5 Minutes

Weekly NFT market snapshot: sales dip, participation rises

The NFT market recorded a notable contraction in trading volume this week, with total NFT sales falling 28.42% to $98.18 million, according to CryptoSlam. Despite the decline in dollar volume, on-chain participation increased: unique buyers climbed 22.86% to 626,341 while sellers rose 13.54% to 469,316. Overall NFT transactions slipped 5.08% to 1,458,311 as the broader crypto market cap eased to $3.71 trillion from last week’s $3.75 trillion.

Top collections: BAYC comeback and mixed performance

DMarket and DX Terminal see pullbacks

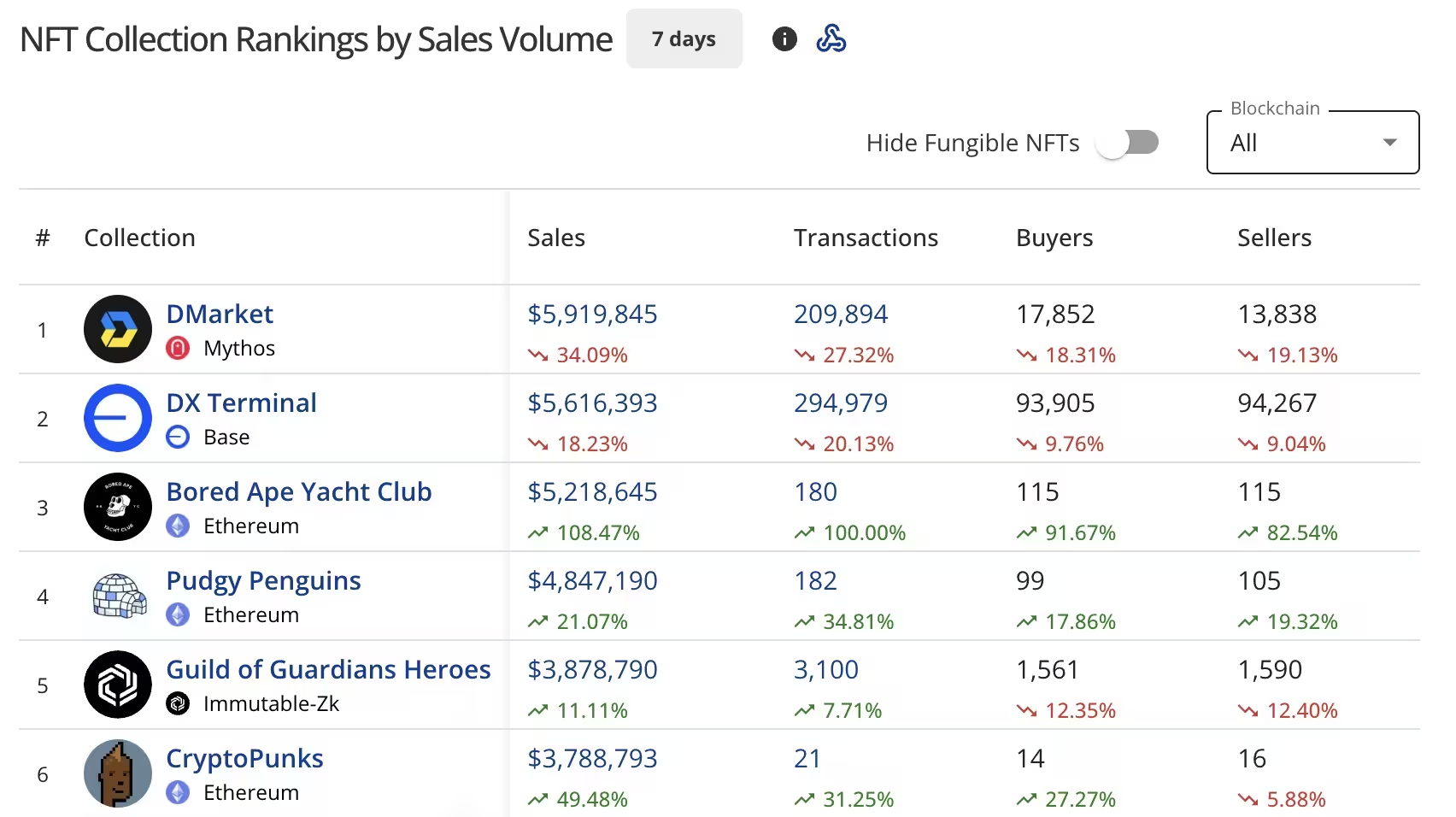

DMarket, launching on the Mythos blockchain, experienced a 34.09% week‑over‑week decline from $9.05 million to $5.92 million in sales, but it retained the top spot by volume. The collection handled 209,894 transactions and recorded 17,852 buyers and 13,838 sellers.

DX Terminal on Base came in second with $5.62 million in sales, down 18.23% from $7.56 million last week, while processing 294,979 transactions.

Top collections by NFT Sales Volume

Bored Ape Yacht Club returns to the top ranks

Bored Ape Yacht Club (BAYC) made a powerful recovery, jumping 108.47% to $5.22 million and reclaiming third place among collections. The Ethereum BAYC activity included 180 transactions with 115 buyers and 115 sellers — a sign that high‑value, low‑frequency trades drove the spike.

Pudgy Penguins climbed to fourth with $4.85 million, up 21.07% from $3.80 million, showing steady collector interest. Guild of Guardians Heroes on Immutable‑ZK moved into fifth with $3.88 million (+11.11%), logging 3,100 transactions. CryptoPunks re‑entered the top six at $3.79 million, surging 49.48% in value despite only 21 transactions (14 buyers, 16 sellers).

