5 Minutes

Market snapshot: NFT volume slumps while Solana shows strength

According to CryptoSlam data, global NFT sales volume fell sharply this week, plunging 15.72% to $64.95 million from $77.10 million the prior week. The decline was driven by a dramatic drop in participation: active buyers and sellers evaporated even as major chains like Solana posted notable weekly gains in sales value.

Key figures at a glance

- Total NFT sales: $64.95 million (down 15.72%)

- NFT buyers: 154,955 (down 68.41%)

- NFT sellers: 115,051 (down 71.48%)

- NFT transactions: 940,713 (down 13.25%)

- Global crypto market cap: $3.07 trillion (up from $3.05 trillion)

Bitcoin recovered to roughly $90,000 after recent volatility, while Ethereum held steady above the $3,000 mark. Despite these macro gains, NFT market participation collapsed, signaling weaker retail engagement and a shallow market depth for many collections.

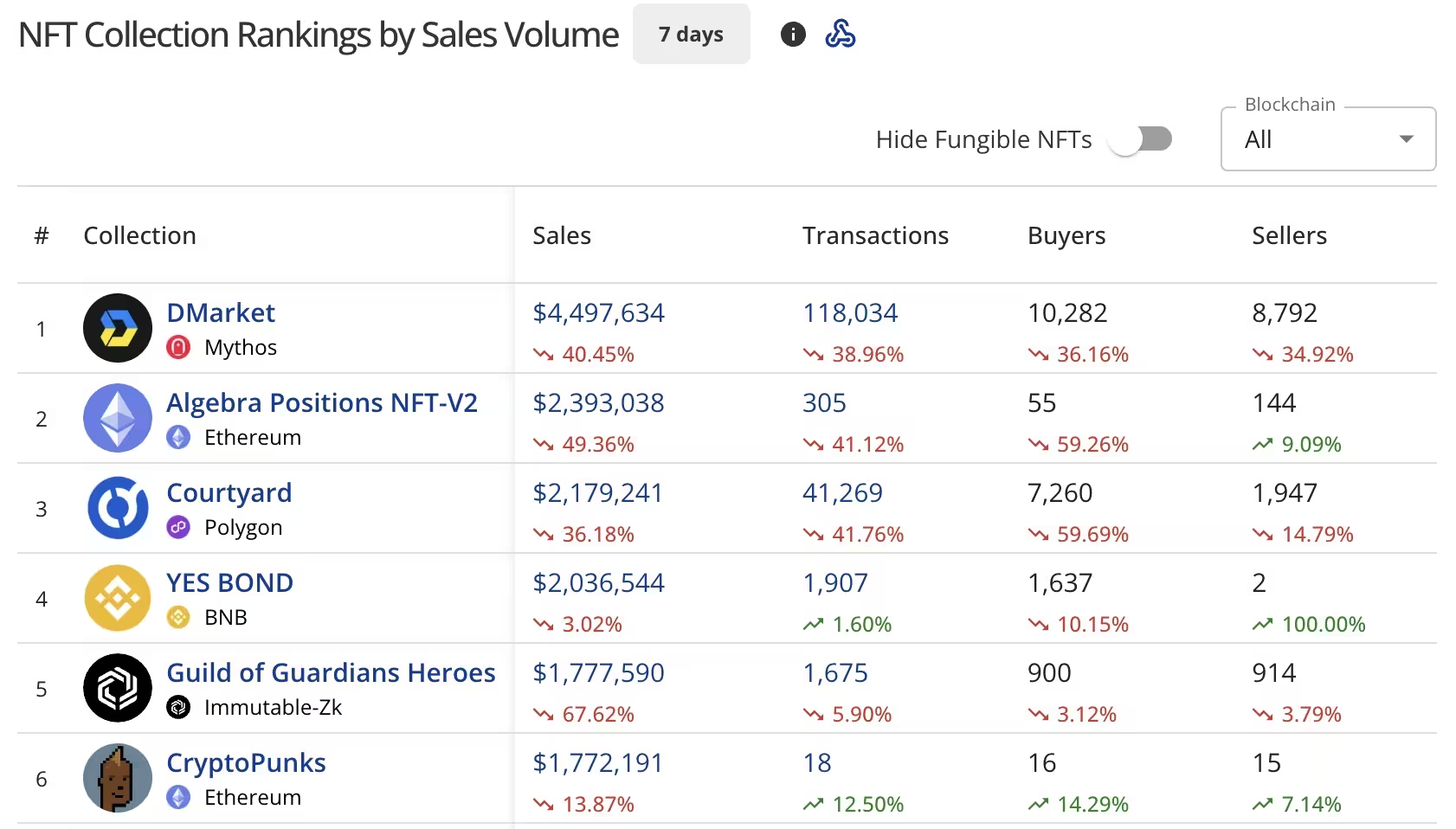

Top NFT collections: DMarket keeps the lead amid falling volumes

Top collections by NFT Sales Volume

DMarket retained the top collection slot on the CryptoSlam charts with $4.50 million in weekly sales, but that figure represents a 40.45% decline from $6.73 million a week earlier. DMarket’s activity included 118,034 transactions with 10,282 buyers and 8,792 sellers, underscoring how transaction counts can remain high even when traded value declines.

Algebra Positions NFT-V2 on Ethereum slipped into second with $2.39 million in sales, down 49.36% from $4.47 million. That collection recorded 305 transactions involving 55 buyers and 144 sellers. Courtyard (Polygon) held third place at $2.18 million, a 36.18% drop from $3.42 million, processing 41,269 transactions.

YES BOND on BNB showed relative resilience in fourth place with $2.04 million in sales, down just 3.02% from $2.09 million and logging 1,907 transactions. Guild of Guardians Heroes on Immutable-ZK tumbled into fifth with $1.78 million, a 67.62% collapse from $5.46 million. CryptoPunks remained a notable name with $1.77 million in sales, down 13.87% from last week, recording 18 transactions (16 buyers, 15 sellers).

Blockchains: Ethereum dominates but wash trading clouds the picture

.avif)

Blockchains by NFT Sales Volume

Ethereum continued to lead blockchain-level NFT sales with $23.93 million, although that is down 10.88% from $27.30 million the prior week. CryptoSlam flagged $4.43 million in potential wash trading on Ethereum this week, bringing the reported wash-trade figure to $28.36 million — a reminder that raw volume figures can be distorted by artificial activity.

