5 Minutes

Weekly NFT market snapshot

NFT sales volume eased slightly this week to $65.58 million, a modest 0.47% decline from last week’s $67.76 million, according to CryptoSlam data. While overall dollar volume remained largely flat, market participation accelerated: NFT buyers rose 26.31% to 292,030 and sellers climbed 24.44% to 205,205. Total NFT transactions were nearly stable, falling only 0.95% to 869,747.

Sales, participation and short-term trends

The market is showing mixed signals: network-level volumes diverged sharply, with Ethereum sales plunging while Bitcoin-based BRC-20 activity spiked. Ethereum retained the highest network sales total but saw a sizable week-on-week decline, reflecting rotation across chains and renewed interest in Bitcoin-native NFTs. These shifts underscore how liquidity and collector attention can move quickly between ecosystems in the broader NFT market.

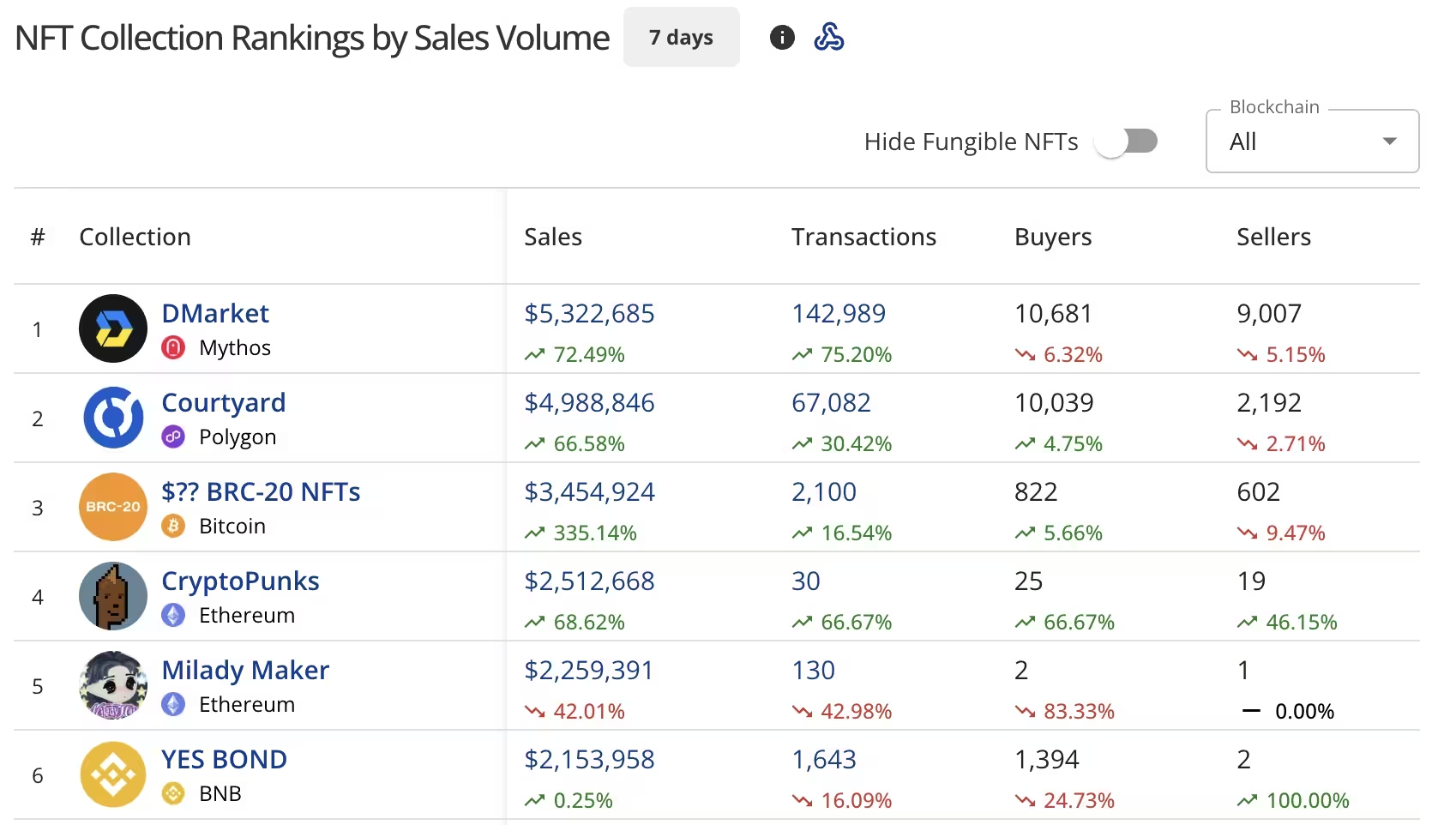

Key marketplace and collection movers

DMarket, operating on the Mythos chain, reclaimed the top marketplace slot with $5.32 million in sales — a 72.49% surge from $3.09 million the prior week. DMarket processed 142,989 transactions, serving 10,681 buyers and 9,007 sellers. Polygon’s Courtyard collection followed with $4.99 million in volume, up 66.58% from $2.97 million, recording 67,082 transactions and 10,039 buyers.

Other standout collections included a Bitcoin BRC-20 group that vaulted into third place with $3.45 million — a dramatic 335.14% increase — registering 2,100 transactions alongside 822 buyers and 602 sellers. CryptoPunks returned to prominence with $2.51 million in sales (up 68.62%), while Milady Maker eased to $2.26 million, down 42.01% from the previous week. YES BOND on BNB held steady around $2.15 million.

