4 Minutes

Global laptop shipments face a rough 2026 as a persistent DRAM shortage squeezes supply chains and forces vendors to make hard choices. A fresh TrendForce report says Apple is better positioned than most rivals to soften the blow — thanks to integrated supply control, strong pricing power, and tight supplier relationships.

TrendForce sounds the alarm on 2026 notebook shipments

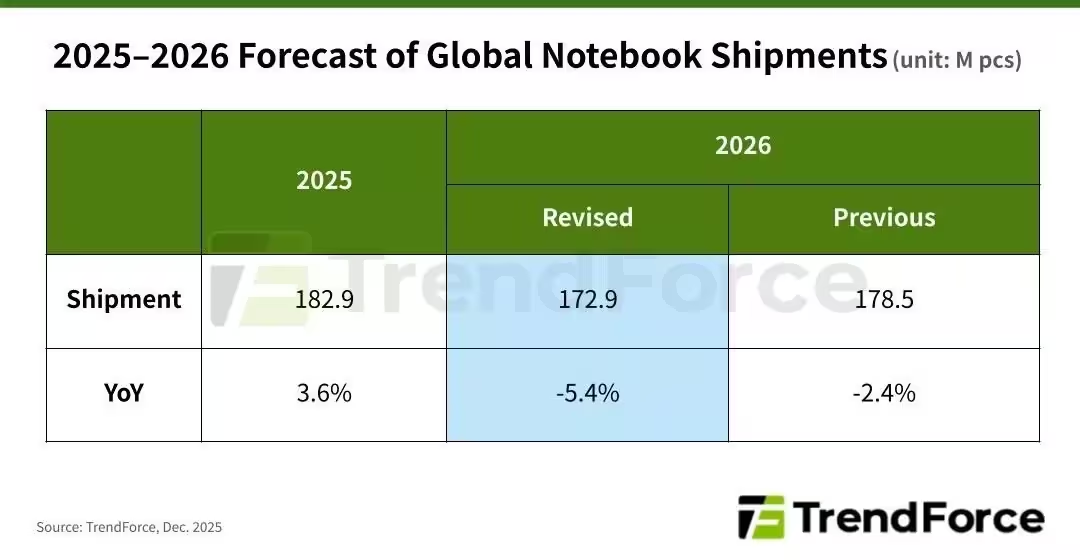

TrendForce has revised its 2026 outlook after ongoing memory shortages pushed makers to compete for limited DRAM. The firm now expects year‑over‑year notebook shipments to fall about 5.4%, from 178.5 million units to 172.9 million. That drop could deepen to roughly 10.1% if DRAM scarcity persists and prices stay elevated.

Manufacturers are already weighing compromises: either raise prices to keep memory configurations generous or downgrade baseline RAM to 8GB in some models. Those tradeoffs make the supply chain more crucial than ever — companies with stronger procurement and predictable demand will have an edge.

Why Apple has the upper hand

Here’s why TrendForce believes Apple can manage the crisis better than most PC makers:

- Integrated supply chain and volume purchasing allow Apple to secure steady memory allocations even when the market tightens.

- Clear product roadmaps and predictable launch schedules make demand easier to forecast, helping Apple maintain supplier relationships.

- Strong pricing power gives Apple flexibility to absorb higher component costs without the same pressure to cut specs as some competitors.

Put simply: when DRAM is scarce, control over sourcing and the ability to plan buys months ahead matter a lot. Apple checks those boxes.

Samsung's role and why it matters

TrendForce also highlights Samsung as a major factor. The company has recently become Apple’s largest DRAM supplier for iPhone 17 and 18 models, providing an estimated 60–70% of LPDDR5X shipments. Those deeper ties with a top memory vendor give Apple more flexibility across its product lineup, from phones to Macs.

MacBook lineup strategy: budget and premium moves

Not all of Apple’s models are expected to contribute equally to growth in 2026. TrendForce points to several product plays that could shape demand:

- Budget MacBook (12.9-inch): Expected in spring 2026, this cost‑focused MacBook with an A18 Pro chip and tight supply control could attract buyers trading down or entering the Apple ecosystem.

- MacBook Air M5 family: A refresh with a stronger M5 chip and competitive pricing could prompt upgrades and help sustain shipments amid a shaky market.

- MacBook Pro M5 Pro/M5 Max: Professional models launching in early 2026 will likely be important for headline impact, but TrendForce expects their contribution to overall shipment growth to be modest compared with affordable MacBook options.

In a market where many vendors may trim RAM or push up prices, an affordable MacBook that keeps reasonable specs could be a meaningful volume driver.

What consumers and rivals should watch

Will Apple fully escape the fallout? Not necessarily. Prolonged DRAM shortages and sustained high memory prices would tighten everyone’s margins. But companies with less predictable demand and weaker supplier leverage could face deeper cuts to specs or steeper price increases.

For consumers, the practical questions are: will baseline RAM shrink across the PC market, and which brands will still offer competitive memory options? For rivals, the challenge is securing supply without eroding product value or alienating buyers.

Why it matters

Imagine shopping for a laptop in 2026 and finding 8GB as the default in far more models. That scenario reshapes upgrade incentives, resale values, and buyer decisions across both Windows and macOS ecosystems. TrendForce’s report suggests Apple’s supply strategy could let it avoid the worst of that shift, at least relative to peers.

Leave a Comment