BNB Chain climbed to second with $9.44 million in sales (up 21.18%), recording $118,899 in suspected wash trading and a sharp decline in distinct buyers to 14,599 (down 76.66%). Bitcoin’s NFT ecosystem held third at $6.10 million, falling 21.20% from the prior week and seeing only 3,552 buyers (down 79.51%).

Solana stood out with a 44.54% weekly increase to $5.54 million in NFT sales, but the surge comes alongside a large flagged wash-trade figure of $5.36 million (totaling $10.90 million in reported wash activity). Interestingly, Solana’s reported buyer count dropped 80.07% to 14,891 despite the sales rise, suggesting a concentration of volume in fewer wallets or repeat trades.

Other chains reported steep declines: Mythos Chain fell to $4.64 million (down 39.26%), Immutable tumbled to $3.15 million (down 63.32%), and Polygon recorded $3.12 million (down 29.38%) while showing $5.99 million in potential wash trading. Across the board, buyer counts plunged, reflecting reduced retail appetite or a pause in speculative trading.

Notable single-item sales and the BRC-20 spotlight

Bitcoin-based BRC-20 token $X@AI claimed the week’s top single-sale position, selling for $809,337.16 (8.7195 BTC) nine days ago. High-profile CryptoPunks sales also made the top-five individual transactions:

- CryptoPunks #6615 — $153,356.75 (47.99 ETH), nine days ago

- CryptoPunks #309 — $134,530.52 (42 ETH), nine days ago

- CryptoPunks #4566 — $123,808.45 (39.9 ETH), four days ago

- CryptoPunks #4172 — $111,232.08 (33 ETH), three days ago

What this means for traders and collectors

The latest CryptoSlam snapshot shows an NFT market in flux: overall dollar volume has declined, participation metrics are down dramatically, but pockets of high-value activity remain, particularly on Solana and Ethereum. Traders should be cautious: wash trading can inflate perceived liquidity, and collapsing buyer counts increase price volatility for mid-cap and smaller collections. For collectors, these conditions may present selective buying opportunities but also require rigorous due diligence.

As the market digests these figures, watch for how buyer participation evolves and whether sustained demand returns to the broader NFT ecosystem or continues to fragment around select chains and blue-chip collections.

Source: crypto

Comments

datapulse

DMarket still top despite value drop? weird market depth, feels like bots and repeat wallets, collectors will be picky now.

coinpilot

Is Solana really up or is wash trading juicing the numbers? buyers vanished but sales up, smells fishy.. anyone else seeing this?

Leave a Comment