3 Minutes

Bitcoin spot volume surges past $300 billion amid October volatility

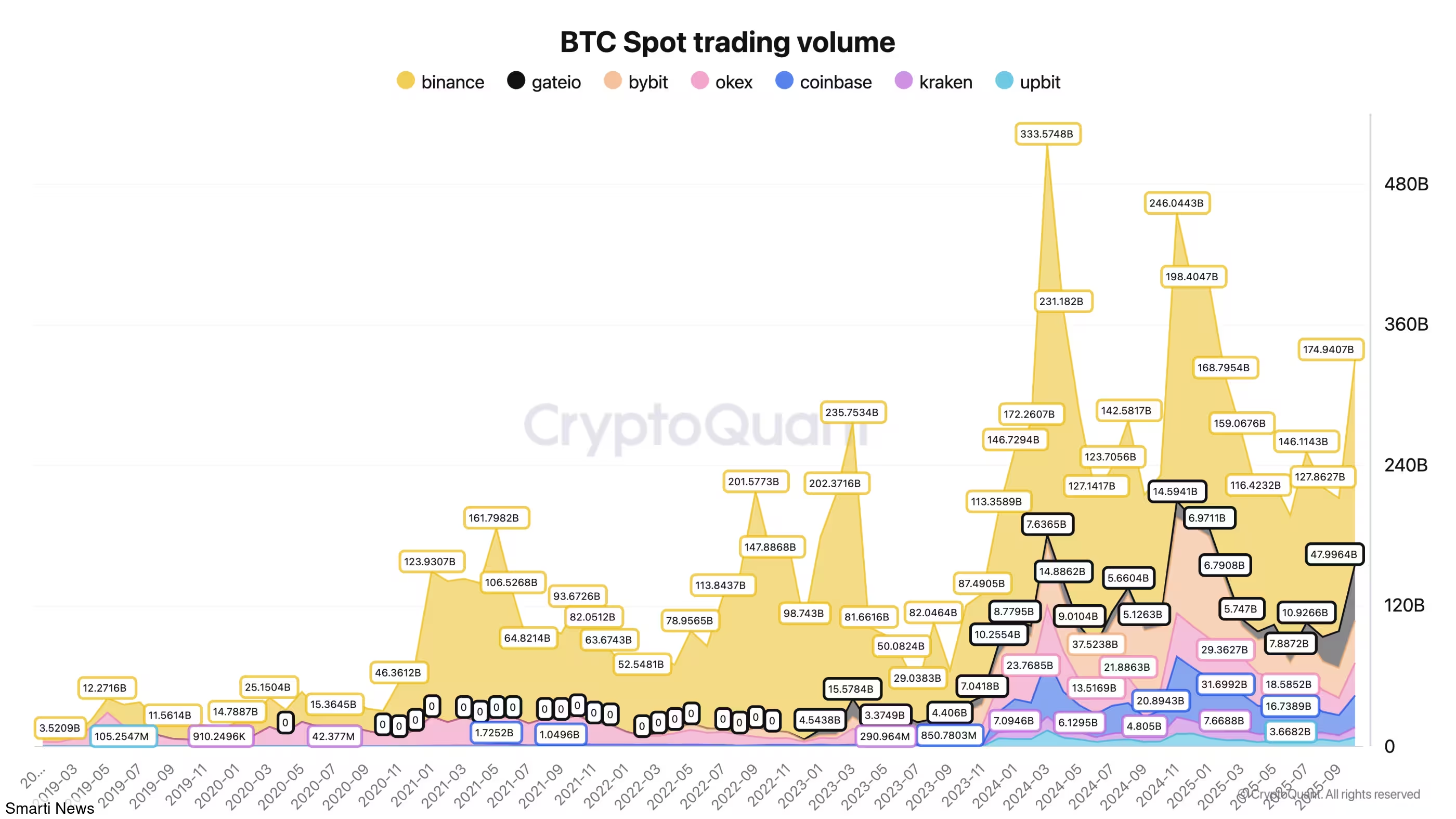

Bitcoin's spot trading volume vaulted past $300 billion during October 2025 as traders rotated into lower-risk spot markets following a mid-month BTC price correction. On-chain analytics provider CryptoQuant finds that, despite a nearly 20% pullback from all-time highs, market participation on the spot side remained robust — a sign many analysts view as constructive for longer-term market stability.

