5 Minutes

Ethereum confirms bullish reversal as exchange reserves hit lows

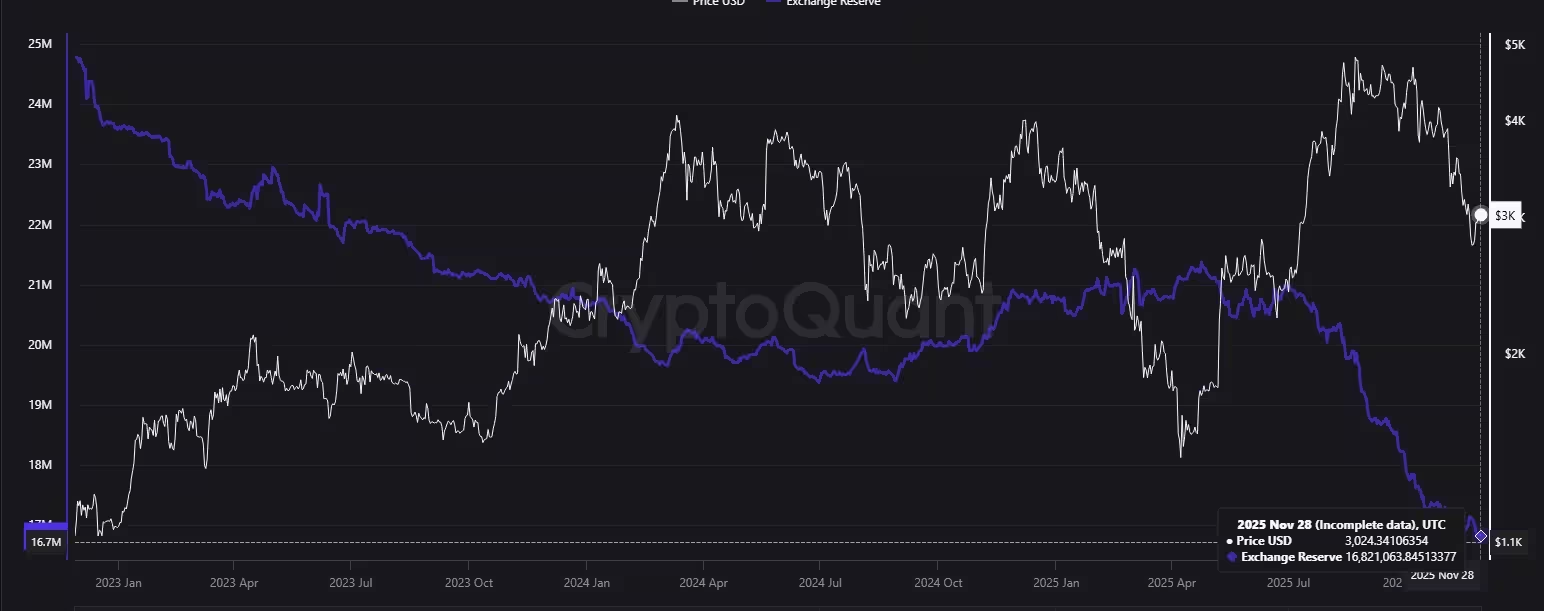

Ethereum has staged a notable recovery after finishing a near two-week decline, confirming a bullish reversal pattern on the daily chart as exchange reserves continue to fall to multi-year lows. Trading back above $3,000, ETH’s move is supported by declining on-exchange supply, positive upgrade sentiment around Fusaka, and renewed spot ETF inflows — a combination that has attracted renewed institutional and retail attention.

Price action and immediate context

ETH fell from $3,633 on Nov. 10 to a monthly low near $2,680 on Nov. 21 before reversing course. The second-largest cryptocurrency is currently trading around $3,013, up roughly 7% in the past week but still about 40% below its August all-time highs. Market structure now shows a clear falling wedge breakout on the daily timeframe — a classic technical signal investors watch for trend shifts from bearish to bullish.

Why exchange reserves matter

Exchange reserves for ETH have been dropping sharply, a trend seen as bullish for price momentum. According to on-chain analytics, exchange-held ETH fell from roughly 20.9 million in early July to about 16.8 million at press time. When fewer tokens sit on exchanges, there’s less immediate liquidity available to sell, which tends to reduce short-term selling pressure and can amplify upside when buying demand returns. Lower reserves are often interpreted as accumulation or long-term holding behavior by whales and institutions.

Fusaka upgrade and network fundamentals

Community anticipation for the Fusaka upgrade — potentially scheduled for Dec. 3 — has added a fundamental catalyst. If implemented as expected, Fusaka would be the most significant network update since The Merge and aims to improve data availability for rollups, addressing a major scalability bottleneck for Ethereum’s layer-2 ecosystem. Better data availability could reduce costs and improve throughput for rollups, strengthening Ethereum’s long-term value proposition.

ETF flows and institutional demand

Spot ETF dynamics have also shifted. After three weeks of outflows totaling approximately $1.7 billion, the nine U.S. spot ETH ETFs registered about $236 million in net inflows this week according to SoSoValue. The return of positive flows can restore confidence among traders and institutional allocators, often translating into steadier bid support for ETH. Meanwhile, ongoing accumulation by entities like Bitmine and other institutional buyers further signals conviction in Ethereum's multi-year outlook.

Ethereum price has broken out of a falling wedge on the daily chart — Nov. 28

Technical outlook: targets and key levels

On the technical front, the confirmed breakout from the falling wedge typically signals a potential trend reversal to the upside. Immediate resistance sits at the 200-day moving average around $3,096, a level that held ETH in check throughout November. A decisive daily close above this moving average could open a path toward $3,600, a zone that aligns closely with the 61.8% Fibonacci retracement from the recent swing high to low — a common pivot where buyers may step in to confirm a sustained trend change.

Conversely, if ETH fails to maintain support near $3,000, the market could revisit lower support around $2,750, which corresponds with the 38.2% Fibonacci retracement level. Traders will be watching volume confirmation on any breakout or breakdown: a strong breakout backed by volume and continued outflows from exchanges would strengthen the bullish thesis, while weak volume could signal a false breakout.

What traders should watch next

Key indicators to monitor include on-exchange ETH balances, ETF flow reports, progress and timing of the Fusaka upgrade, and reactions at the 200-day moving average. Institutional accumulation patterns and large withdrawals from exchanges are particularly important for gauging whether the bullish reversal has sustainable underpinnings.

Ethereum's near-term trajectory now depends on whether buyers can sustain momentum above $3,000 and clear the 200-day moving average. If they do, a move toward $3,600 becomes increasingly feasible; if not, risk remains for a pullback toward $2,750.

Source: crypto

Comments

Reza

Is the ETF inflow real or just short term window dressing? 236m this week sounds small vs outflows, curious if whales really stacking

coinpilot

Whoa, ETH back above 3k and reserves dipping... Fusaka hype doing work? Institutions piling in, but watch 200dma, could be a fakeout. still bullish tho

Leave a Comment