3 Minutes

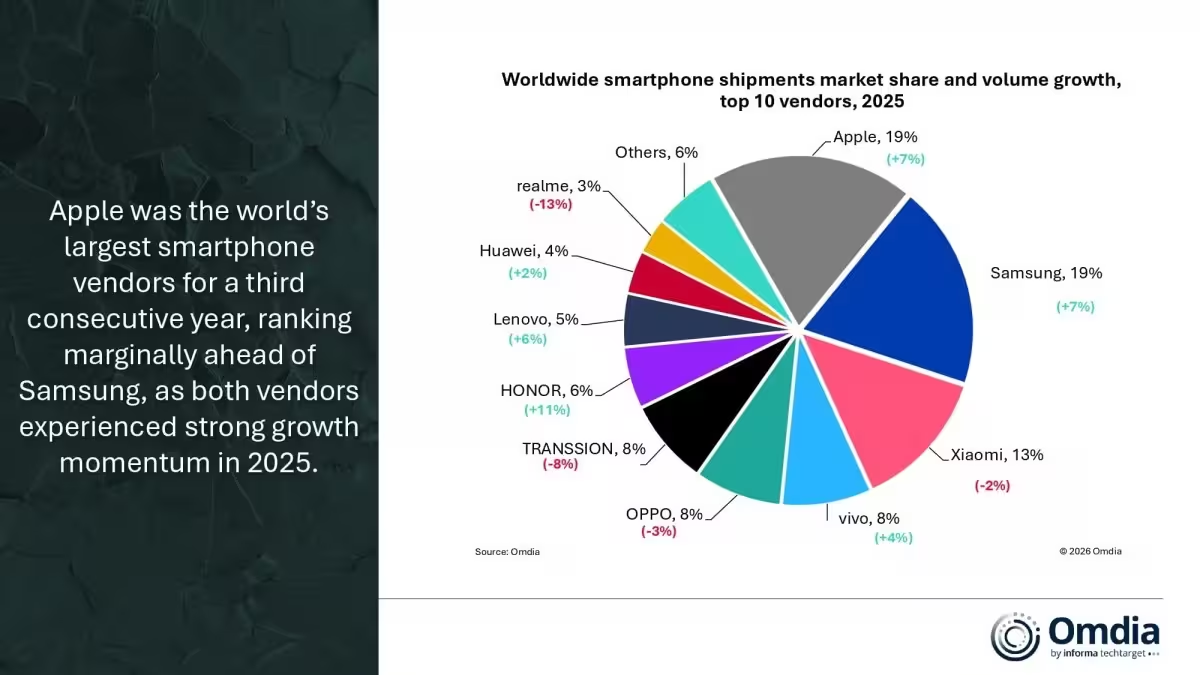

The smartphone race in 2025 came down to fractions—Apple shipped 240.6 million iPhones, Samsung 239.1 million phones. Close doesn't begin to describe it. Both giants recorded a 7% year‑over‑year lift, and when rounded, each claims roughly 19% of the market. The headline? Apple just edged Samsung, but the field beneath them is shifting faster than you might think.

Honor was the surprise accelerant, posting the fastest growth among major brands at 11%. Xiaomi, meanwhile, slipped 2% to 165.4 million units and now holds about 13% market share. vivo and Oppo sit on either side of the 100‑million mark: vivo shipped 105.3 million devices, up 4% (around 8% share), while Oppo moved 100.7 million units, down about 3% but still near an 8% share.

.avif)

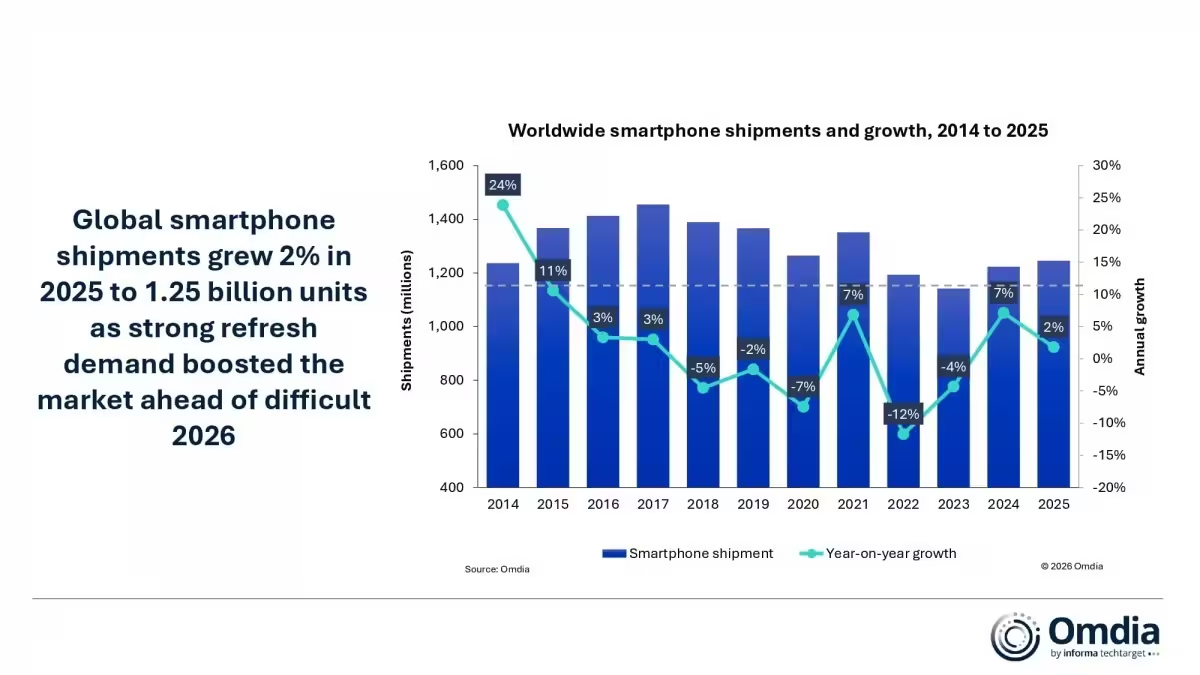

Transsion hovered close behind the top five with roughly an 8% slice of shipments. Honor holds about 6%, Lenovo 5%, Huawei 4% and Realme 3%. All told, global smartphone shipments grew 2% in 2025 to reach about 1.25 billion units. Steady overall growth, but the geography tells a different story.

Greater China bucked the global trend with a slight decline. Why? Analysts point to the fading effect of a national subsidy program that had propped up sales the year before. Yet Apple's performance in Mainland China was striking: demand for the iPhone 17 series helped the company grow roughly 26% in that market, erasing some of the regional headwinds other vendors faced. What happens in China still moves the board.

Numbers only tell part of the story. The market is stabilizing at a new normal: matured replacement cycles, pockets of subsidies and timing around flagship launches. Manufacturers that can stitch together appealing hardware, competitive pricing and carrier or retail incentives will pick up share. Those who rely purely on volume and promotions will find margins squeezed and headlines fleeting.

Bottom line: Apple holds a razor‑thin lead globally, Samsung stays neck and neck, and Honor is the growth story to watch.

Expect next year to be about product cadence and regional tactics more than runaway unit growth. Who refines their offer fastest could define the leaderboard again.

Source: gsmarena

Leave a Comment