Binance drives most of the rebound

The concentrated nature of the rebound is notable. CryptoQuant's aggregated exchange data shows Binance accounted for roughly $174 billion of the October spot tally, making it the primary venue for renewed Bitcoin spot interest. For bulls, heavy spot activity — especially on major exchanges — suggests that buying demand is more organic and less reliant on leveraged derivatives flows.

Bitcoin spot trading volume

Why spot dominance matters

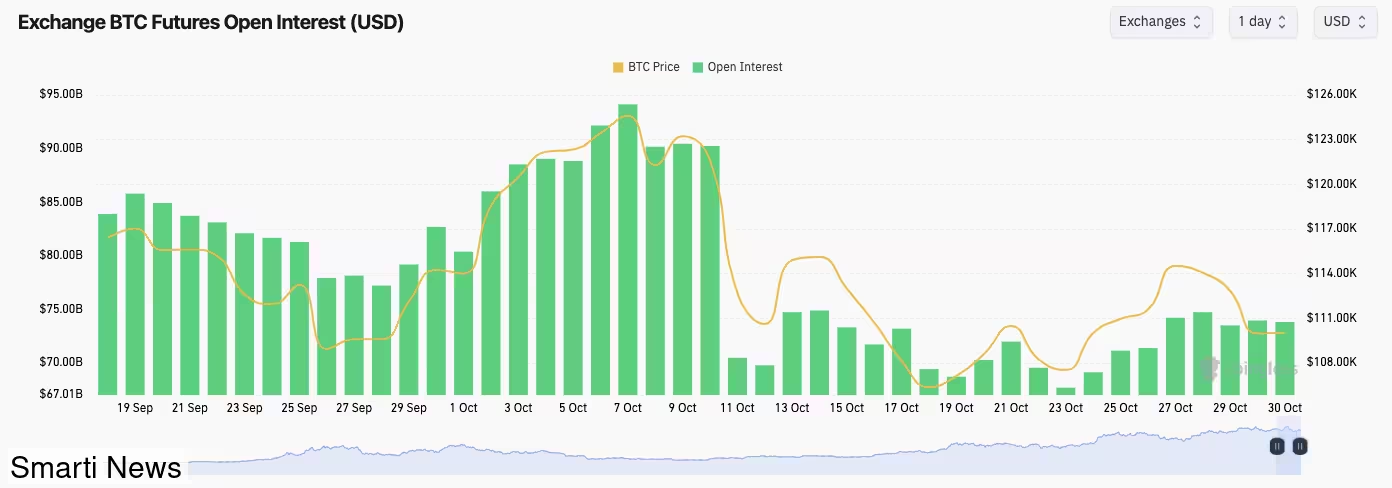

Markets dominated by spot trading tend to be less prone to the short, violent swings often produced by excessive derivatives open interest. Earlier in October, BTC’s sharp decline erased significant derivatives open interest (OI) and triggered mass liquidations across futures markets. That event appears to have prompted a portion of traders to pivot away from leveraged positions and back into outright BTC ownership.

Bitcoin futures open interest

Traders showing 'highly constructive' behavior

CryptoQuant contributor Darkfost described the shift as “highly constructive,” pointing to increased participation from both retail investors and institutional players on the spot side. A spot-led market can indicate stronger organic demand for Bitcoin and greater resilience in the face of volatility, because it reduces the probability of cascading liquidations that amplify price shocks.

The October episode also highlighted the ongoing interplay between spot volume and derivatives markets. While derivatives still play an important role in liquidity and hedging strategies, a heavier tilt toward spot trading generally correlates with healthier market structure and improved price discovery.

What traders should watch next

Key metrics to track going forward include exchange inflows and outflows, futures open interest, and funding rates — all of which help indicate whether liquidity is moving back into leveraged products or remaining concentrated on spot exchanges. For leveraged traders, the October drop provided both opportunities and risks, as the market swung rapidly and liquidated sizable long and short positions.

Overall, the October 2025 surge in Bitcoin spot volume — led by Binance and documented by CryptoQuant — signals a noteworthy rotation in trader behavior that could support a more stable BTC market as the macro and on-chain narratives evolve.

Source: cointelegraph

Leave a Comment