3 Minutes

Bitcoin faces a disappointing Uptober as bulls lose momentum

Bitcoin's price action in October has left bulls concerned as the market drifts inside a tight trading band. After an early surge toward new highs, BTC reversed and currently trades between roughly $107,000 and $111,500, putting the cryptocurrency on track for one of its weakest Octobers since 2013. Market monitors show BTC is about 2.3% below its October opening level, raising the prospect of the first "red" October since 2018.

BTC/USD monthly returns

How bad could October get?

Data from analytics provider CoinGlass highlights the scale of the shortfall. Historically, October has often been favorable for Bitcoin: the average gain since 2013 sits near 20%, which would push BTC well above $130,000 by month-end under normal seasonality. In contrast, if BTC finishes roughly 4% lower than the month’s opening price, October 2025 would rank as the worst October performance in 12 years.

The contrast is starker when comparing this year to prior bull-market Octobers. During major bull years like 2017 and 2021, October produced at least 40% gains. The weakest historical October occurred in 2014, when Bitcoin slid about 13%.

Seasonality and on-chain context

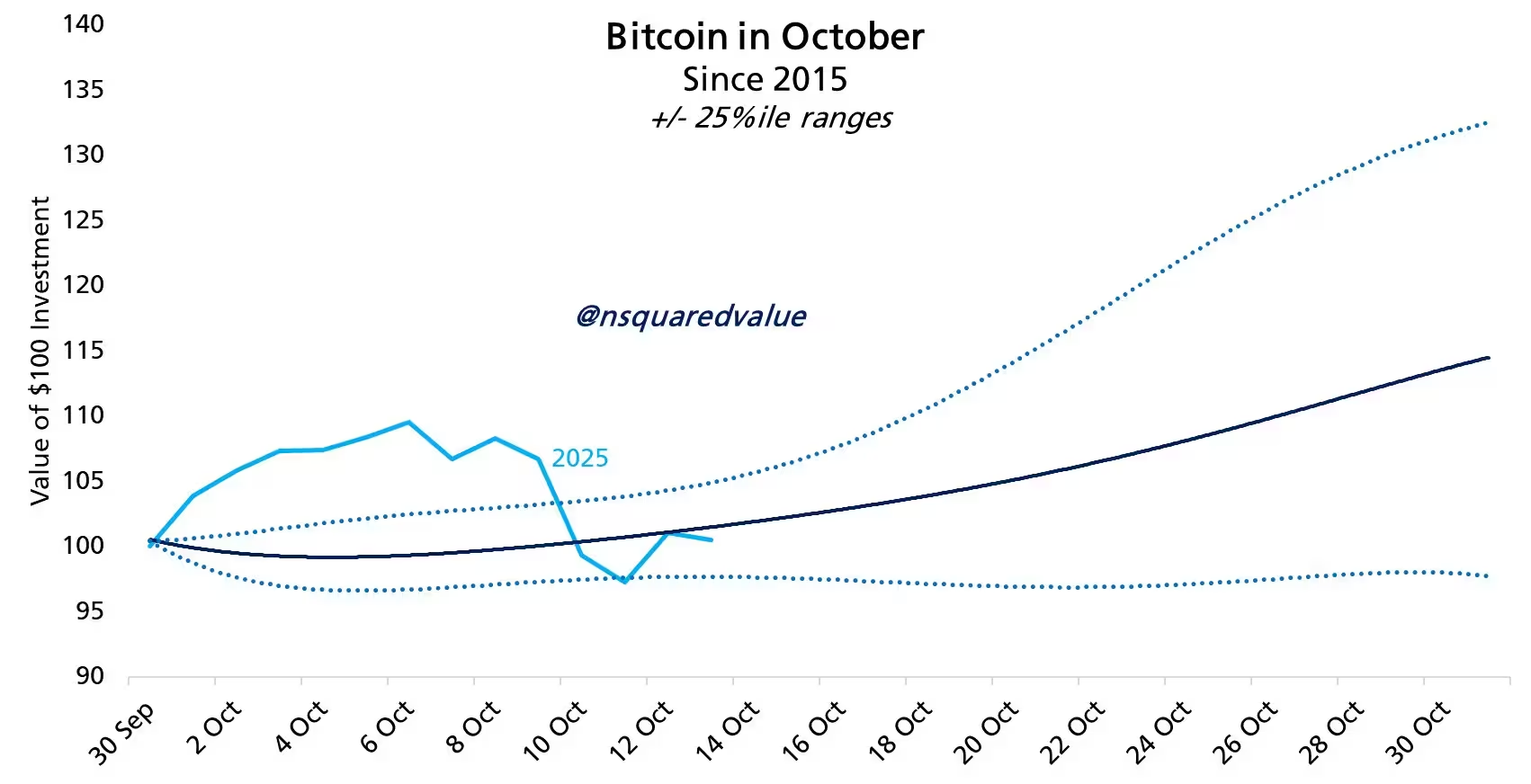

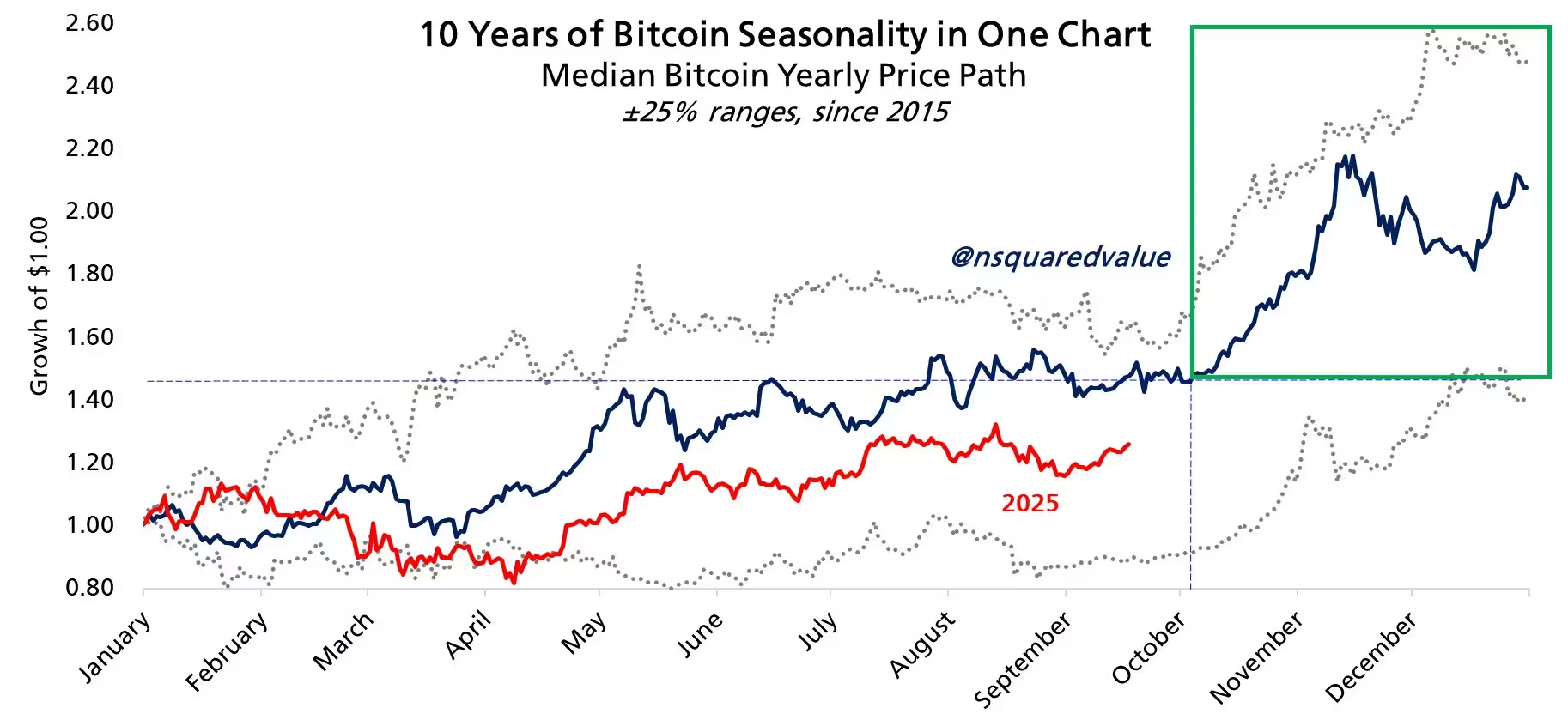