Network-level flows: Ethereum extends its lead

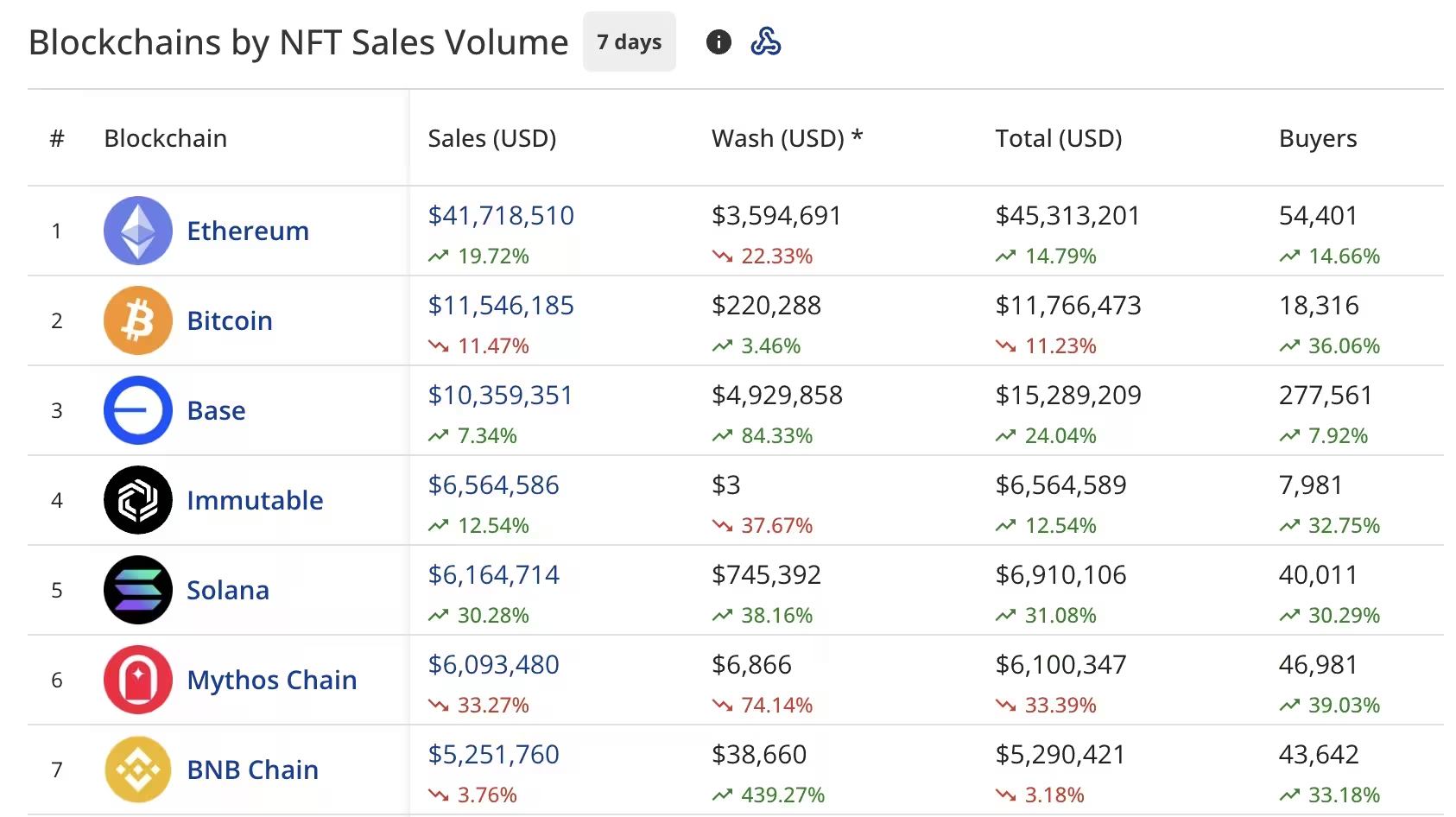

Ethereum led blockchain NFT volumes with $41.72 million — a near 19.72% increase from $35.04 million the previous week. CryptoSlam’s data also flagged $3.59 million in suspected wash trading on Ethereum, bringing the adjusted total to around $45.31 million. Buyer activity on Ethereum rose 14.66% to 54,401 addresses.

Blockchains by NFT Sales Volume

Bitcoin held second for NFT sales at $11.55 million, down 11.47% from $13.17 million, while reporting 18,316 buyers (up 36.06%). Base remained in third with $10.36 million (+7.34%), though it logged a sizable $4.93 million in wash trading and saw buyers increase 7.92% to 277,561.

Immutable rose to fourth with $6.56 million (+12.54%) and 7,981 buyers (up 32.75%). Solana gained momentum, posting $6.16 million in NFT sales — a 30.28% jump — attracting 40,011 buyers (+30.29%). Mythos Chain retreated to sixth at $6.09 million (-33.27%) despite buyer growth, and BNB Chain rounded out the top seven with $5.25 million (-3.76%) and buyers up 33.18% to 43,642.

High‑ticket sales and market implications

High‑value transactions continued to shape headlines. The top single sale was CryptoPunks #8407 at $413,469.94 (100 ETH). BAYC #3105 sold for $359,769.63 (90 ETH), and V1 Cryptopunks Wrapped #4350 traded for $248,839.14 (62.9 ETH). Autoglyphs #256 fetched $222,558.91 (59 WETH), and CryptoPunks #7378 closed the top five at $212,360.44 (51 ETH).

These outsized sales demonstrate that while aggregate NFT dollar volume softened, collector appetite for marquee items remains robust. The divergence — fewer dollars but more participants — suggests increased retail engagement in lower‑value drops and continued interest from whales in flagship collections such as BAYC and CryptoPunks.

Outlook for NFT traders and collectors

For traders and collectors watching market signals: expect continued volatility in weekly NFT volume as networks and marquee collections rotate in and out of focus. Monitor wash trading reports, network liquidity, and buyer counts to separate genuine demand from transient volume spikes. Ethereum still commands the lion’s share of value, but blockchains like Solana and Base are attracting growing buyer pools — important for creators, marketplaces, and NFT investors evaluating strategy.

This summary synthesizes CryptoSlam data and reflects current NFT market dynamics that matter to collectors, investors, and blockchain observers.

Source: crypto

Comments

mechbyte

BAYC roaring back, crazy that 115 buyers for one BAYC sale only, whales still runnng the show. hype city, floor meh

coinpilot

Weird combo of more buyers but less $... is wash trading skewing the numbers? smells fishy, imo. lots of tiny flips tho

Leave a Comment