3 Minutes

Coinbase prepares to unveil prediction markets and tokenized equities

Coinbase, the largest US crypto exchange by trading volume, is reportedly set to reveal new product lines that include prediction markets and tokenized stocks. Bloomberg sources say the exchange will host a livestream on Wednesday to showcase upcoming offerings, although the company has not confirmed which features will be included in the presentation.

Livestream, leaks and industry context

Speculation accelerated after tech researcher Jane Manchun Wong identified landing pages for tokenized equities and prediction markets provided by Kalshi. While landing pages point to imminent launches, Coinbase has not yet officially rolled out these products. The move would place Coinbase directly into a competitive race with other exchanges and platforms expanding into event-driven trading and tokenized securities.

Coinbase joins prediction market coalition

On the same day Bloomberg published its report, Coinbase announced membership in the Coalition for Prediction Markets (CPM), a group initiated by Kalshi and Crypto.com. Faryar Shizad, Coinbase's chief policy officer, framed prediction markets as tools that help democratize fact-finding and deliver broader financial freedom. The CPM aims to engage with US policymakers to protect access to these markets.

How Kalshi and others shape prediction market growth

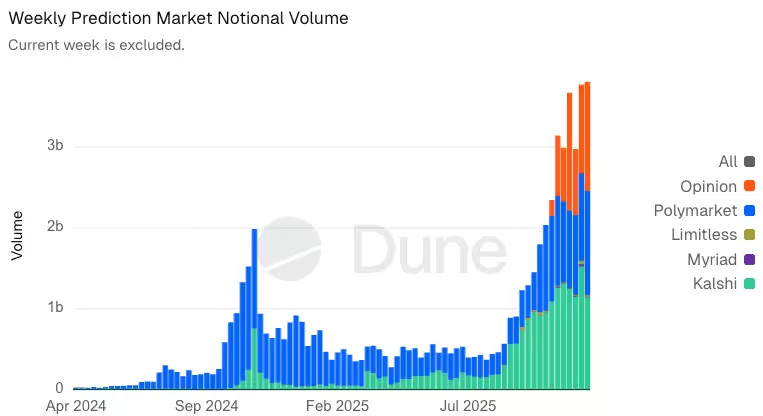

Kalshi, founded in 2018 by MIT alumni Tarek Mansour and Luana Lopes Lara, enables trading on real-world event outcomes as financial contracts. Alongside operators such as Polymarket and Opinion, Kalshi has driven a boom in prediction market activity. According to Dune Analytics figures cited by industry trackers, weekly trading volumes on major prediction platforms have surged — with some reports indicating peaks near $4 billion in recent weeks, though figures have been questioned by certain analysts.

Weekly trading volumes on prediction markets

Regulation and exchange competition

Regulatory scrutiny remains a key factor. The Commodity Futures Trading Commission recently gave guidance that created more clarity for prediction markets on data and record-keeping. Meanwhile, rival exchanges have accelerated launches: Crypto.com announced a dedicated prediction platform earlier this year, and Gemini obtained CFTC approval to offer prediction markets in the US. Any Coinbase rollout of tokenized stocks and event markets will likely proceed carefully, balancing product innovation with compliance requirements.

What this means for traders and markets

If Coinbase follows through, listing tokenized equities would expand retail access to fractionalized or blockchain-represented stock exposure, while prediction markets would let traders speculate on political, economic, and other event outcomes using familiar exchange mechanics. For traders, this could mean new avenues for hedging, speculation, and arbitrage — but also new regulatory and counterparty considerations tied to tokenized securities.

Cointelegraph reached out to Coinbase for comment on the Bloomberg report and had not received a response at the time of publication. As the industry watches for Wednesday's livestream, market participants and policymakers will be closely monitoring how Coinbase frames compliance, custody, and market integrity for these nascent products.

Source: cointelegraph

Leave a Comment