3 Minutes

Bitcoin OGs cashing out raises liquidity and selloff risks

The recent transfer of Bitcoin from long-term holders to less committed buyers has renewed debate about market resilience. As BTC $86,421 sees larger volumes shifting hands, veteran gold investor Peter Schiff warned that this movement — from so-called "OGs" to "weak" hands — could amplify future selloffs. Schiff argues that when experienced holders liquidate, they increase available float and create opportunities for sharper drawdowns if new owners lack conviction.

Why moving coins out of strong hands matters

When whales and early adopters exit positions, they inject significant liquidity into the market. That liquidity can be absorbed by retail traders and institutions in the short term, but it also raises the risk of heavier price corrections down the line. The market’s capacity to handle concentrated selling depends on depth, exchange order books and the behavior of new entrants. Data shows that whales and long-term holders offloaded more than 400,000 BTC in October, contributing to downward pressure that pushed prices below key levels.

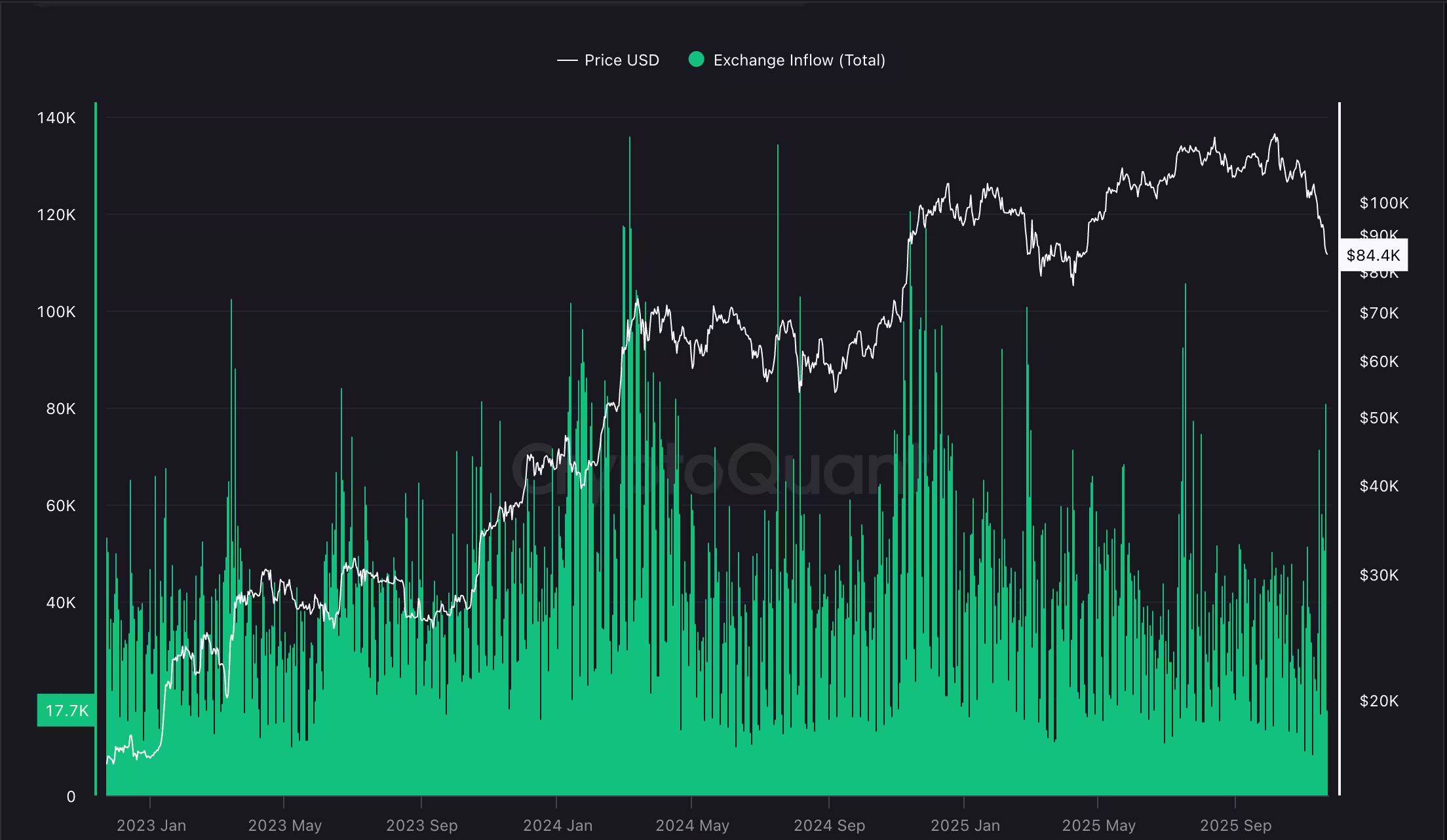

The Bitcoin exchange inflow, which tracks the number of BTC sent to exchanges for selling, remains elevated.

Who is selling and how the market reacts

High-profile sellers included some of the earliest holders and public investors. For instance, one early adopter sold an entire 11,000 BTC position in recent months, while author and investor Robert Kiyosaki disclosed he sold his holdings after a long period of accumulation. Kiyosaki said he will redeploy profits into cash-flowing businesses and may re-enter Bitcoin later with positive cash flow — a sign of shifting strategies among seasoned investors.

Leveraged liquidations and short-term pressure

Analysts point to two immediate causes of recent drawdowns: selling by long-term holders and leveraged liquidations in crypto derivatives markets. Firms like Bitfinex have suggested these forces are the dominant drivers of short-term price weakness. Forced liquidations can trigger cascading outsized moves, especially when combined with concentrated selling from whales.

Despite the turbulence, some fundamentals remain favorable. Institutional interest and adoption continue to support Bitcoin’s long-term narrative, and many market participants believe that improved liquidity conditions will eventually restore upward momentum.

Retail conviction and the path ahead

However, lack of conviction among retail investors is a critical vulnerability. Venture leader Vineet Budki of Sigma Capital warned that retail holders often sell at the first sign of trouble, and that this behavior can exacerbate declines in a bear market — potentially driving steep drawdowns. The interplay between institutional absorption capacity and retail sentiment will likely determine whether the market stabilizes quickly or faces a prolonged correction.

For traders and investors, monitoring exchange inflows, whale wallets, on-chain liquidity metrics and derivatives positioning remains essential. These indicators can offer early warnings of mounting sell pressure and help market participants prepare for increased volatility in both bull and bear phases.

Source: cointelegraph

Leave a Comment