5 Minutes

Bitcoin ETFs record heavy outflows after US shutdown ends

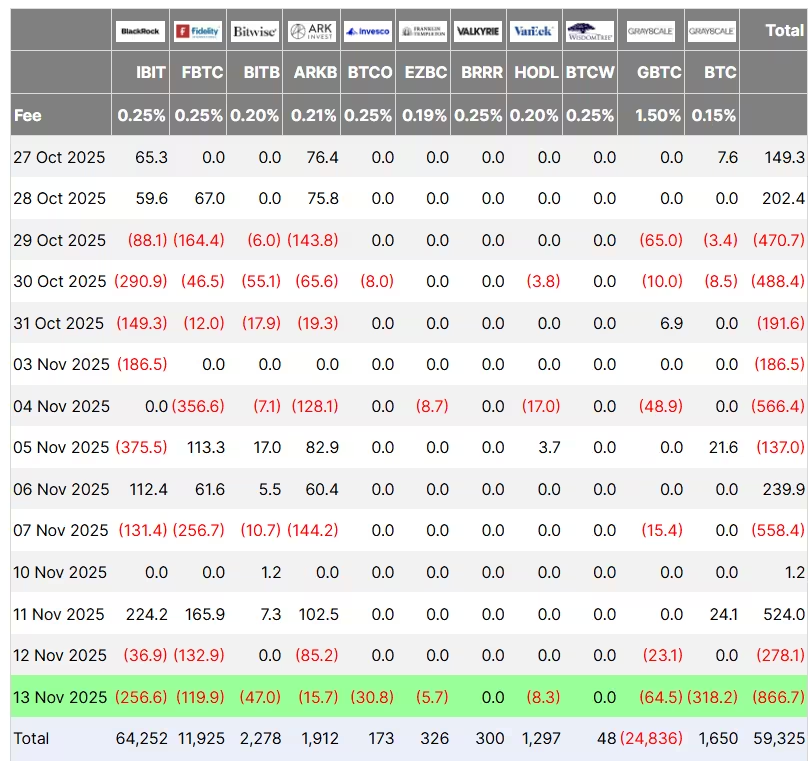

Demand for Bitcoin and crypto-linked investment products slid sharply on Thursday as US spot Bitcoin ETFs recorded $866 million in net outflows. This marked the second-largest single-day withdrawal on record, trailing only the $1.14 billion exodus seen on Feb. 25, 2025, per Farside Investors. The outflows came despite the end of the 43-day US government shutdown and the passage of a funding bill that keeps federal operations funded through Jan. 30, 2026.

Bitcoin ETF flows (in USD, million)

The sell-off pushed BTC toward a six-month low and intensified debate about investor appetite and market structure. ETFs had been one of the primary drivers of Bitcoin's price momentum in 2025, alongside large institutional buyers and corporate treasury allocations. With these inflows reversing, market participants are now scrutinizing whether the rally has lost steam or is merely pausing.

What drove the exodus and why it matters

Several factors likely contributed to the withdrawals. The end of the federal shutdown removed a short-term political tailwind for risk assets and may have prompted profit-taking among traders and institutions. Liquidity dynamics in ETF wrappers can also amplify moves: when large shareholders redeem or rebalance, that selling pressure flows through to the spot market. For Bitcoin, where liquidity depth varies by venue and time of day, ETF-related outflows can have outsized price impact.

Analysts warn that ETF demand remains a core component of Bitcoin market health. Reduced inflows raise questions about the pace of institutional adoption and the sustainability of current price levels. On-chain indicators and derivatives markets should be watched closely for signs of shifting positioning.

