4 Minutes

Long-term Bitcoin whales increase selling pressure in 2025

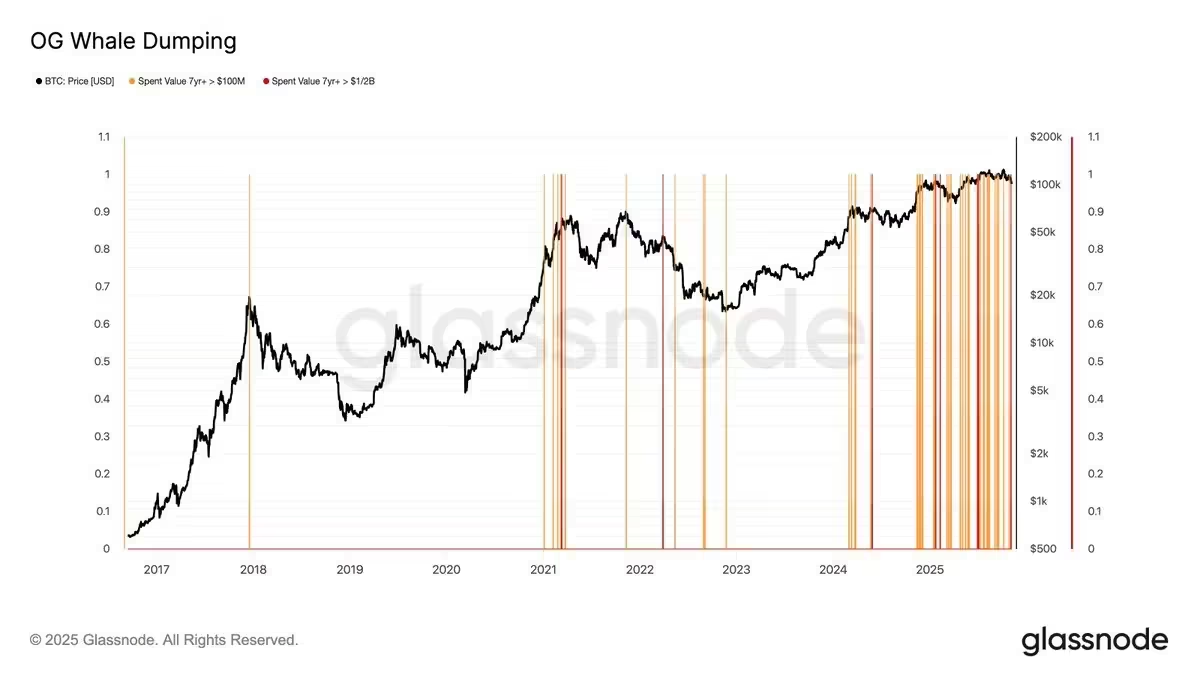

Bitcoin (BTC) faced renewed downside risk as long-term, or "OG," whale wallets began significant sell-offs throughout 2025. On-chain analytics and market charts suggest that heavy distribution from holders who have held coins for seven years or more is a key factor weighing on BTC price action and investor sentiment.

On-chain data highlights persistent outflows

Traders and analysts point to multiple prolonged outflows from legacy wallets as a primary driver of the recent correction. Charles Edwards, co-founder of Capriole Investments, flagged these high-volume transfers on social media, calling attention to a colorful pattern of $100 million and $500 million-level moves that intensified after November 2024 and accelerated into 2025.

