3 Minutes

Market liquidation creates potential buying window for Bitcoin

Bitcoin's latest market shock — a record $19 billion liquidation over the weekend of Oct. 10 — pushed BTC down to roughly $104,000 at its four-month low and sent tremors through crypto markets. Despite the volatility, Standard Chartered's global head of digital assets research, Geoff Kendrick, tells Cointelegraph that this drawdown could mark an accumulation phase and a strategic buying opportunity for investors.

Forecast: $200,000 by year-end

Speaking at the 2025 European Blockchain Convention in Barcelona, Kendrick reiterated a bullish outlook: "My official forecast is $200,000 by the end of the year." He added that even under a conservative scenario driven by lingering macro uncertainty — including renewed tariff rhetoric from US political leaders — Bitcoin could still trade well above $150,000 if the Federal Reserve follows market expectations and eases monetary policy with rate cuts.

BTC/USD, 1-month chart.

Why the liquidation may accelerate a rally

The $19B liquidation event triggered a sharp, short-term correction, yet such liquidations often clear leveraged positions and reduce immediate selling pressure. Kendrick suggests the weeks following the crash will allow markets to stabilize, enabling institutional and retail participants to accumulate BTC at lower levels. Historically, these forced sell-offs can precede renewed upward momentum as liquidity normalizes.

ETFs and gold dynamics as key price drivers

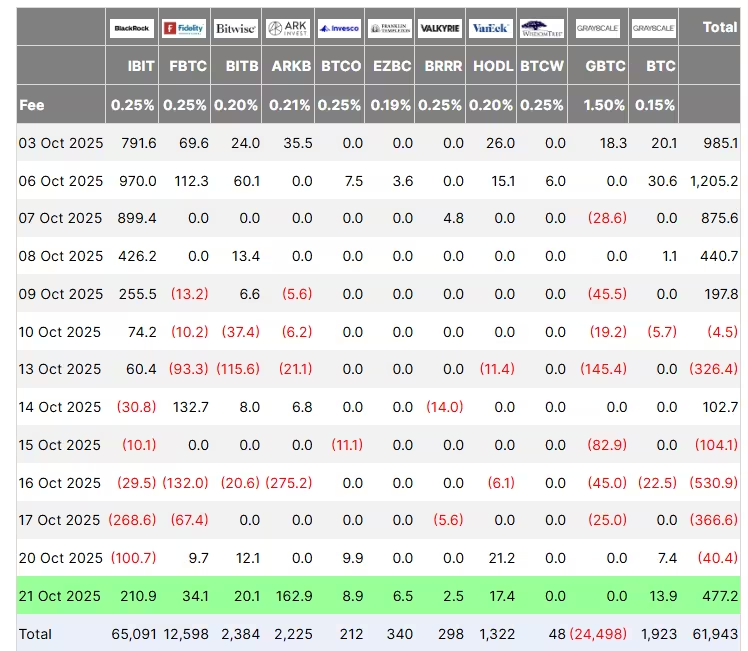

Kendrick identifies Bitcoin exchange-traded funds (ETFs) as the primary catalyst for the next leg higher. Continued ETF inflows, he says, will underpin price discovery and provide persistent demand for BTC. This thesis gained traction when Bitcoin ETFs posted a rebound of $477 million in net positive flows after several politically influenced outflows, according to Farside Investors data.

Bitcoin ETF inflows, USD, million.

He also points to gold's resurgence: as gold reclaims safe-haven narrative and approaches new highs, Bitcoin may benefit from similar investor behavior. The correlation between precious metals and BTC — especially amid expectations for Fed rate cuts — could reinforce Bitcoin's store-of-value narrative and draw further capital into crypto assets and ETF products.

Short-term pain, long-term opportunity

Bitcoin traded around $108,260 at the time of reporting, down roughly 6% over the past month. While short-term volatility remains elevated, Kendrick believes the market will absorb the liquidation shock within several weeks. Once deleveraging completes, he expects institutions and whales to treat the dip as an accumulation opportunity, potentially fueling a sustained rally into year-end.

Risks to the outlook

Key downside risks remain: unexpected macro shocks, prolonged hawkish Fed policy, or further geopolitical escalations could delay or temper the rebound. Political developments — such as tariff announcements — can also trigger headline-driven flows. Nevertheless, if macro policy shifts toward easing and ETF inflows continue, the conditions for a significant Bitcoin uptrend remain intact.

In a broader timeframe, Kendrick has previously outlined even more ambitious scenarios for BTC that hinge on sustained institutional adoption and favorable monetary policy. For traders and long-term investors, the recent liquidation may therefore represent both a reminder of crypto’s volatility and a potential entry point for exposure to Bitcoin via spot markets and ETFs.

Source: cointelegraph

Leave a Comment