3 Minutes

Bitcoin reclaims $90K as support amid holiday calm

Bitcoin staged a notable rebound, holding the $90,000 area as support and pushing BTC price targets back toward the mid-$90,000s. The rally coincided with subdued U.S. markets over the Thanksgiving holiday, giving bulls a breathing space from potential selling pressure and allowing spot and futures indicators to show improving health.

BTC/USD four-hour chart

Key resistance looms near yearly open

Traders say the next technical battleground sits around the 2025 yearly opening level above $93,000. If Bitcoin clears that threshold, renewed momentum could pave the way for six-figure price expectations. One well-known market commentator noted that a successful breach would reopen the path to $100,000, while cautioning that a period of consolidation would be desirable before a decisive breakout.

BTC/USD one-day chart

Why $97K–$98K matters

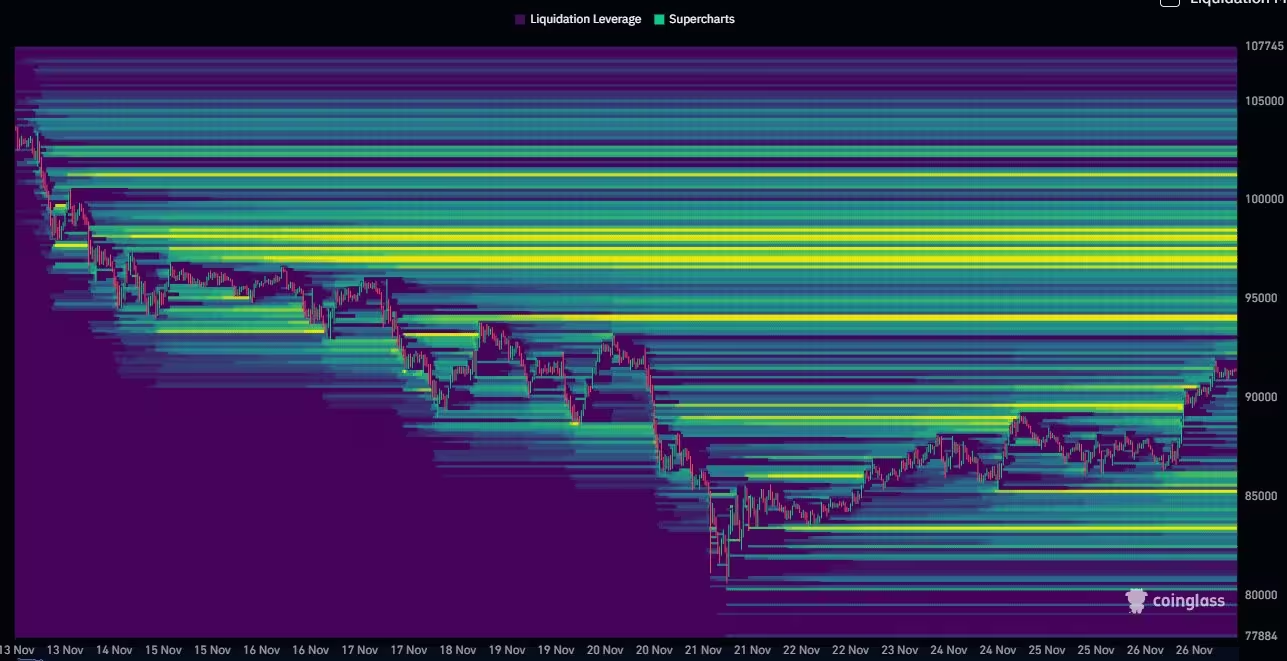

Order-book analysis from independent traders flagged the $97,000 to $98,000 band as a major liquidity cluster. This zone accumulated large sell-side activity during recent pullbacks, creating a pocket of marginally lower highs that now offers a clear upside target for market participants watching exchange liquidity.

BTC liquidation heatmap

Some analysts also suggested that a short-term retest toward $88,000 would be healthy for the uptrend, reinforcing the idea that the broader bull cycle for BTC remains intact despite periodic volatility.

