5 Minutes

Market reaction: why the recent BTC pullback isn’t explained by headline events

Bitcoin’s recent price pullback has sparked debate across crypto markets, but traders and on-chain analysts say the retreat is unlikely to be driven mainly by the short-lived US government shutdown or fears of an AI bubble. Instead, several crypto experts point to structural market dynamics — including high futures leverage and liquidity flows — as more plausible culprits behind BTC’s drop from October highs.

Context: the latest price action and investor narratives

Bitcoin (BTC) slipped to its lowest level in nearly eight months after reaching all-time highs of $125,100 in October. Many observers attributed volatility to macro headlines, such as the recent US government shutdown and widespread AI euphoria. Yet leading on-chain analysts have pushed back, arguing that these narratives don’t fully explain the scale or timing of the decline.

Bitcoin is down 13.90% over the past 30 days.

The shutdown thesis held that federal uncertainty would reduce risk appetite and spill into crypto. The AI-bubble angle suggested investors rotated out of speculative assets as tech valuations came under scrutiny. But analysts monitoring on-chain and derivatives data say the real story is more technical.

Futures leverage and forced liquidation dynamics

Rational Root, a noted on-chain analyst, argued in a recent podcast that excessive leverage in Bitcoin futures was the primary driver of the drawdown. When funding rates and leverage reach elevated levels, even modest price moves can trigger cascading liquidations that amplify volatility. These deleveraging waves often look like panic selling but are mechanical — tied to margin calls and forced exits — rather than purely sentiment-driven by news events.

PlanB and other market modelers also dismissed the AI-bubble thesis. Analysts noted Nvidia’s strong earnings and record revenue — which in many ways validated AI optimism rather than undermining it — arguing that AI-related fear does not neatly translate into Bitcoin weakness in this instance.

Remaining narratives: cycle theory and liquidity

Only a few macro explanations remain on the table. First is the long-discussed four-year Bitcoin cycle narrative. Some proponents still see the traditional halving-driven price rhythm as a dominant force. Critics, including institutional voices like Cory Klippsten of Swan Bitcoin, argue that institutional adoption could be muting or altering those historical cycles.

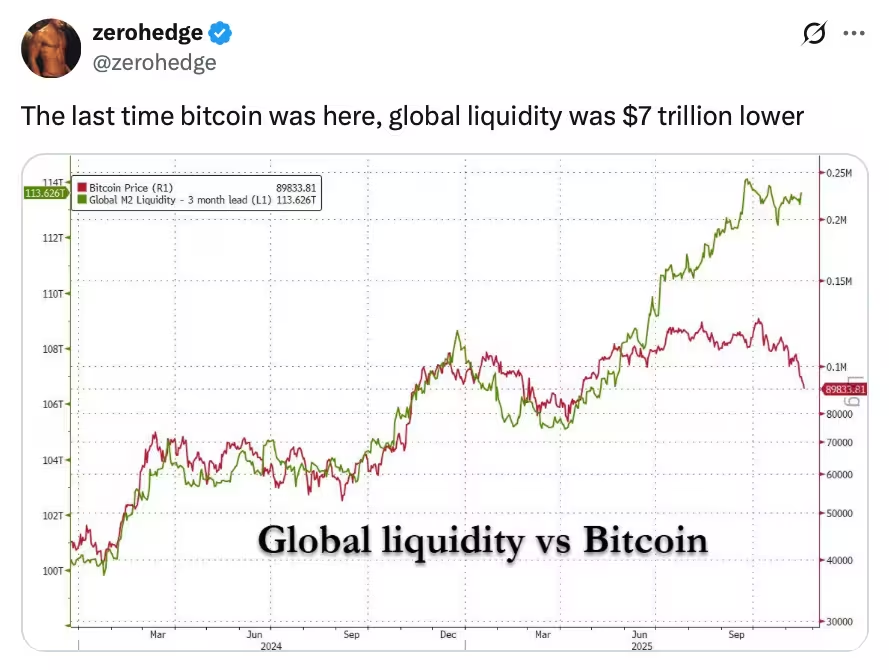

Second is global liquidity. Many traders track measures such as M2 money supply and central bank behavior to assess risk asset flows. Strike CEO Jack Mallers recently noted that Bitcoin is particularly sensitive to liquidity shifts — it often moves ahead of other markets as flows change.

A constructive view: resets can precede stronger rallies

Analysts like Rational Root emphasize that periodic resets during bull runs can be constructive. He highlighted that in the last three years BTC experienced several reset events comparable to bear-market drawdowns; each reset preceded renewed upward movement. From this perspective, the recent consolidation could create a cleaner base for the next leg up, especially if leverage normalizes and liquidity conditions turn more supportive.

Some market participants also expect US regulatory and institutional developments to shape the medium-term outlook. With the government back in session, speculation persists that the SEC could greenlight more crypto exchange-traded funds (ETFs) in 2026, a shift that could attract fresh institutional capital.

What traders should watch next

Key indicators to monitor include futures funding rates, open interest, spot liquidity, and macro liquidity gauges. On-chain metrics such as accumulation by long-term holders, exchange inflows/outflows, and realized volatility can help distinguish structural corrections from sentiment-driven sell-offs. Combined with macro catalysts — regulatory clarity or ETF approvals — these data points will better explain Bitcoin’s next directional move.

Overall, analysts advise focusing on market internals instead of headline chasing. While headlines like a US shutdown or AI hype can influence sentiment, the mechanics of leverage and liquidity typically drive the sharper, short-term swings in BTC markets.

Source: cointelegraph

Comments

Ethan

Seen this in prop desks: funding spikes -> margin calls then dump. Not sexy, just mechanical. patience, trim leverage and ride the reset.

pegshift

Is it really the shutdown? Feels more like futures leverage and cascading liquidations. Media will still pick headlines tho, sigh.

Leave a Comment