4 Minutes

Picture a company that spent years nicking market share with solid value phones, then quietly began climbing the ladder into premium territory. Fast climb. Sharper focus. Different game.

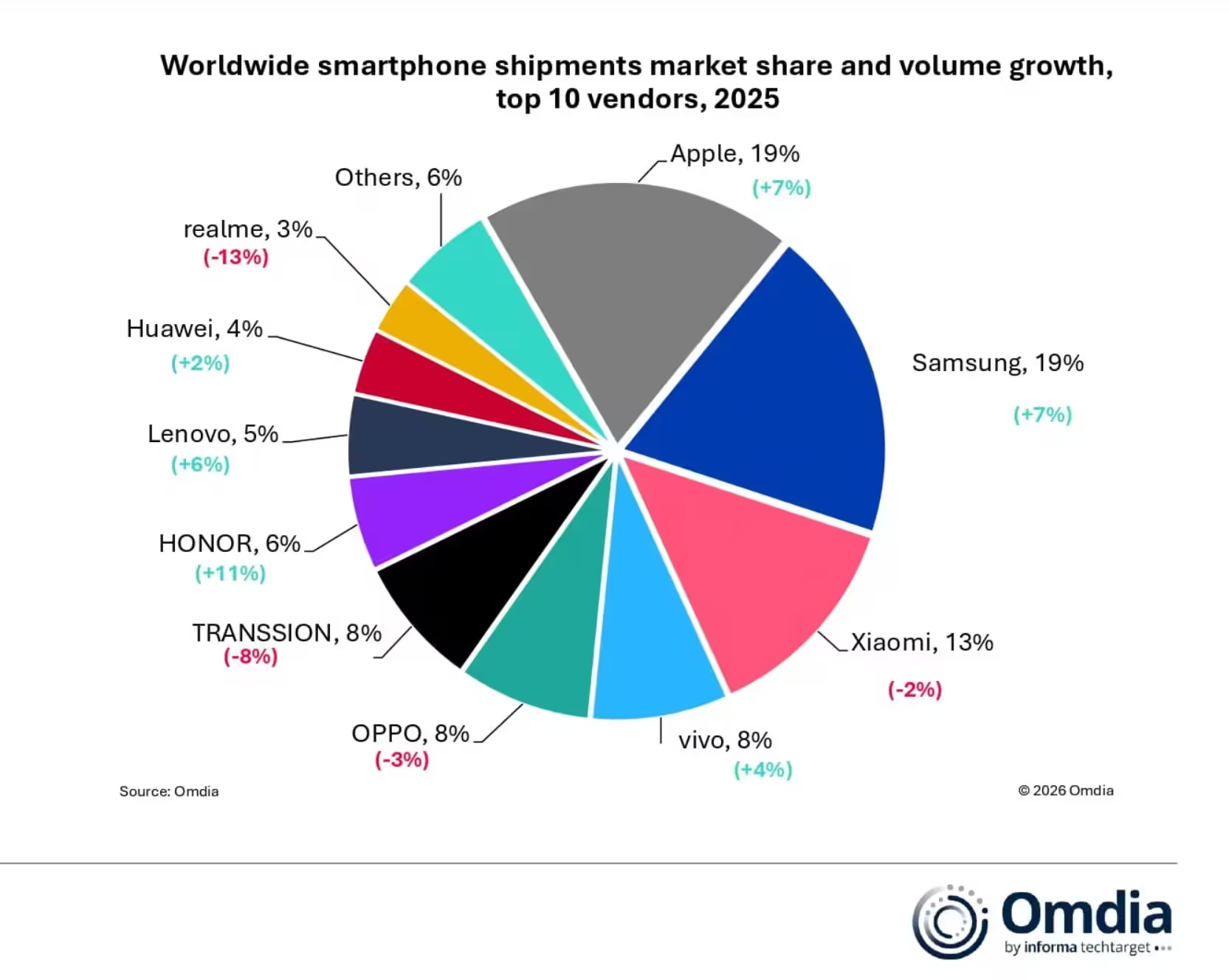

That is HONOR’s recent trajectory, according to Omdia: an 11% year-over-year rise in global smartphone shipments for 2025, enough to make it the fastest-growing major brand among the world’s top ten. Numbers alone are dry. The nuance is where HONOR chose to grow — not by flooding low-cost shelves, but by targeting higher-margin pockets overseas.

IDC’s data fills in the picture. Through the first three quarters of 2025 the company led all top-ten brands in overseas shipment growth within key premium tiers: smartphones priced above $300 and tablets in the $300–$600 band. That kind of segmented expansion suggests a deliberate push upmarket, a move to improve unit economics while widening global footprint.

Wang Ban, HONOR’s President of Sales and Services, celebrated the milestone on Weibo, but the celebration is only part of the story. The shipment gains look less like a lucky streak and more like fuel for the next phase — the sort of capital and credibility needed to underwrite riskier bets in product and platform innovation.

And HONOR is about to test those bets live on the world stage. Come March in Barcelona, the brand plans to showcase two headline devices: the HONOR ROBOT PHONE, positioned as a bold experiment in AI-integrated mobile interaction, and the HONOR Magic V6, a next-generation foldable flagship aimed at mainstreaming the format rather than treating it as a niche curiosity.

HONOR’s 11% shipment growth in 2025 signals real momentum — and the launches at MWC will test whether that momentum can translate into durable premium-market share.

These products sit inside what HONOR calls the "Alpha Plan," a roadmap emphasizing human-centric AI behavior and radical form factors. The strategy reads like a two-pronged bet: make phones smarter at the edge, and reinvent the canvas those experiences appear on. If the Robot Phone locks useful AI features to everyday tasks and the Magic V6 makes folding feel seamless, HONOR could change how buyers weigh features versus brand cachet.

Why does this matter beyond HONOR’s own balance sheet? Because hardware alone doesn’t win markets — perception, ecosystem, and timing do. A brand that can move from rapid unit growth into profitable premium segments while shipping genuinely differentiated products becomes harder to displace. Competitors will watch pricing, channel strategy, and whether HONOR can sustain software support for its AI ambitions.

There is also a geopolitical angle. Expanding growth beyond a single home market reduces concentration risk and opens new R&D and partnership avenues. For a company aiming to pair advanced AI features with novel form factors, global scale helps amortize costs and attract talent.

MWC26 will be the moment to see if HONOR’s sales momentum was a prelude or the main act. Expect demos, comparisons, and a lot of talk about how AI changes the mobile equation. Will the Robot Phone feel like a genuine assistant or a clever demo? Will the Magic V6 make folding a daily habit instead of a weekend toy? The answers could reshape handset roadmaps across the industry.

Source: gizmochina

Leave a Comment