Top collections by NFT Sales Volume

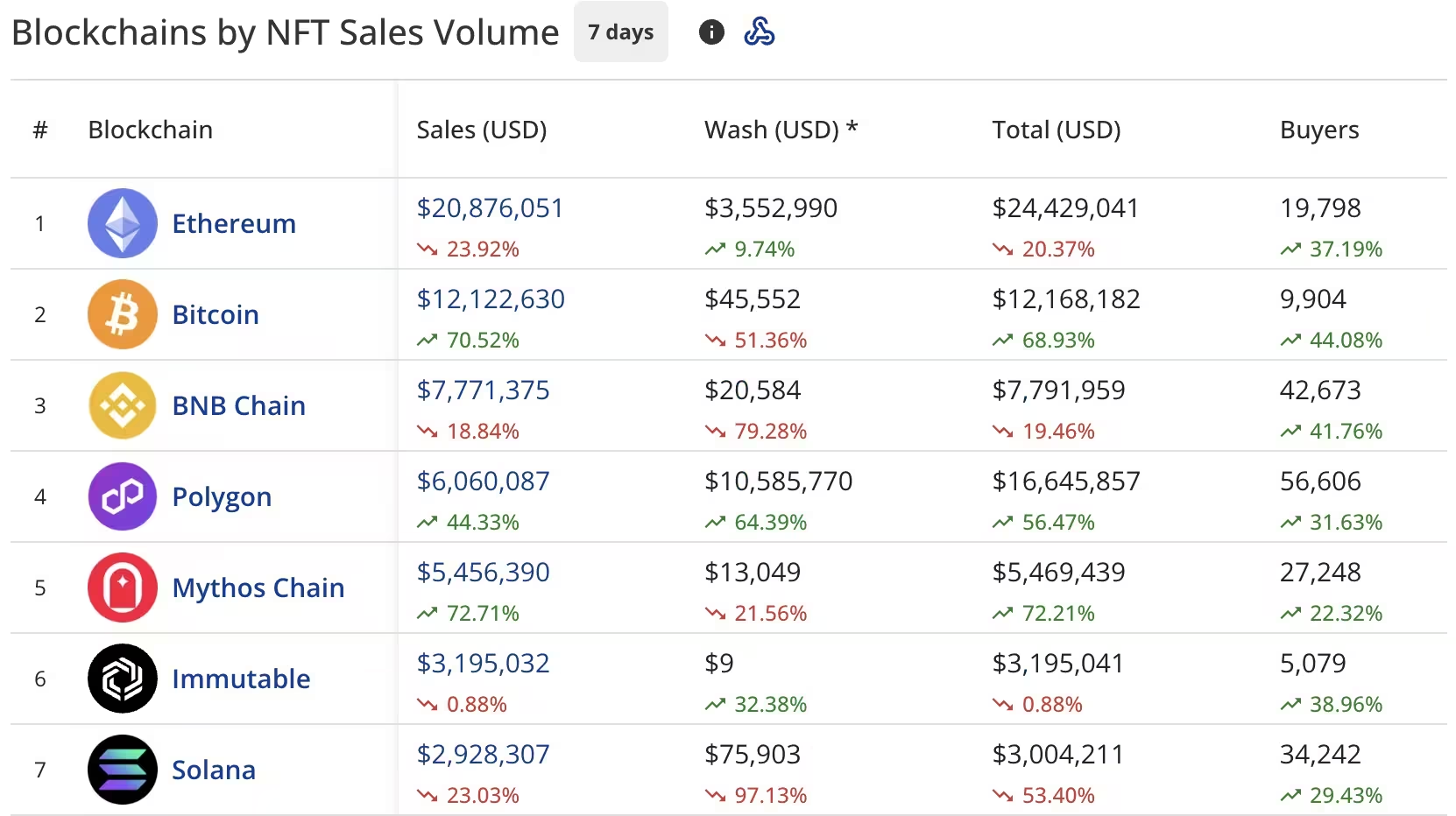

Blockchain performance and wash trading

Chain-level results paint a clear picture of rotation across the NFT ecosystem. Ethereum remained the largest network by sales at $20.88 million, but that represented a 23.92% drop from $28.06 million the prior week. CryptoSlam flagged $3.55 million in wash trading on Ethereum, bringing adjusted totals to $24.43 million. Despite the decline in volume, Ethereum saw buyer counts jump 37.19% to 19,798.

Bitcoin’s NFT market surged to second place with $12.12 million in sales, up 70.52% week-over-week. The Bitcoin ecosystem recorded $45,552 in wash trading and a significant rise in buyers to 9,904 (up 44.08%). BNB Chain fell to third with $7.77 million (down 18.84%) and reported $20,584 in wash trading, while Polygon posted $6.06 million, growing 44.33% and reporting $10.59 million in wash trading (totaling $16.65 million when adjusted).

Mythos Chain climbed strongly to $5.46 million (up 72.71%), Immutable held around $3.20 million, and Solana slipped to $2.93 million, down 23.03%. Buyers across multiple chains rose notably, signaling broadening participation even as dollar volumes shifted between ecosystems.

Blockchains by NFT Sales Volume

High-value sales and BRC-20 momentum

High-ticket Bitcoin BRC-20 sales dominated the top individual transactions this week. Leading sales included $X@AI BRC-20 NFTs at $1.92 million (21.7344 BTC) and another BRC-20 lot at $1.79 million (20.4401 BTC). A BTC domain — #372a75d6671ec00a1337f33999fb75acf9 — sold for $362,729.32 (4.1293 BTC).

Ethereum blue-chip activity remained notable, with CryptoPunks #8408 and #8476 fetching roughly $118k (39 ETH) and $110.9k (36.6 ETH) respectively. These sales highlight persistent demand for established blue-chip NFT collectibles even as attention flows to new Bitcoin-native formats and alternative chains.

What this means for collectors and traders

The week’s data suggests a nuanced market: overall sales dollars are stable, but capital is reallocating across chains and formats. The spike in BRC-20 activity and rising buyer counts point to renewed experimentation among collectors and traders, while wash trading flags underscore the need for careful on-chain analysis when evaluating volume metrics. For NFT investors, this environment rewards active monitoring of chain-level flows, marketplace liquidity, and high-value transaction trends.

As the NFT market continues to evolve, tracking on-chain metrics such as wash trading, buyer and seller growth, and cross-chain volume will be essential for understanding true demand and identifying sustainable opportunities.

Source: crypto

Comments

atomwave

Interesting to see buyers rising even as dollar volumes stay flat, chain rotation looks real. gonna watch mint flows

coinpilot

is this even true? wash trading numbers smell fishy, BRC-20 hype tho, weird rotation. quick take

Leave a Comment