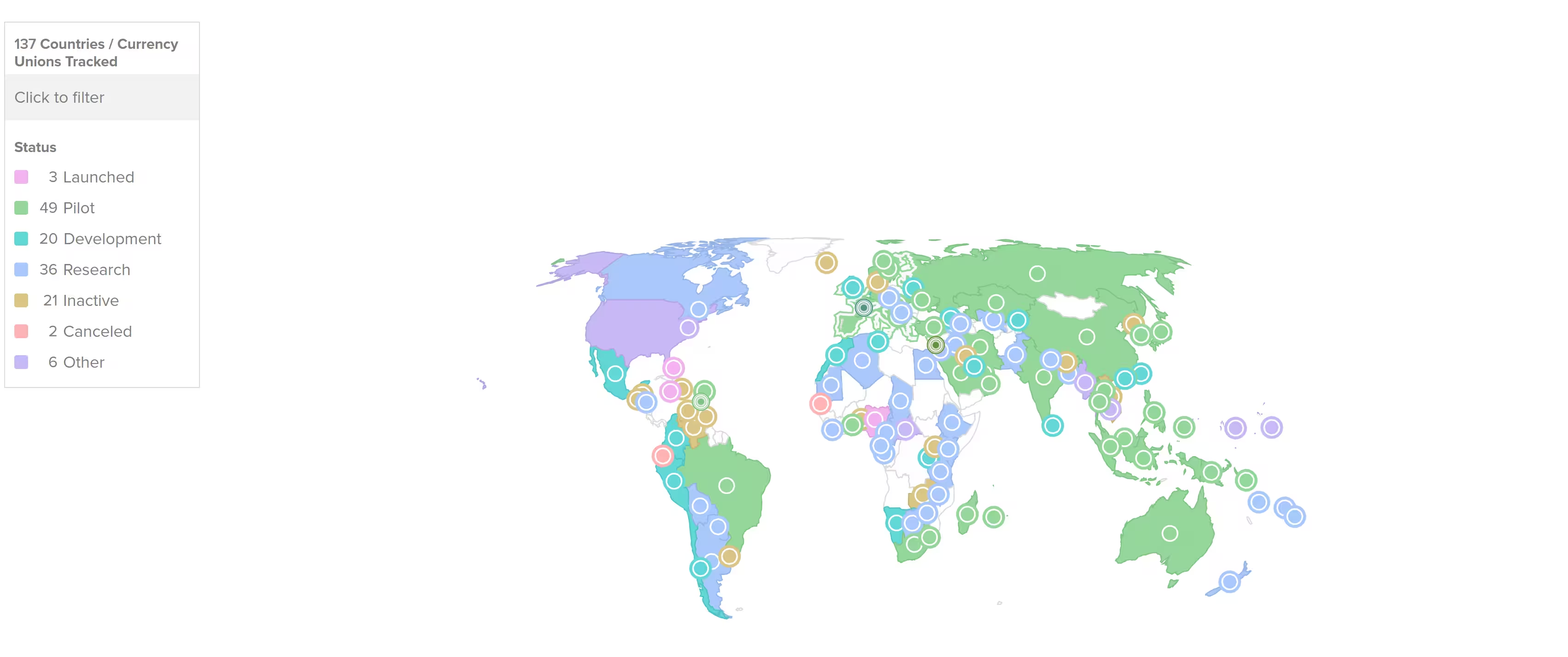

137 countries and currency unions, representing 98% of global GDP, are exploring a CBDC

Timeline and legislative milestones

The ECB’s Governing Council agreed on October 29–30 to move the digital euro project forward after a two-year preparatory phase. A pilot phase is planned for 2027, with a potential full rollout targeted for 2029, contingent on EU legislation expected in 2026. This timeline underlines the need for careful cost planning by banks that will integrate CBDC interfaces and retail wallet functionality into existing systems.

Commercial bank concerns and the twin approach

Some French and German banks have warned that an ECB-backed retail wallet could siphon deposits from commercial banks, weakening traditional intermediation. To address that, ABI’s Rottigni proposed a “twin approach” combining the ECB’s digital euro with complementary commercial bank-backed digital solutions. This hybrid model aims to protect private payment systems — like bank consortium initiatives such as Wero — while ensuring Europe remains competitive in digital payments.

Tech partnerships, risks, and functionality

The ECB has already signed framework agreements with seven tech providers to help build core functions for a retail CBDC. Contracts cover fraud and risk management, secure payment data exchange, and software development. Vendors named include fraud-detection specialist Feedzai and security firm Giesecke+Devrient (G+D). The planned features include alias lookup — allowing payments without knowing the recipient’s payment service provider — and offline payment capabilities, both of which are critical for mass retail adoption.

What this means for banks, regulators and crypto markets

For banks, the central issue is managing integration costs and safeguarding deposit stability while participating in a public digital currency ecosystem. Regulators must balance innovation, privacy, and financial stability. For the broader crypto and blockchain community, the digital euro represents a potential bridge between regulated CBDCs and private tokenized payment rails, with implications for digital sovereignty, payment system competition, and tokenization of assets.

According to the ECB, the selected firms will also develop features such as “alias lookup,” enabling users to send or receive payments without knowing the recipient’s payment service provider and offline payment capabilities.

Source: cointelegraph

Leave a Comment