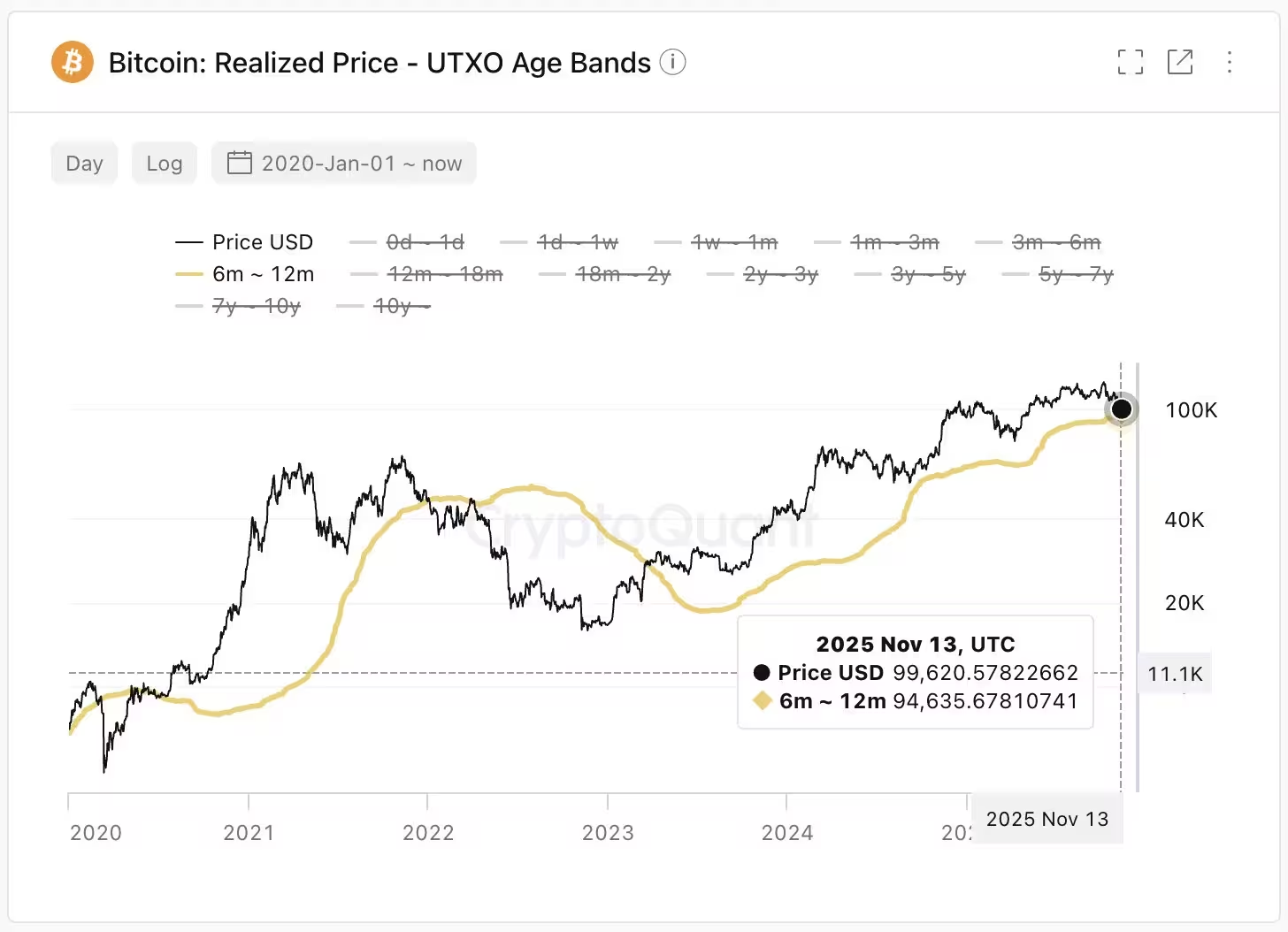

Key support level highlighted by CryptoQuant

Ki Young Ju, founder and CEO of crypto intelligence platform CryptoQuant, emphasized that Bitcoin's broader bullish trend remains intact unless price drops below a critical level near $94,000. This figure represents the average cost basis of investors who purchased BTC in the past six to 12 months and acts as a psychological and technical support zone. Ju recommended patience and cautioned against declaring a bear market prematurely.

Market structure evolving with ETFs and new administration

Not everyone sees the recent outflows as a turning point. Hunter Horsley, CEO of asset manager Bitwise, argued that the launch of spot Bitcoin ETFs and shifts in US policy mark a new market structure that could alter traditional cycle dynamics. Horsley suggested the market may already be transitioning out of a short-term corrective phase, and that the current setup for crypto adoption looks robust.

Altcoin ETFs show pockets of demand

While Bitcoin ETFs felt the pressure, some altcoin-based exchange-traded funds signaled underlying investor interest in regulated crypto exposure. The Canary Capital XRP (XRPC) ETF debuted as the first US-based fund holding spot XRP tokens and produced the largest Day One volume among all ETF launches this year, according to Bloomberg analyst Eric Balchunas. XRPC reported about $58 million in trading volume on day one, narrowly edging out another notable ETF.

Other crypto ETFs were mixed. Ether ETFs logged roughly $259 million in outflows on Thursday, while Solana ETFs saw modest inflows of $1.5 million, extending a 13-day streak of positive flows. These divergent flows underscore that investor interest is rotating across digital-asset exposures rather than disappearing entirely.

Outlook and what to watch next

Investors and traders should monitor ETF flow data, on-chain liquidity metrics, and derivatives positioning to gauge whether the current wave of redemptions is transient or the start of a broader trend. Key levels around $94,000 for Bitcoin will be critical in determining whether bulls can defend recent gains. Institutional demand, regulatory clarity, and macroeconomic developments will continue to shape ETF flows and crypto market structure in the months ahead.

Overall, the $866 million outflow is a significant signal but not definitive proof of a market regime change. Market participants should balance flow data with on-chain and macro indicators to form a clearer view of near-term risk and longer-term adoption trends.

Source: cointelegraph

Comments

Tomas

Feels overhyped tbh. Altcoin ETFs showing some life, rotation > vanish. If $94k cracks then things get interesting…

blocktone

Wait so $866M outflow right after shutdown ended? feels like profit taking + ETF mechanics, not full panic yet. $94k is key, liquidity could bite.

Leave a Comment