3 Minutes

Crypto Dispensers weighs sale amid legal turmoil

Crypto Dispensers, the Chicago-based operator of Bitcoin ATMs, is reportedly exploring a potential $100 million sale as its founder and CEO faces a recent federal indictment. The company said it has engaged advisors to run a strategic review and to gauge interest from prospective buyers, while making clear that it may remain independent depending on the review's outcome.

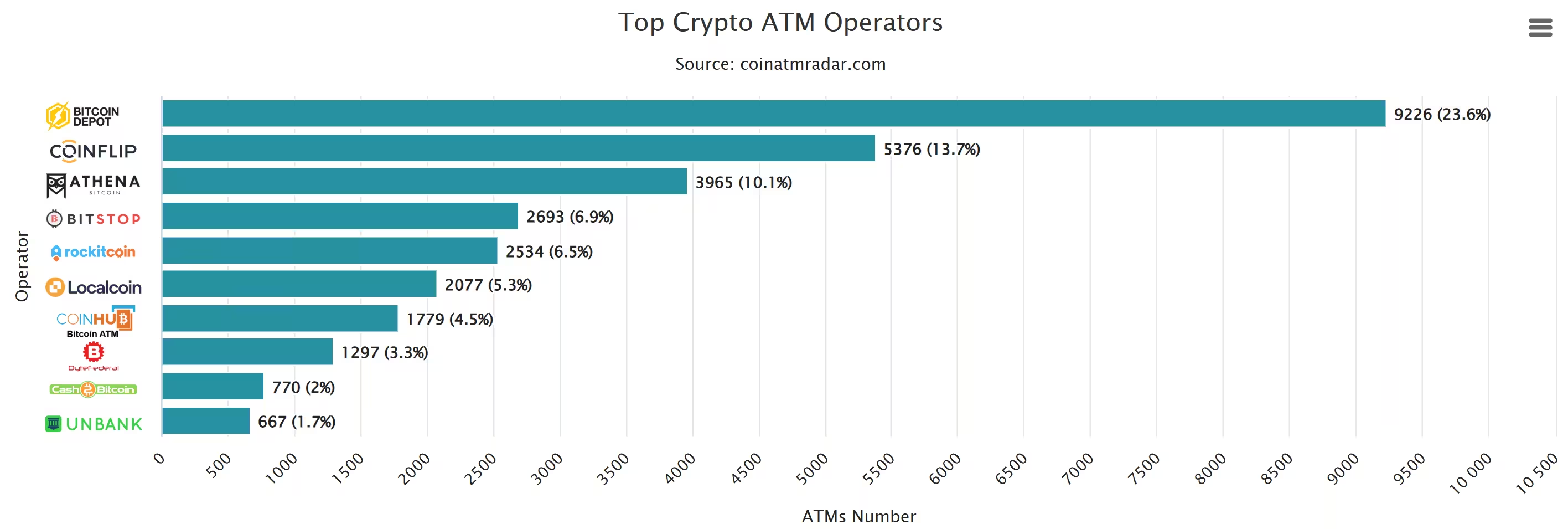

Top 10 crypto ATM operators

Shift from hardware to software and scale ambitions

In public statements, Crypto Dispensers highlighted a strategic pivot that began in 2020: a transition away from standalone kiosks toward a software-driven model designed to manage fraud, strengthen KYC controls and meet heightened regulatory requirements. CEO Firas Isa framed the sale review as the next stage of growth, noting, "Hardware showed us the ceiling. Software showed us the scale." The company cautioned there is no guarantee a transaction will be completed.

Why the timing is sensitive

The announcement comes just days after the U.S. Department of Justice unsealed an indictment charging Isa and the firm with facilitating an alleged $10 million money laundering scheme. Prosecutors allege that between 2018 and 2025 the company accepted illicit proceeds from wire fraud and narcotics trafficking through its ATM network, converted those proceeds into cryptocurrency, and transferred funds to wallets intended to conceal their origin. Both Isa and Crypto Dispensers have pleaded not guilty to the single conspiracy count, which carries a potential 20-year federal sentence. If convicted, assets tied to the alleged scheme could be subject to forfeiture.

Regulatory pressure on crypto ATMs intensifies

U.S. regulators and local governments have increasingly scrutinized crypto ATMs amid a rise in kiosk-related scams. The FBI reported nearly 11,000 complaints tied to crypto kiosks in 2024, with reported losses exceeding $246 million. Those figures have prompted lawmakers and enforcement agencies to question the anonymity of Bitcoin ATMs and their potential to facilitate illicit transactions.

Local responses: bans and limits

Several U.S. cities have moved to restrict or ban crypto ATMs. Stillwater, Minnesota, cited repeated consumer losses and banned kiosks after residents fell victim to scams. Spokane, Washington, implemented a citywide prohibition in response to a spike in fraud. Other municipalities prefer targeted limits: Grosse Pointe Farms, Michigan—despite having no active kiosks—adopted a $1,000 daily cap and a $5,000 two-week limit on future kiosk transactions to reduce fraud risks.

What this means for the market and users

For the broader crypto ATM market, a sale of Crypto Dispensers could signal consolidation as operators pivot from hardware to compliance-centric software services. For consumers, ongoing enforcement actions and local caps mean increased scrutiny of KYC processes and transaction limits at Bitcoin ATMs. Market participants and regulators alike will be watching how the DOJ case unfolds and whether buyer interest materializes in a deal that could reshape how crypto ATM services are delivered and governed.

Source: cointelegraph

Leave a Comment