Bitcoin OG whale dumping

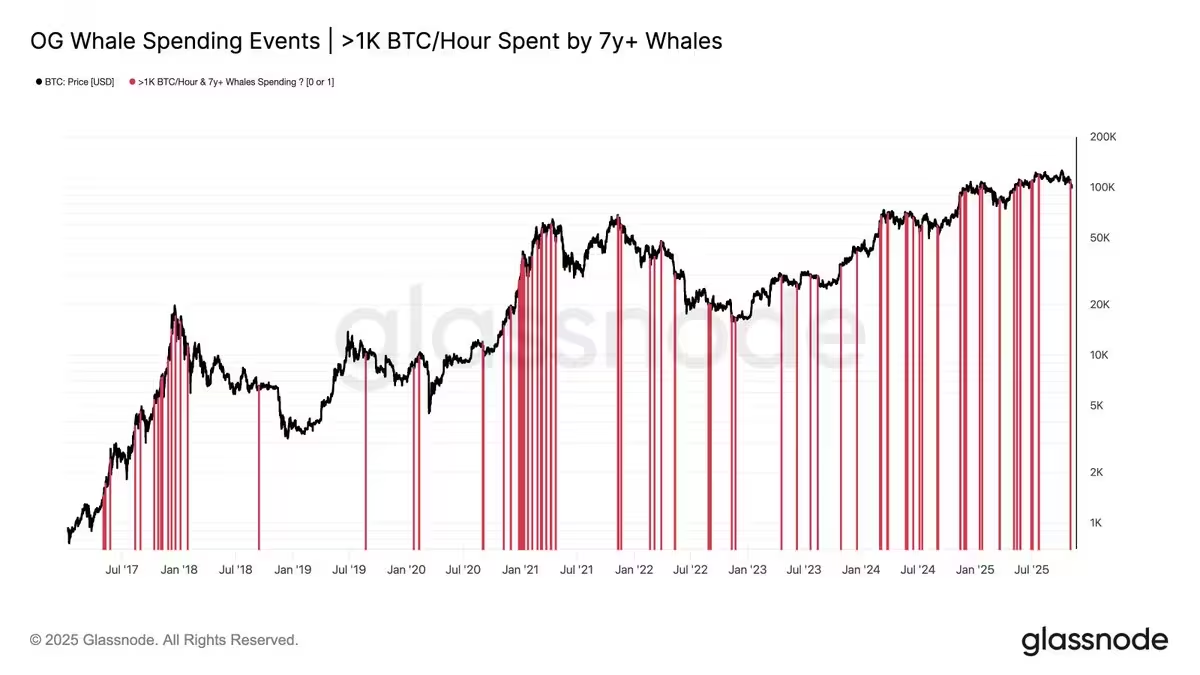

Glassnode metrics corroborate Edwards' observations, showing repeated events where more than 1,000 BTC per hour left long-held addresses. These sustained outflows have created distribution pressure that many market participants believe is suppressing an otherwise resilient market rally.

Bitcoin OG whale spending events

Not all moves mean immediate selling

Some experts, including Willy Woo, urge caution before concluding these transfers are outright liquidations. Woo notes that transfers from addresses dormant for seven years can represent activity other than spot selling: custody reshuffles, moves to Taproot addresses for quantum-resistant storage, or seeding of institutional treasury wallets. Such behavior can inflate on-chain "spend" metrics without equating directly to market supply being sold into exchanges.

One notable example identified by Lookonchain involved an address associated with "Bitcoin OG Owen Gunden," which moved roughly 3,600 BTC (about $372 million) toward exchange infrastructure. Reports indicated an initial 500 BTC deposit to Kraken, with the remainder likely to follow — activity that raises red flags for spot liquidity and exchange order books.

Technical picture: bear pennant raises possibility of deeper correction

Beyond on-chain flows, technical indicators are painting a cautious outlook. Cointelegraph Markets Pro and TradingView charting show BTC forming a bear pennant — a continuation pattern that often precedes a downward leg following consolidation. In this setup, a decisive break below the pennant's lower trendline near $100,650 could pave the way for a measured move toward approximately $89,600, roughly a 12% decline from recent levels.

BTC/USD six-hour chart

Market strategists emphasize the importance of the weekly close relative to the 50-week exponential moving average (EMA). The 50-week EMA sits near $100,900; a weekly close above that level would reduce odds of a heavy correction, while failure to hold it could open the path toward $92,000 or lower.

What this means for traders and investors

For crypto traders, the confluence of persistent OG whale outflows and the bear pennant pattern warrants heightened risk management. Short-term traders may watch pennant support and the 50-week EMA closely for trade signals, while longer-term investors should monitor exchange inflows and on-chain distribution events to gauge whether selling represents genuine market supply or custodial rotations.

Keywords such as Bitcoin, BTC price, whales, on-chain analytics, Glassnode, Kraken, bear pennant, and 50-week EMA remain central to decoding market signals. Sentiment can shift quickly: sizable whale deposits to exchanges often precede short-term volatility, but not every transfer equates to a sell order.

Bottom line

OG whale activity in 2025 has injected renewed uncertainty into the Bitcoin market. While some of the movements likely reflect custody changes or preparations for quantum-safe storage, the frequency and scale of transfers — coupled with a technical bear pennant — create a credible path toward $90,000 if key support levels fail. Traders and investors should prioritize on-chain monitoring, exchange flow analysis, and strict risk controls as the market navigates this critical phase.

Source: cointelegraph

Leave a Comment