4 Minutes

Altcoin momentum approaches a decisive level

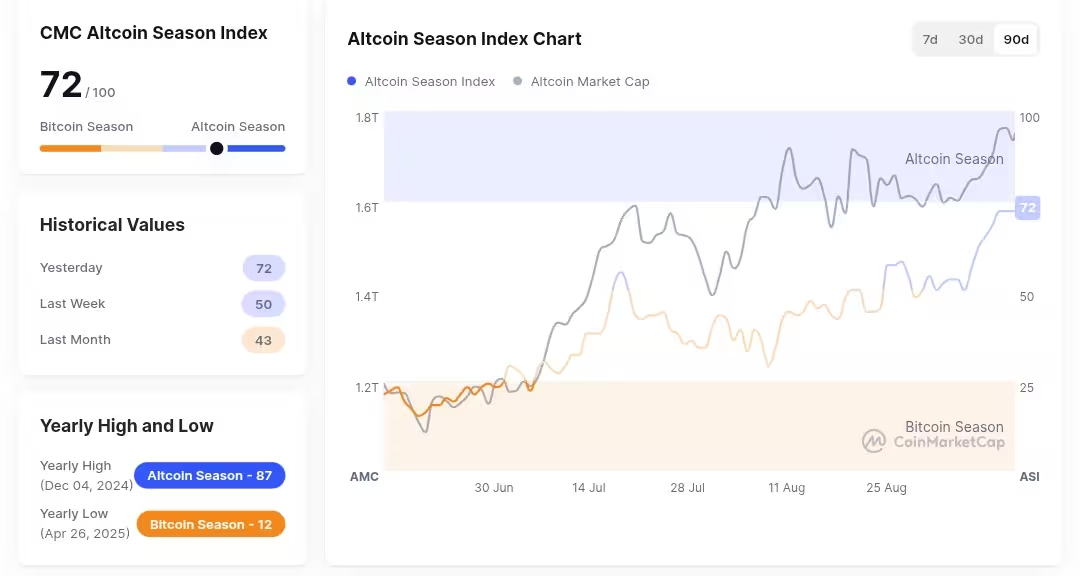

The cryptocurrency market is showing renewed appetite for altcoins as the Altcoin Season Index climbs to 72 — just below the 75 level widely regarded as confirmation of an "altseason." Gains among leading alternative tokens have reignited trader enthusiasm, but market analysts warn that the rally carries meaningful risks and could mirror past corrections if investors become overly exposed.

Major altcoins post strong weekly gains

Over the past week several blue-chip altcoins pushed higher. Ethereum advanced past $4,600, XRP reclaimed the $3.00 area, Dogecoin traded above $0.28, and Cardano pushed past $0.90. The most notable move came from Solana, which climbed more than 17% in seven days to reach about $248. That price action lifted SOL’s market capitalization to roughly $135 billion, allowing Solana to overtake Binance Coin and become the fifth-largest cryptocurrency by market value.

Institutional flows appear to be supporting some of the upside. Galaxy Digital’s reported accumulation of $6.5 million in SOL added a degree of institutional conviction to the Solana rally. Meanwhile, momentum has filtered down to smaller-cap tokens: MYX Finance, MemeCore, and OKB registered large percentage gains, indicating elevated risk appetite among retail and speculative traders.

Market breadth and open interest dynamics

Broader market measures underscore the shift: the Altcoin Season Index surged from 68 last week to 72 this week, reflecting increasingly strong performance from non‑Bitcoin assets. At the same time, on‑chain data shows rising open interest in altcoins while Bitcoin open interest has remained relatively flat — a divergence that some analysts find concerning.

Analyst warns of parallels to late‑2024 correction

CryptoQuant researcher Maartunn highlighted this disconnect on X, drawing parallels to December 2024, when altcoin speculation swelled while Bitcoin’s derivatives activity stayed muted. That episode preceded a roughly 30% drawdown in early 2025 and a subsequent three‑month period of sideways price action. Maartunn’s core point: surging altcoin open interest disconnected from Bitcoin momentum can create conditions for sharp unwinds if market sentiment reverses.

"We’ve seen this before. It doesn’t mean it will play out the same way, but you should know where your exits are," Maartunn wrote, likening the market to a game of musical chairs where not every participant will find a seat when the music stops.

What traders should watch next

Key variables to monitor include continued institutional accumulation, net inflows to altcoin derivatives, and macroeconomic or regulatory shifts that could trigger volatility. If institutional support wanes or macro uncertainty increases, the current altcoin advance could face a steep correction or devolve into a low‑volatility “chop” similar to past cycles.

Balancing opportunity and risk

For investors and traders, the current environment presents both opportunity and danger. Elevated momentum across large caps like Solana and Ethereum, coupled with rapid moves in small‑cap tokens, offers potential upside for active traders. At the same time, the divergences in open interest and the historical precedent of a deep correction demand disciplined risk management: position sizing, clearly defined stop levels, and attention to liquidity and funding conditions in crypto derivatives markets.

As the Altcoin Season Index approaches the 75 threshold, market participants should remain alert. Whether this rally matures into a full altseason or fizzles into another false start will depend on the next wave of flows, on‑chain signals, and broader macro and regulatory developments.

Source: crypto

Leave a Comment