5 Minutes

Massive $1.8B Liquidation Shakes Crypto Markets

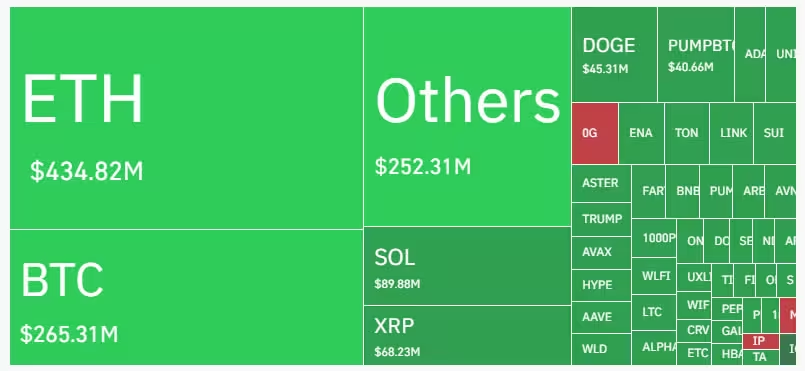

The crypto market experienced a dramatic wave of forced sell-offs as roughly $1.8 billion in leveraged positions were liquidated in a single trading day. The sudden churn expelled more than 370,000 traders from derivatives markets, according to industry trackers, and wiped over $150 billion off total market capitalization. Rather than signaling an abrupt end to the bull cycle, many analysts point to excessive leverage and technical pressure as the primary drivers behind the rout.

What happened to Bitcoin and Ethereum?

Bitcoin (BTC) briefly slipped below $112,000 during the liquidation event, while Ether (ETH) dropped under $4,150 — the steepest pullback observed since mid-August. Despite the volatility, the market has settled into a more stable range for now, but September’s historical volatility keeps the door open for further downside. Data provider CoinGlass flagged this episode as the largest long-position liquidation of 2025, continuing a pattern of large-scale liquidations earlier this year in February, April and August.

Leverage, Altcoins and a Domino Effect

Several researchers and market commentators traced the severity of the crash to outsized leveraged exposure in altcoin markets versus Bitcoin. One prominent analyst going by the handle Bull Theory noted that Ethereum alone accounted for more than $500 million of liquidations — over twice the amount wiped from long Bitcoin positions. When leverage concentrates on altcoins, even a modest downward impulse can trigger a cascade of margin calls and stop-losses across derivatives platforms.

Raoul Pal, founder of Real Vision, characterized the pattern as cyclical: traders pile into leveraged longs expecting a major breakout; the market falters on the first attempt; a liquidation wave then forces weaker participants out; and only afterward does the main directional move occur with fewer players left in the market. This sequence, he argues, is a recurring dynamic in crypto markets driven more by positioning and sentiment than by sudden changes in fundamentals.

Exchange strategy and risk management take center stage

Exchanges and derivatives desks were front and center during the sell-off. Large concentrated positions and thin liquidity at certain price levels amplified executions, increasing slippage and widening funding rate imbalances. For traders, the episode is a stark reminder of leverage risks in perpetual futures, margin trading and other derivatives that magnify both gains and losses.

Macro context and medium-term outlook

Not all experts viewed the correction as catastrophic. Nassar Achkar, Head of Strategy at CoinW, argued that the move is more of a short-term reset than a confirmation of a bear market. He pointed to supportive macroeconomic conditions and ongoing accommodative monetary policy as tailwinds for risk assets like Bitcoin. From this perspective, the liquidation offers buying opportunities for longer-term investors to accumulate on weakness.

On the technical side, Tony Sycamore of IG suggested that a retracement toward the $100,000–$105,000 zone — near the 200-day moving average around $103,700 — would be a healthy consolidation. Such a pullback could clear speculative long positions and create a cleaner base for renewed upside into year-end. Interestingly, BTC’s current decline from its all-time high is roughly 9.5%, a relatively modest correction compared to deeper drawdowns in prior cycles.

Seasonality and trader sentiment: watching Uptober

September has historically been one of Bitcoin’s more volatile months, with price declines in eight of the last 13 years. Even so, BTC remains roughly 4% higher year-to-date despite recent turbulence. Many market participants are now looking ahead to “Uptober,” a hopeful term referencing historically stronger performance in October, and positioning for a possible rebound if macro signals remain favorable.

Key takeaways for traders and investors

- Excessive leverage in altcoins can accelerate market-wide liquidations — risk management is essential.

- Short-term technical corrections do not necessarily negate a longer-term bullish trend.

- Watch support zones near $100k–$105k for BTC and monitor ETH liquidity levels for signs of stabilization.

- Derivatives traders should be aware of funding rates, isolated vs. cross margin risks, and potential slippage during low-liquidity periods.

While forced liquidations can create sharp intraday moves, they also recalibrate positioning, clear speculative excess, and often set the stage for healthier market advances. Whether this event marks the final washout or simply another reset ahead of Uptober will depend on liquidity dynamics, macroeconomic developments, and how traders adjust leverage across BTC, ETH and the broader altcoin market.

Source: cointelegraph

Leave a Comment