Futures and on-chain signals point to a healthier setup

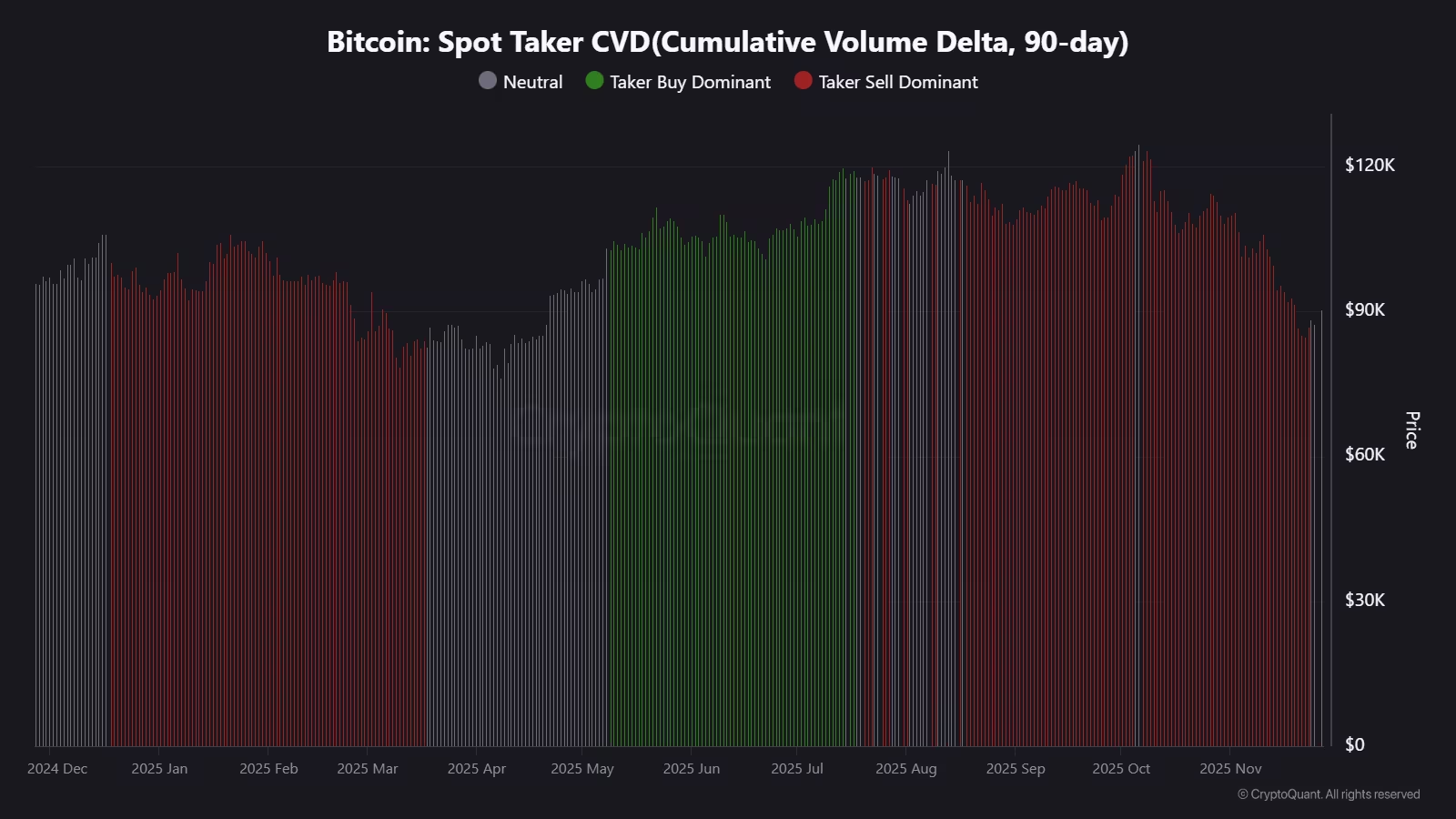

On-chain and derivatives metrics have started to tilt favorably for Bitcoin. CryptoQuant contributors and other on-chain analysts reported that spot taker cumulative volume delta (CVD) has improved, moving from negative territory back toward neutral—an indicator many view as a turning point for retail and spot demand.

