5 Minutes

Zcash Weakness Despite Institutional Moves

Zcash (ZEC) has shown surprising weakness even after Grayscale filed to convert its Zcash Trust into a U.S. spot ZEC ETF. At press time, ZEC traded near $470, down roughly 7.8% in 24 hours and about 28% lower on the week, despite a strong November rally that had pushed the coin up some 37% month-over-month. The divergence between rising institutional interest and weakening price action highlights how short-term technical dynamics, diminished trading volume, and fading derivatives momentum can outweigh positive fundamental headlines in crypto markets.

Trading Volume, Futures, and Open Interest Trends

Spot and derivatives metrics indicate cooling market participation. Zcash recorded $740 million in 24-hour spot volume — a 25.5% decline from recent levels. Derivatives data from CoinGlass showed futures volume down 16.36% to $3.15 billion, while open interest eased by 4.52%. Lower volumes and contracting open interest typically signal traders are closing positions rather than adding fresh exposure, reducing liquidity and amplifying volatility during pullbacks.

What the numbers mean for traders

Declining spot volume and shrinking futures activity suggest fewer buyers are stepping in to support the rally. When retail traders crowd into leveraged positions at market tops, larger market participants often use that liquidity to exit, which can accelerate reversals. For ZEC, this dynamic likely contributed to the sharp retracement after November’s upswing.

Grayscale Filing and Corporate Treasury Interest

On Nov. 26, Grayscale filed an S-3 registration with the U.S. SEC to convert the Zcash Trust (ZCSH) into a spot ZEC ETF listed on NYSE Arca, offering regulated exposure to ZEC. Grayscale framed ZEC as a valuable allocation for a balanced digital asset portfolio and cited renewed global demand for privacy-focused blockchains. The filing also acknowledged prior regulatory pressure that led to several ZEC delistings in 2023–2024, though market capitalization has since recovered above $8 billion.

