4 Minutes

Bitcoin at a pivotal resistance zone

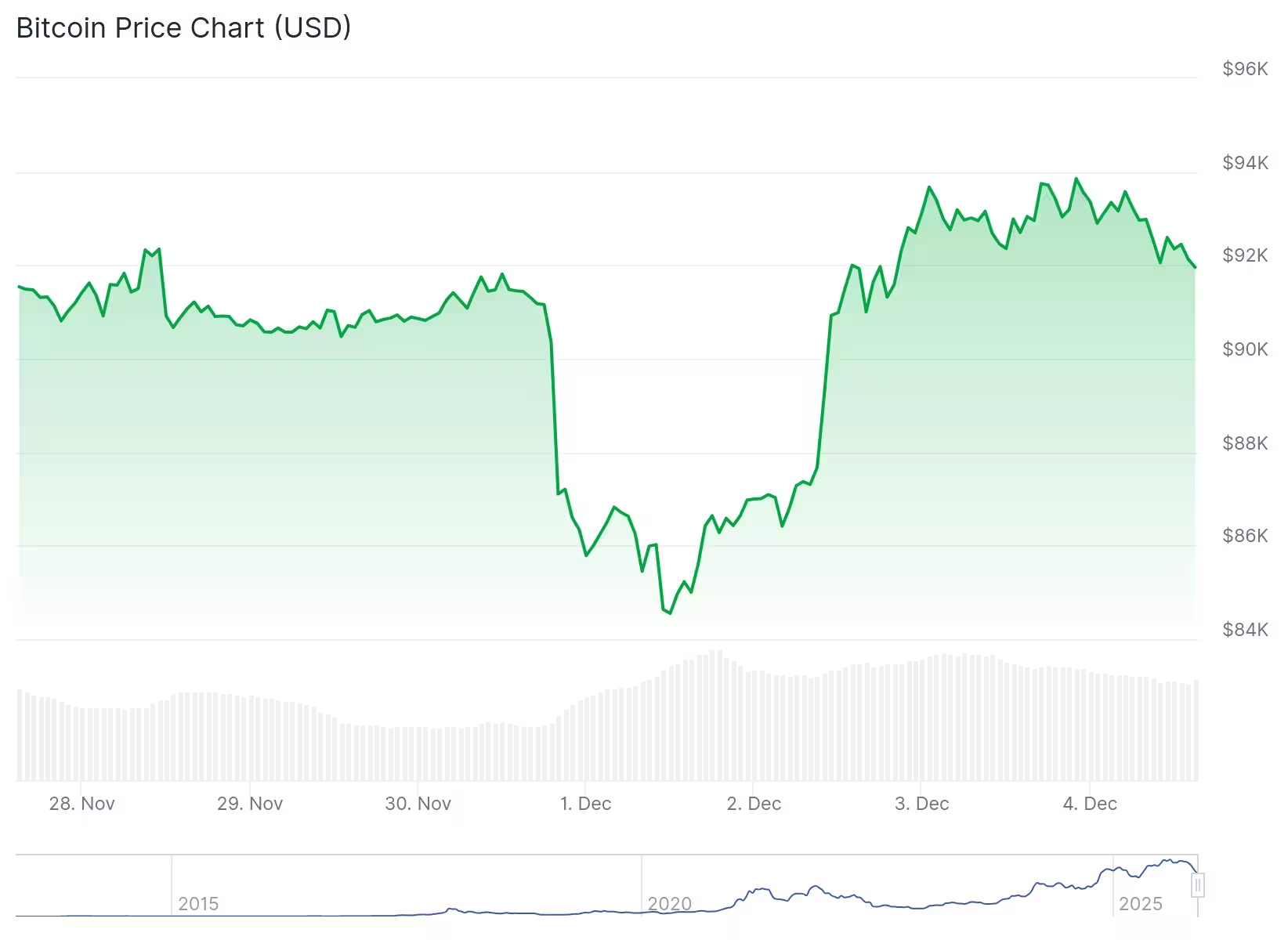

Bitcoin (BTC) is trading into one of the most consequential resistance areas of this cycle: the $98,000–$100,000 band. Traders and analysts are watching closely because a clean breakout through that zone could reshape the market’s high-time-frame structure and determine whether bulls can push Bitcoin into a final year-end leg higher or if the rally will stall and form a lower high.

Trader Mayne’s outlook and technical context

Popular crypto analyst Trader Mayne has emphasized that the coming days are decisive. After Bitcoin formed a cycle low near $80,000 and reversed an aggressive downtrend, price has climbed back to the yearly open. Mayne notes constructive elements—higher lows and a developing bullish break on the four-hour (H4) chart—but remains cautious because the market hasn’t yet produced a confirming H4 higher high.

Why the $98K–$100K band matters

The $98K–$100K band lines up with a daily downtrend line and a former price floor, creating a heavy confluence resistance. Clearing that area would be the first significant shift in macro structure since Bitcoin’s all-time high around $125,000. If bulls reclaim the zone and the downtrend line breaks decisively, the odds of a sustained rally increase materially.

Probability scenarios and market structure

Mayne assigns a higher probability to Bitcoin forming a lower high versus making a new all-time high—his base estimate sits around 70%–80% for a lower high—unless bulls manage to push past the $98K threshold and break the downtrend. In that altered scenario, the probability tightens closer to 50%–60% for a lower high, as a breakout would confirm a weekly cycle low and potentially trigger the last major rally of the four-year cycle.

What would a breakout vs. failure mean?

Breakout: bullish continuation

A clean break and quick follow-through above the $98K–$100K range could flip market sentiment and structure, opening the door for higher targets into year-end. Mayne highlights that the ideal bullish outcome would be an impulsive move without extended consolidation—rapid moves limit seller coordination and can trap short positions, accelerating momentum.

Failure: lower high and renewed downside

Failing to clear this resistance or producing choppy consolidation around the yearly open would resemble a bear-flag formation and increase the likelihood that Bitcoin has already printed its cycle top. In that case, Mayne believes a larger cyclical pullback could revisit $50K–$60K, presenting shorter-term opportunities for traders who prefer short exposure.

Macro environment and catalysts

Macro signals are a supporting backdrop for risk assets: the U.S. dollar index has rejected key resistance and dollar dominance is retreating, which can help renew liquidity flows into stocks and crypto. Other cycle catalysts cited include the end of Federal Reserve quantitative tightening, renewed liquidity expectations, and institutional developments such as Vanguard enabling IBIT purchases—all factors that could boost demand if momentum confirms.

Risk management and trading strategy

Even with near-term bullish signals, Mayne recommends caution. His preferred approach is to reduce spot exposure into strength—targeting near $100K or higher—and to hedge or derisk ahead of potential larger cyclical corrections. He also points out tactical trendline rules: a break above the daily downtrend signals bullish continuation, while a break of the rising short-term trendline would indicate the short-term structure is invalidated.

Bottom line

Bitcoin sits at its most important resistance since the all-time high. A decisive push through $98K–$100K could change the cycle narrative, while a failure there would likely confirm a lower-high scenario and hand initiative back to the bears. For traders, the immediate priority is to watch price action around this band, manage risk, and wait for follow-through that confirms whether momentum belongs to bulls or bears.

Source: crypto

Leave a Comment