3 Minutes

Pepe Coin under pressure despite renewed whale accumulation

Pepe Coin, one of the largest Ethereum-based meme coins, continues to trade under strain as technical indicators flash warning signs. The token recently dropped to $0.000004512 — roughly an 85% decline from its peak this year — and is hovering near its lowest levels since April of last year. While market-wide weakness has hit many meme tokens, including Shiba Inu and Dogecoin, on-chain activity shows significant whale interest that could influence short- to medium-term dynamics.

Key on-chain moves: whales buying, exchange supply slipping

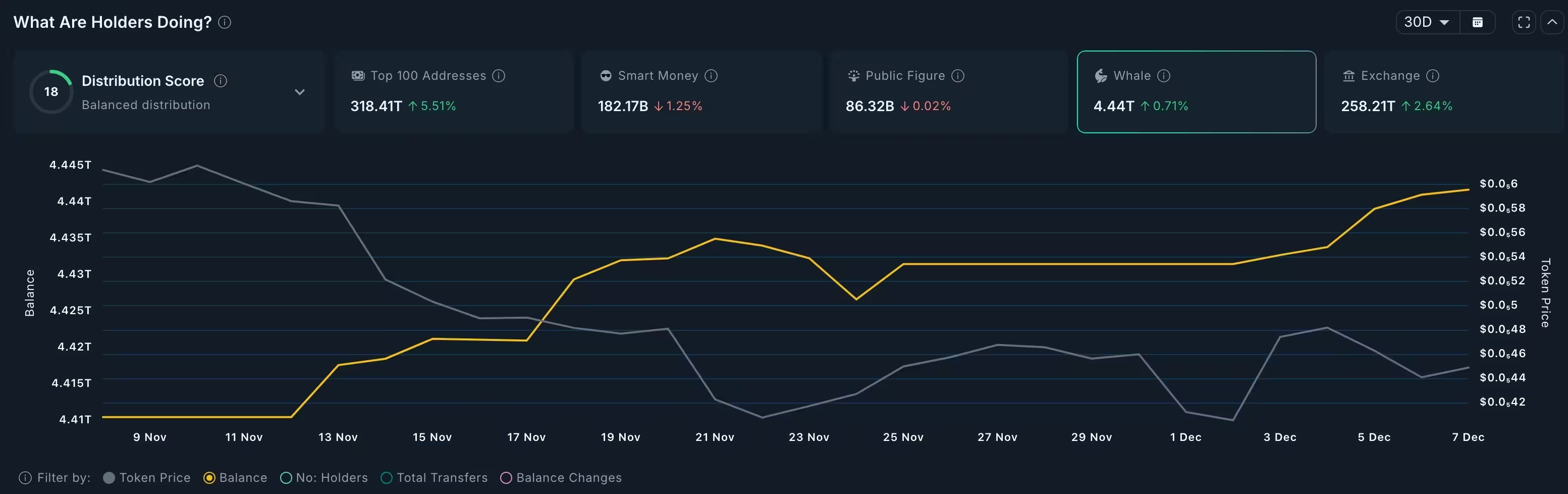

Nansen analytics reveal that large holders have increased their Pepe stakes, lifting whale balances from 4.41 trillion tokens in November to 4.44 trillion today — an accumulation of approximately 30 billion tokens. At the same time, the amount of Pepe held on exchanges has edged lower, falling to 258.2 trillion tokens from a recent high of 259.10 trillion. A declining exchange balance is often interpreted as buying pressure or long-term holding sentiment as investors withdraw tokens from exchange custody.

Pepe whales buying

However, not all on-chain metrics are bullish. Smart money addresses — often considered experienced or professional investors — have reduced their holdings to 182.17 trillion tokens, down sharply from this month’s high of 184.47 trillion. This sell-off among sophisticated wallets raises questions about whether accumulation by larger, less experienced wallets is opportunistic or contrarian to professional positioning.

Technical outlook: bearish patterns dominate

The weekly chart paints a cautious picture. Pepe fell from a reported all-time high of $0.00002832 in December to the current levels around $0.000045. The token has broken below a key support at $0.0000052, which also formed the neckline of a head-and-shoulders pattern. According to on-chain and price data, the pattern’s head sits at $0.002832 while the shoulders register near $0.00001665. Such structures typically signal trend reversals, and in this case, they point toward downside risk.

Pepe price chart

In addition, Pepe has formed a small bearish pennant — a short consolidation that follows a sharp move down and often precedes continuation of the same trend. Taken together, the head-and-shoulders neckline break and the pennant increase the probability of further downside toward the year-to-date low of $0.000002797 unless the market quickly recovers.

What traders should watch

Market participants should monitor whale accumulation trends, exchange balance flows, and smart money activity. A sustained drop in exchange supply accompanied by increased whale holding can indicate long-term buy-and-hold conviction, but supportive price action and liquidity are still needed to reverse the technical bearish setup. Key levels to watch include the $0.0000052 support-turned-resistance and the $0.000002797 year-to-date low.

Bottom line

Pepe Coin’s current setup blends on-chain accumulation by whales with clear technical risks. Traders and investors focused on meme coins should weigh the implications of continued smart money selling, potential bearish chart patterns, and reduced exchange supply before positioning for a rebound in this volatile sector of the crypto market.

Source: crypto

Leave a Comment