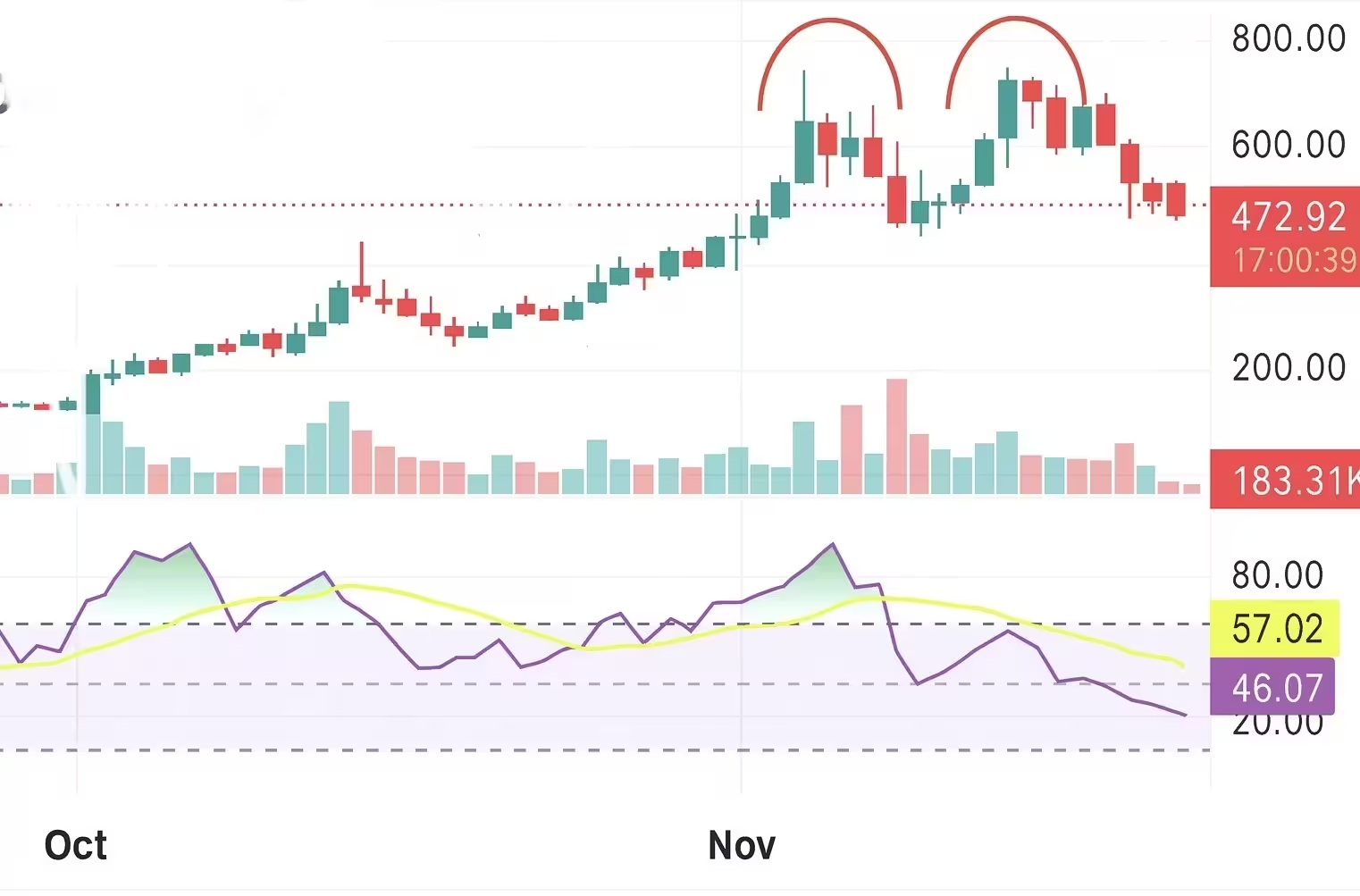

Zcash daily chart

Corporate treasuries are beginning to test that thesis. Nasdaq-listed Reliance Global Group reportedly converted its digital treasury into Zcash, liquidating holdings in Bitcoin, Ethereum, Cardano, and XRP, calling ZEC “the most compelling” long-term option for privacy-enabled transactions. Cypherpunk Technologies also amassed over 200,000 ZEC this month, underscoring growing institutional appetite for privacy coins.

Technical Analysis: Exhaustion, Patterns, and Indicators

Despite the bullish institutional backdrop, ZEC’s recent sell-off appears primarily technical. November’s rally drove the Relative Strength Index (RSI) above 80, signaling overbought conditions and exhaustion. Price subsequently fell out of a rising channel and breached a symmetrical triangle — both common signs that an uptrend has stalled.

A clear double top formed near $780–$800, a classic reversal pattern. The neckline sits around $470, which ZEC is currently testing. A decisive daily close below $470 would validate the double top and increase the likelihood of a deeper correction.

Key indicators to watch

- RSI: Now around 46, neutral but down from overbought territory.

- MACD and momentum indicators: Flashing sell signals in the short term.

- Moving averages: Short-term MAs (10–30 day) are turning lower, while longer-term averages (50–200 day) still slope upward, suggesting the larger trend is not yet decisively bearish.

If ZEC holds the $470 level, a bounce toward $550–$600 is possible. Breaking above $600 would relieve pressure from the double top and give bulls room to rebuild momentum. Conversely, a breakdown beneath $470 could push support tests to $450 and potentially $420.

What this means for investors and traders

For long-term investors bullish on privacy coins and institutional adoption, Grayscale’s ETF filing and corporate treasury allocations are constructive developments for ZEC’s fundamentals. However, short-term traders should respect the technical picture: lower trading volume, falling open interest, and classic reversal patterns indicate the path of least resistance is toward downside until momentum indicators and volume show renewed strength.

Monitor order book depth, spot and derivatives volume, and on-chain flows to gauge whether institutional buyers step in to absorb selling pressure. Until then, risk management with clearly defined stop-loss levels and position sizing remains critical for exposure to ZEC and other privacy-focused cryptocurrencies.

Source: crypto

Comments

Marius

whoa that double top at 780-800 was brutal, sold too early lol. if it breaks 470 i'm out, but a 550-600 bounce would be sweet

cryptloom

Wait so Grayscale files for a spot ZEC ETF yet price tanks? Is volume really the culprit or are whales just unloading... feels off, idk

Leave a Comment