Network economist Timothy Peterson has published charts showing the current bull market’s distinct behavior compared with previous cycles. His work points out that much of "Uptober" upside historically tends to materialize later in the month: roughly 60% of Bitcoin’s annual gains often occur after October 3rd. That seasonal pattern gives bulls hope that the latter half of October could flip the script if momentum returns.

Bitcoin October performance comparison

Macro catalysts: the Fed and market risk appetite

A key macro event that could reshape BTC’s path is the U.S. Federal Reserve meeting on Oct. 29. Markets are watching for signals that the Fed may end quantitative tightening (QT) or move toward interest-rate cuts. If the Fed telegraphs a looser stance or confirms the end of QT, crypto and other risk assets could receive a meaningful boost — a scenario that would likely revive Bitcoin buyers and reverse October losses.

Bitcoin price seasonality

What traders should watch

Traders should monitor several variables: BTC price relative to the $107k–$111.5k range, monthly candle close, on-chain liquidity and derivative funding rates. Also track macro indicators such as Fed commentary, inflation prints, and risk-on flows into equities. A decisive breakout above the local range combined with dovish Fed signals could revive the Uptober narrative; failure to reclaim higher ground risks cementing a rare negative October for Bitcoin.

Conclusion: Uptober remains undecided. Seasonality and a potentially market-moving Fed decision offer the chance for recovery, but current price action leaves Bitcoin exposed to a historically poor month unless bulls stage a late comeback.

Source: cointelegraph

Leave a Comment