Bitcoin spot taker CVD

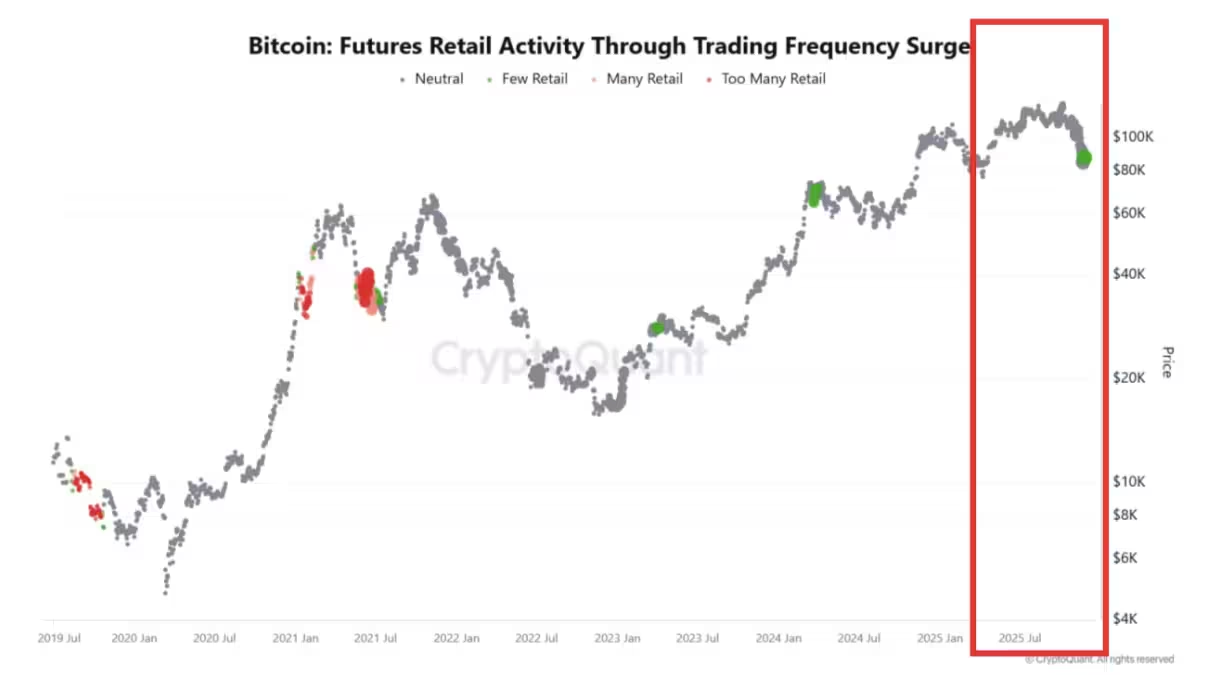

Concurrently, futures market dynamics indicate a recent deleveraging phase. That “washout” of excessive leverage, reflected in shrinking long/short imbalances and reduced liquidation risk, may establish firmer ground for a sustainable recovery. Institutional and longer-term capital flows appear to be re-entering, according to dedicated on-chain research teams tracking retail investor behavior on Bitcoin futures.

Bitcoin futures retail investor indicator

What traders should watch next

Market participants should monitor several key areas:

- Resistance around $93,000 (the 2025 yearly open) for a potential breakout toward $100,000.

- The $97K–$98K liquidity zone identified on exchange order books as a short-term upside magnet.

- Futures funding rates and liquidation maps to judge whether the recent deleveraging continues.

- On-chain CVD and retail futures indicators for signs that long-term capital is returning.

Overall, the mix of stabilizing spot flows, a cleaner futures backdrop, and concentrated order-book liquidity have combined to deliver what some analysts describe as a “significant step” toward a more durable Bitcoin recovery. While short-term swings remain likely, the technical and on-chain picture has improved enough to put six-figure scenarios back on the table for traders and investors monitoring BTC price action.

Source: cointelegraph

Leave a Comment