4 Minutes

Bitcoin ETFs drive strong start to ‘Uptober’

US-listed spot Bitcoin ETFs recorded a surge of investor demand in the opening week of October, posting approximately $3.24 billion in cumulative net inflows. That figure—just shy of the all-time weekly record—represents the funds’ second-best week since launch and signals renewed institutional and retail interest in Bitcoin and crypto ETFs.

ETF inflows nearly match record weekly intake

Data from SoSoValue show spot Bitcoin ETFs drew $3.24 billion this past week, nearly matching the $3.38 billion record from the week ending Nov. 22, 2024. This jump is a sharp reversal from the prior week’s $902 million in outflows and reflects a broader shift in market sentiment toward risk assets amid expectations for additional US interest rate cuts.

Iliya Kalchev, dispatch analyst at Nexo, told Cointelegraph that growing expectations of another Federal Reserve rate reduction have been a major catalyst: “A shift in sentiment has renewed demand for Bitcoin ETFs, bringing four-week inflows to nearly $4 billion.” Kalchev added that at current run-rates, Q4 ETF flows could effectively remove more than 100,000 BTC from circulation—more than double the new issuance rate—supporting tighter supply dynamics for Bitcoin.

US spot Bitcoin ETFs, all-time chart, weekly

Price reaction and technical outlook

The fresh capital influx briefly pushed BTC above $123,996 on Friday, a six-week high not seen since mid-August, according to TradingView. That breakout above the psychological $120,000 level has traders and portfolio managers watching for a rapid move toward new all-time highs, with some strategists forecasting a test of $150,000 before the end of 2025 if momentum continues.

BTC/USD, 1-day chart.

Charles Edwards, founder of Capriole Investments, suggested at Token2049 that an accelerating ETF absorption rate combined with reduced distribution from long-term holders is helping Bitcoin build a firmer technical base close to key support levels.

Macro backdrop and near-term catalysts

Market participants say the macroeconomic environment is crucial to sustaining this rally. Continued dovish signals from the Federal Reserve—particularly hints of another interest rate cut—have buoyed risk appetite across equities and crypto. Investors will closely watch a series of events this week, including a speech from Fed Chair Jerome Powell and the release of the FOMC minutes, which could influence rate expectations and ETF flows.

A delayed US jobs report is another variable. Publication timing for the report may be affected by the ongoing US government shutdown, adding uncertainty to the economic calendar and potentially amplifying short-term market moves.

Seasonality and historical performance: why ‘Uptober’ matters

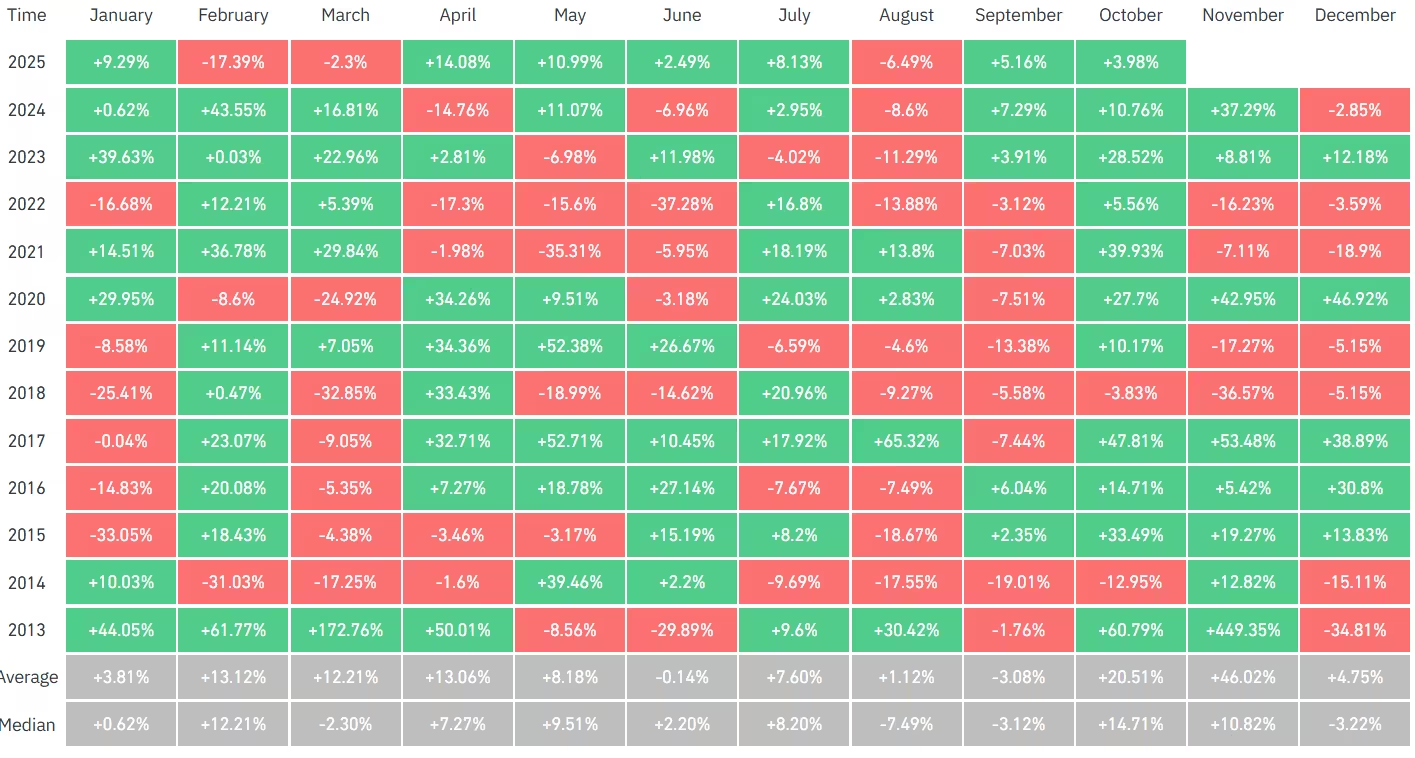

October has historically been one of Bitcoin’s strongest months. CoinGlass data show BTC’s average historical monthly returns are roughly 20% in October, 46% in November and about 4% in December—statistics that have fueled the community’s nickname for the month: “Uptober.” Continued weekly ETF inflows are widely interpreted as positive seasonal and structural tailwinds for Bitcoin’s price.

Bitcoin monthly returns

Implications for investors and the crypto market

Spot Bitcoin ETFs are increasingly viewed as a real-time sentiment gauge for the crypto industry. Large, sustained inflows into these products not only increase institutional exposure to BTC but may also tighten circulating supply, supporting higher price floors. If ETF demand remains robust and macro conditions stay dovish, analysts say Bitcoin could see renewed momentum through Q4.

However, risks remain: central bank communications, macro surprises, or a prolonged government shutdown could quickly alter expectations. Traders and investors should monitor ETF flow data, macro headlines, and on-chain metrics that indicate long-term holder behavior as they evaluate risk and position size in the weeks ahead.

Overall, the recent $3.2 billion inflow week has rekindled optimism in the crypto market and set the stage for what many market observers hope will be a breakout October for Bitcoin.

Source: cointelegraph

Leave a Comment