3 Minutes

The crypto market has pushed higher this week, with Bitcoin and Ethereum closing in on previous all-time highs and total market capitalization topping $4.2 trillion. Below we break down the four primary drivers behind the rally: rising odds of Federal Reserve interest rate cuts, Bitcoin’s growing role as a safe-haven, seasonal strength in October and Q4, and hopes for broader ETF approvals for altcoins.

1. Fed interest rate cut expectations

Weaker jobs data shifts market odds

One of the clearest catalysts for the rally is the increasing market conviction that the Federal Reserve will cut interest rates before year-end. ADP’s weaker-than-expected jobs report — showing a loss of 36,000 jobs in September versus forecasts for gains — pushed traders to price in a higher probability of rate reductions. Lower interest rates typically support risk assets, and cryptocurrencies often benefit from a looser monetary backdrop as liquidity and yield-seeking flows return to markets.

2. Bitcoin and crypto as a safe-haven

Government risk and ETF inflows

Investors have leaned on Bitcoin as a defensive asset amid heightened U.S. political uncertainty and a partial government shutdown. That dynamic has also helped other stores of value such as gold hit new highs. Institutional research from major asset managers points to Bitcoin’s fixed 21 million supply and rising demand as key fundamentals supporting its safe-haven narrative.

Ongoing ETF inflows underline this trend: Ethereum funds recorded more than $1.3 billion in inflows while Bitcoin ETFs added roughly $3.2 billion, signaling continued institutional adoption and real capital moving into crypto ETFs.

3. Seasonality: Uptober and a strong Q4

Historical patterns favor gains

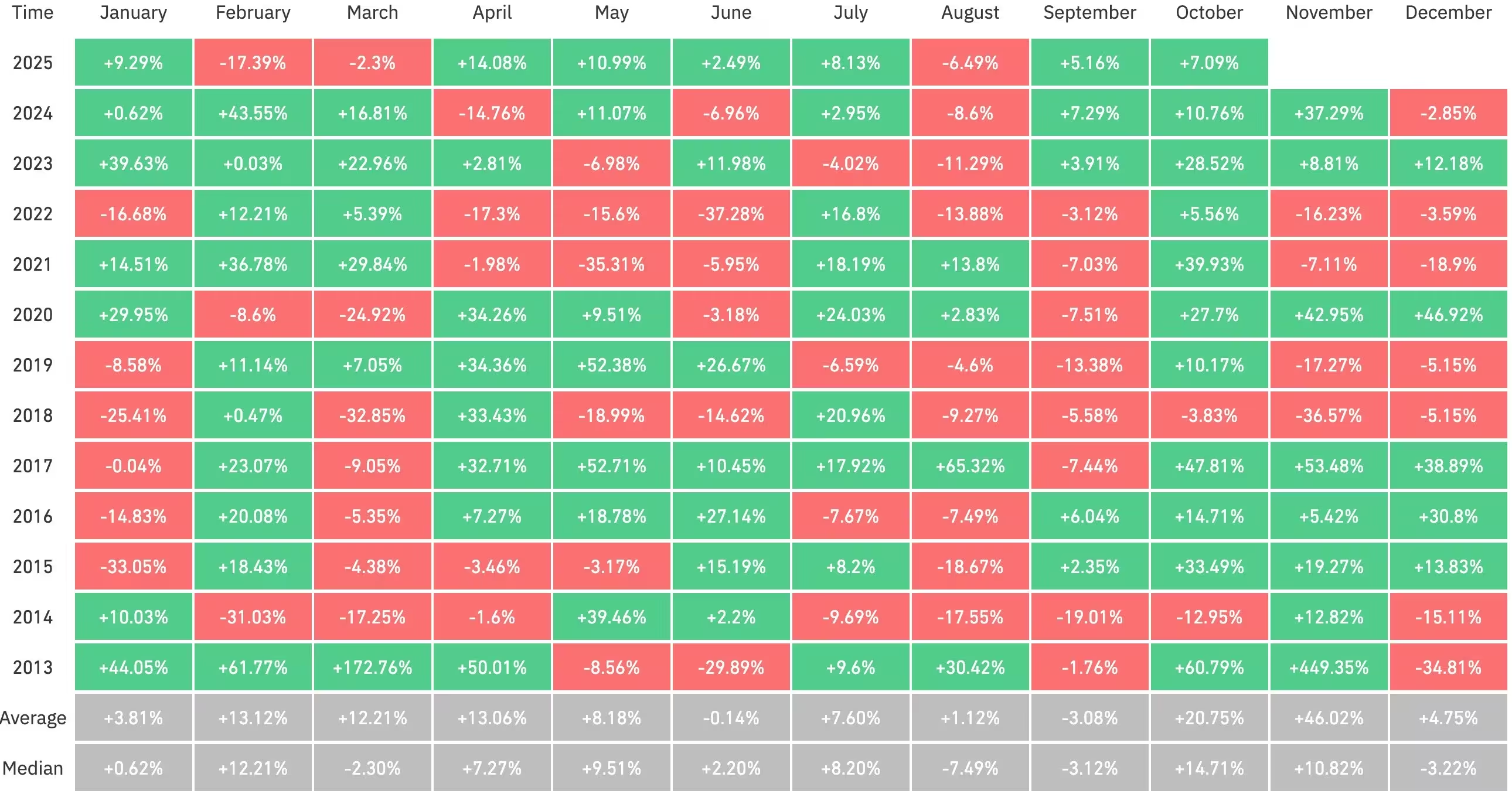

Seasonal momentum is another supporting factor. Crypto traders often refer to “Uptober” when markets rally in October, and historical data backs this up. CoinGlass data shows Bitcoin has typically delivered positive returns in October since 2020, and the average October return since 2013 sits near 20%, making it one of the best months of the year after November. The fourth quarter historically outperforms most parts of the year for crypto, helping fuel investor optimism as Q4 approaches.

Bitcoin return by month

4. Anticipation of altcoin ETF approvals

SEC deadlines and Wall Street demand

Finally, optimism around SEC approvals for altcoin ETFs has boosted the market. The Securities and Exchange Commission has set October deadlines for several high-profile altcoin ETF applications, including contenders like Solana and XRP. If approved, these products could unlock substantial Wall Street demand similar to the flows seen with Bitcoin and Ethereum ETFs, lifting altcoin market caps and broadening institutional exposure.

Overall, the current rally is driven by a mix of macro and crypto-specific factors: the prospect of Fed easing, renewed risk demand as Bitcoin takes on safe-haven attributes, seasonal strength entering October and Q4, and the potential expansion of ETF access to altcoins. Together, these elements are helping push crypto market capitalization above the $4.2 trillion mark as investors rotate into digital assets and crypto-focused investment products.

For market participants, monitoring Fed communications, ETF rulings, and institutional flow data will be critical to assessing whether this breakout sustains into year-end.

Source: crypto

Leave a Comment