3 Minutes

Solana ETFs draw $369 million amid ETF outflows

Solana-focused ETFs have attracted $369 million in net inflows so far this month as crypto investors shift toward yield-bearing products. While Bitcoin and Ether ETFs saw large redemptions, market participants increasingly treat SOL exposure as a productive, income-generating allocation rather than a pure speculative trade.

Capital rotation toward staking and yield

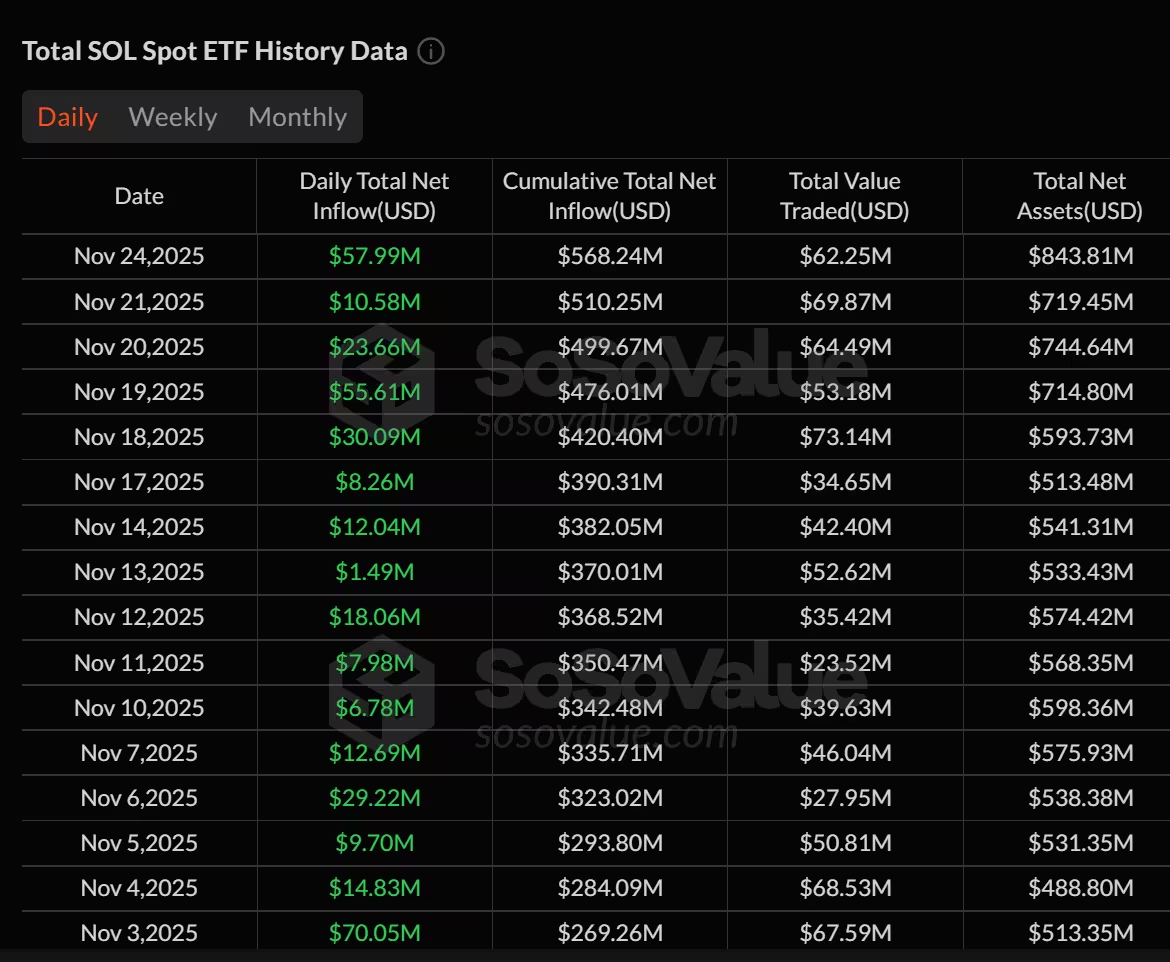

Data compiled by SoSoValue shows a striking divergence between the large-cap ETF market and Solana products: from Nov. 3 to Nov. 24, Bitcoin ETFs recorded roughly $3.7 billion in net redemptions and Ether ETFs lost about $1.64 billion, while Solana staking ETFs brought in $369 million. Solana ETFs have attracted $369 million in inflows this month. Source: SoSoValue

Bohdan Opryshko, co-founder and COO of Everstake, told Cointelegraph that both institutional and retail investors appear to view Solana as a yield-generating asset. Native staking rewards on Solana — commonly in the 5%–7% range — create a yield profile that Bitcoin ETFs cannot offer and that only some Ethereum products provide.

Staked supply climbs despite market swings

Network-level data indicates growing long-term engagement: total staked SOL jumped from roughly 350 million to 407 million this year, even while SOL traded between $100 and $260. Retail delegators increased modestly from about 191,179 to 194,157 between Oct. 30 and Nov. 24, and added more than 238,000 SOL during the market downturn. Whale delegators consolidated positions rather than exiting, keeping the overall stake steady. Everstake reported that Trezor users alone staked over 1 million SOL through its service in the month.

Why staking yield is becoming a primary driver

Market participants and service providers say staking yields are increasingly central to portfolio allocation. Opryshko described a bifurcation in crypto investing after ETF approvals: some investors focus on speculative appreciation via tradable assets, while others prioritize “productive assets” that generate passive income through staking. For a growing segment, staking yield is a primary allocation driver.

Solana’s competitive staking profile

Coinbase analytics indicates about 67% of circulating SOL is staked, a participation rate that Sebastien Gilquin of Trezor calls one of the strongest among major proof-of-stake blockchains. Institutions tightening traditional yield exposure are reportedly gravitating toward productive crypto assets; Solana-based ETFs pulled in over $420 million during their debut week last month, demonstrating demand for liquid instruments that can still offer native staking returns.

What investors should consider

Investors seeking yield should weigh the benefits of staking rewards against network and protocol risks. Staking can provide attractive nominal returns, but returns vary by provider and are subject to network performance, validator behavior, and lock-up or liquidity constraints depending on the product. Liquid staking ETFs or custody solutions can bridge yield with tradability, but fees and counterparty risk remain important considerations.

Overall, the recent inflows into Solana ETFs reflect a broader trend: crypto investors are increasingly diversifying between appreciation-focused holdings and yield-oriented, staking-enabled exposures as part of multi-faceted allocation strategies.

Source: cointelegraph

Leave a Comment