4 Minutes

Bitcoin fills CME futures gap but rebound stalls

Bitcoin recovered down to a familiar technical target after the Wall Street open, filling the recent CME Group futures gap near $104,000. Despite that gap fill — a pattern traders have tracked reliably for years — a large market sell-off from whale orders arrested any meaningful BTC price rebound toward $104K and beyond.

BTC/USD four-hour chart

Resistance capped gains near $107.5K

The BTC price had attempted to push higher after fresh November highs near $107,500, but that level created a strong resistance zone. Sellers stepped in, reversing the intraday move and driving the pair back toward the weekend gap that appeared on CME Bitcoin futures. Historically, these futures gaps are short-term magnet levels for Bitcoin, and this week was no exception.

CME Bitcoin futures one-hour chart

Market commentator Daan Crypto Trades noted that the early-week gap fills have become an almost routine occurrence: a reliable technical behavior that market participants anticipate. With the gap closed, attention pivoted to order-flow and whale behavior to determine whether bulls could reassert control.

Whale selling: a $240M market dump

On-chain and order-book analytics flagged a dramatic influence from large sellers. Material Indicators highlighted what it described as a $240 million market dump that appeared in the BTC order book, which pressured the price around the $104K area.

That large liquidity sweep coincided with renewed short interest and additional selling, as trader Skew observed: “Some size sold into $104K price area & renewed short interest,” identifying that region as a pivotal point for intraday direction.

BTC/USDT order-book data

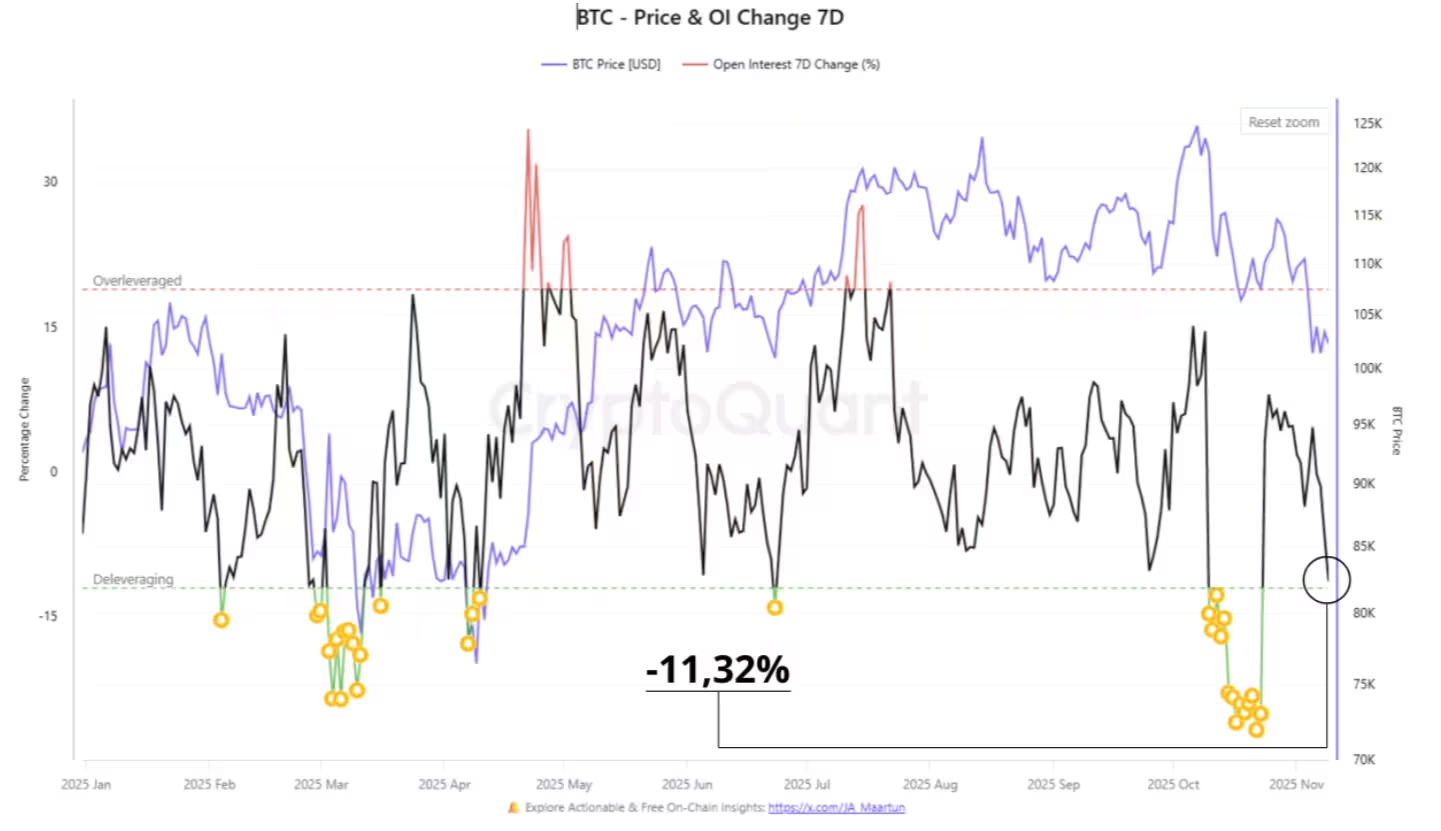

Derivatives deleveraging signals lower risk appetite

Beyond the spot order book, derivatives metrics reflect a cautious market tone. CryptoQuant reported an 11.32% drop in open interest (OI) across one week — an indicator that speculative leverage is being removed. Historically, such deleveraging episodes often precede consolidation and can set the stage for the next leg higher, as excess leverage is absorbed.

Does this create a buying opportunity?

CryptoQuant contributors framed the ongoing deleveraging as a potential buying window for long-term holders. While short-term volatility may persist, reduced open interest implies fewer speculative positions that could be force-liquidated in the next sell-off, which may help stabilize BTC price action around the $100,000 psychological level.

What to watch next: if whales remain active selling into local highs, resistance around $107K–$108K will likely hold. If OI continues to shrink and exchanges show net inflows to spot wallets, traders could interpret the current range as a consolidation phase ahead of another attempt at $100K-plus levels.

Takeaway

The recent CME gap fill near $104K followed established technical behavior, but the momentum to retake higher levels was halted by a sizable $240M sell-side event and a broader derivatives deleveraging. Traders should monitor whale order flow, open interest trends, and liquidity around key psychological levels ($100K and $104K) to gauge the next directional move for Bitcoin. For market participants focused on risk management, the present environment emphasizes the value of watching on-chain signals, order-book imbalances, and futures metrics before committing to fresh directional exposure.

Source: cointelegraph

Leave a Comment