4 Minutes

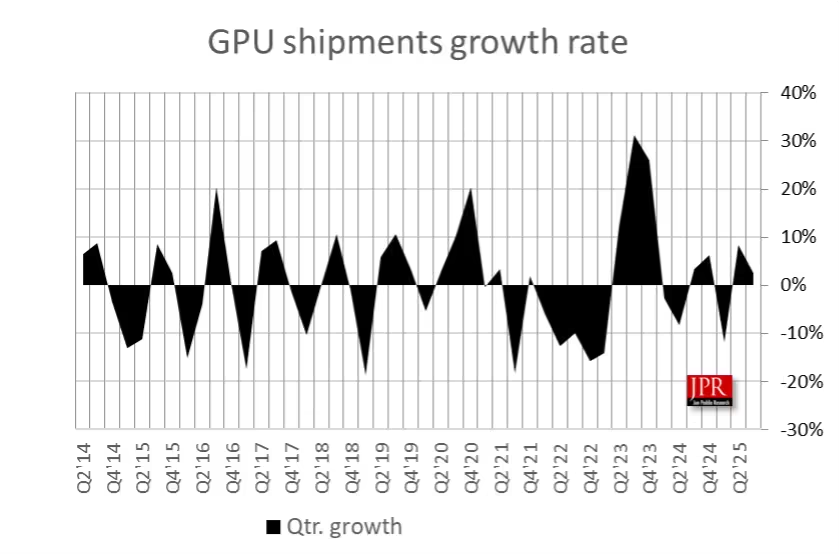

Jon Peddie Research's Q3 2025 snapshot shows a PC graphics market that’s nudging higher: overall GPU and CPU shipments climbed modestly, discrete cards saw a healthy year-over-year jump, and AMD picked up ground in the quarter even as yearly trends tell a more mixed story.

Q3 by the numbers: modest growth, discrete strength

Here are the headline figures from JPR’s Q3 2025 report:

- Global PC GPU shipments: 76.6 million units (overall GPU shipments rose 4.0% year-over-year).

- PC CPU shipments: 65 million units.

- Quarter-over-quarter, GPU shipments increased 2.5% and CPU shipments rose 2.2%.

- Discrete GPUs jumped 10.7% year-over-year, while notebook GPUs increased 1.4%.

- GPU attach rate (integrated + discrete across desktops, notebooks, workstations) climbed to 120%, up 2.9% from the prior quarter.

- The overall PC CPU market was down 2.2% year-over-year but up 2.2% quarter-over-quarter.

Market share: a quarter of shifts and a year of reshuffle

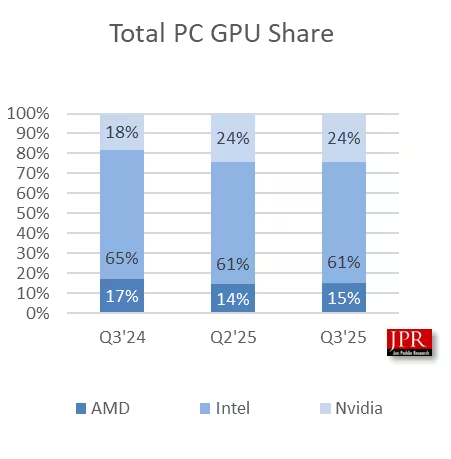

This quarter gave AMD some momentum. On a quarter-to-quarter basis, AMD’s overall GPU share rose by roughly 0.9%, while NVIDIA and Intel slipped about 0.1% and 0.9% respectively. Still, looking at year-over-year figures paints a different picture:

- Intel remains the largest in total GPU shipments (including iGPUs), holding about 61% of the market.

- NVIDIA climbed from 18% in Q3 2024 to 24% in Q3 2025 — the strongest year-over-year gain among the three.

- AMD’s share fell from 17% a year ago to roughly 15% in Q3 2025.

When you narrow the view to discrete GPUs, NVIDIA dominates — previously reported Q2 numbers showed NVIDIA with about 94% of that market, AMD at 6% and Intel effectively 0%. That split is expected to remain largely unchanged for Q3.

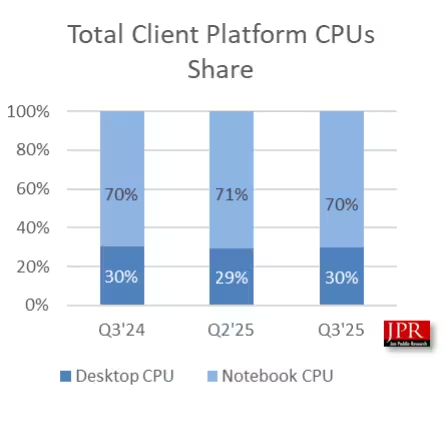

CPUs: notebook demand stays dominant

CPU shipments showed a small uptick quarter-over-quarter and AMD added roughly 1% to its CPU market share while Intel lost about 0.8%. The split between form factors remains steady: notebooks account for roughly 70% of CPU shipments and desktops for 30%, unchanged from last year.

Why this matters — short-term bumps, long-term positioning

What should industry watchers take away? Discrete GPUs getting a double-digit yearly lift suggests gamers and professionals are still upgrading or buying new systems, even if the broader PC market is relatively flat. AMD’s quarterly gain is a sign its product and pricing mix is resonating in the short term, but NVIDIA’s year-over-year expansion shows it’s still the force to beat — especially in discrete graphics.

Intel’s large iGPU footprint keeps it top in total GPU shipments, but the company must convert that installed base to discrete or higher-performance designs to close the competitive gap in graphics performance markets.

Looking ahead: deals season and next-gen roadmaps

No vendor launched major new GPUs in Q3, and CPU activity was similarly quiet. That means Q4 is where seasonal promotions could lift shipments, and most eyes are on early 2026 for fresh product launches: NVIDIA, AMD and Intel are reportedly focused on new lineups expected in the first half of 2026. Expect the holiday quarter to show interesting swings, especially if pricing moves — AMD has reportedly notified partners of planned GPU price increases of at least 10% — and channel inventories shift.

In short: Q3 2025 brought steady growth and a few notable share moves, but the big story may still be coming as new GPUs and CPUs roll out next year.

Source: wccftech

Leave a Comment