3 Minutes

Memory chips are suddenly calling the shots. Prices have climbed so fast that industry forecasters now expect a meaningful contraction in smartphone shipments next year.

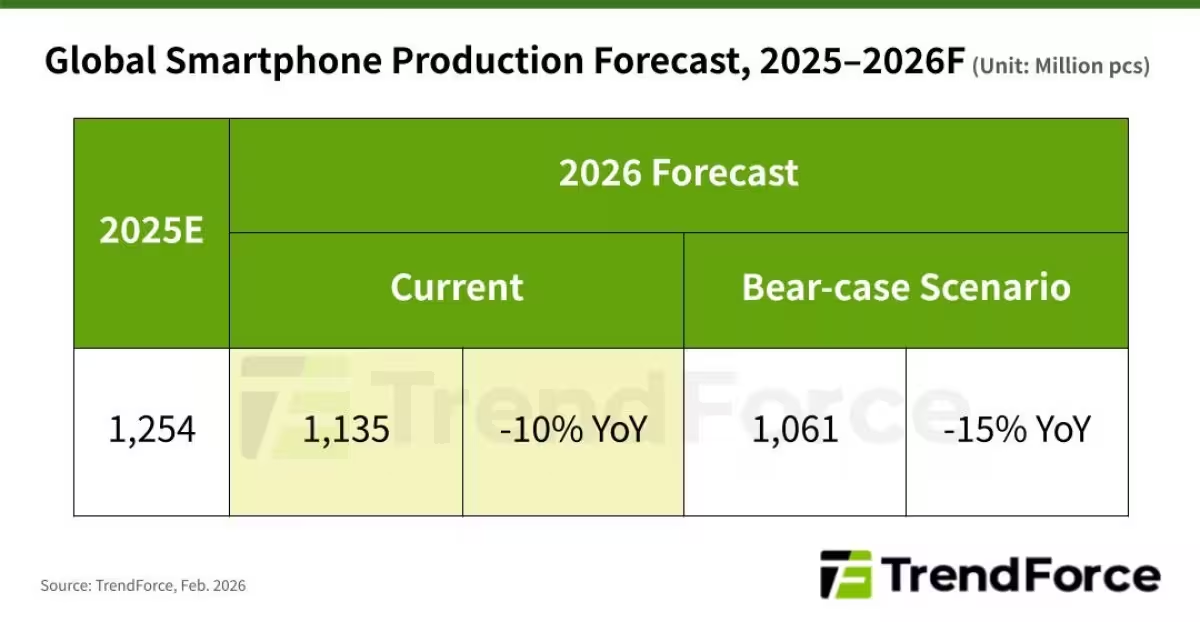

TrendForce's latest forecast pins a 10% decline in global smartphone shipments for 2026, trimming annual volumes to roughly 1.135 billion units. There is a darker scenario too: a bear case that sees shipments sliding as much as 15%, down to about 1.061 billion units.

That swing matters because 2025 closed on a rare positive note after a soft year, with the market ending up about 2% and shipments estimated between 1.24 and 1.26 billion units. The momentum from that modest recovery may be erased if memory costs remain elevated.

Why the alarm? Memory used to be a modest line item—historically about 10–15% of a smartphone's bill of materials. TrendForce now estimates memory could account for 30–40% of BOM for some devices. When one component swells to that degree, manufacturers face stark choices: absorb the hit, cut production, or pass costs to buyers. None are painless.

Not every maker will feel the squeeze the same way. Samsung occupies a privileged spot thanks to vertical integration and a strong memory supply position. Apple, with a loyal high-end customer base, typically walks a smoother road when price tags climb. The bulk of Chinese OEMs, which live and die by competitive pricing on low- and mid-range models, look far more exposed. Brands that depend on entry-level volume, Xiaomi among them, could see margins crushed or inventory strategy upended.

What should industry watchers watch for? Inventory adjustments at memory suppliers, OEM production cuts, and any early signs of price increases from tier-one brands. Small shifts in memory availability ripple quickly when that component now absorbs such a large share of costs.

Memory costs could push smartphone shipments down by double digits in 2026, and the market will sort winners from losers by their ability to manage price pressure.

Keep an eye on supply-chain moves and pricing announcements; the next few quarters will reveal whether this is a temporary shock or a structural reset for smartphone economics.

Source: gsmarena

Leave a Comment