3 Minutes

Imagine scrolling your feed and buying a share with a tap. No app-switching. No clunky links. That scenario is about to become real on X, the platform once known as Twitter.

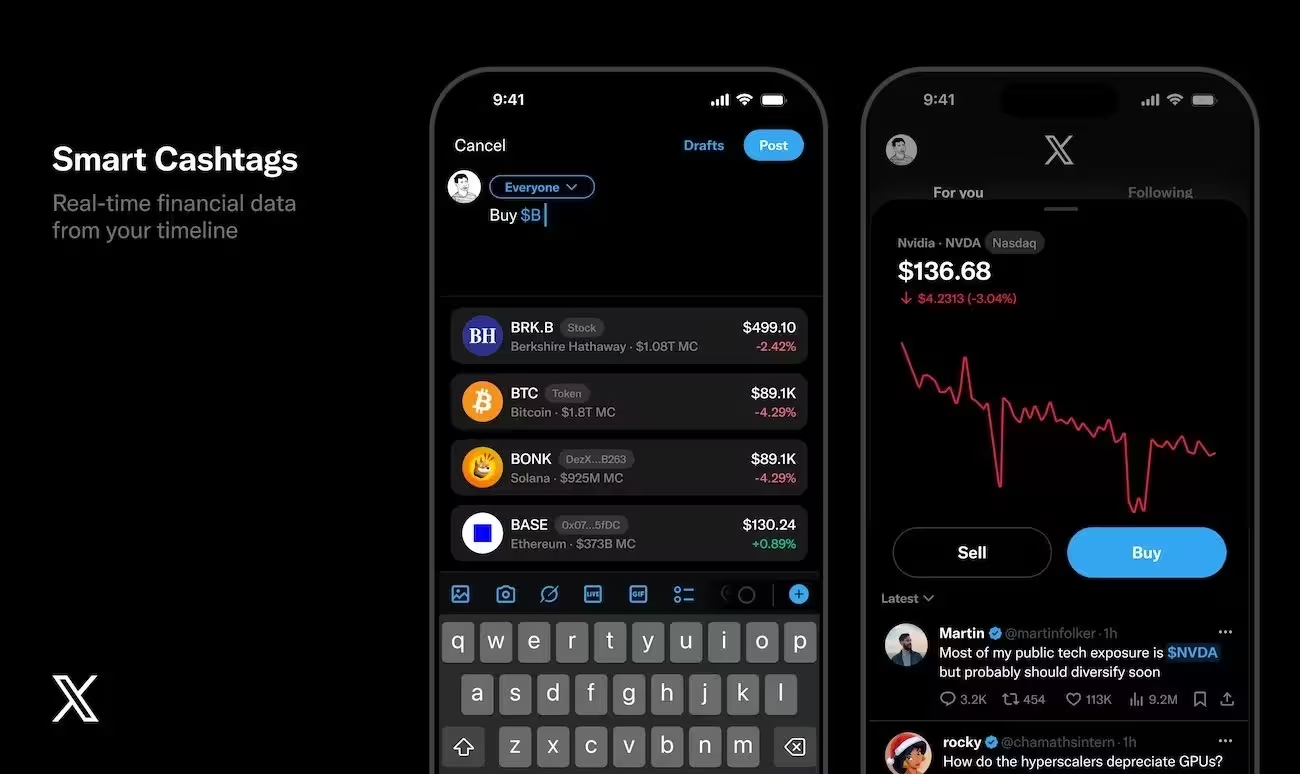

Product lead Nikita Bier announced a set of new features that will let users trade stocks and cryptocurrencies directly inside the app. The headline feature is called Smart Cashtags. Spot a ticker like TSLA or a crypto symbol such as BTC in a timeline post, tap, and you can begin a trade right there. Simple as that. The company says the trading flow will arrive within a few weeks.

This isn’t the platform’s first flirtation with market data. Back in 2022 X offered a basic cashtag system that showed live prices for assets like Bitcoin and Ethereum. That experiment faded away. What’s coming back now is smarter, deeper—and built to handle transactions rather than just quotes. In effect, X is moving from a real-time price board toward functioning like an online broker.

At the same time, Elon Musk previewed another piece of the puzzle at his xAI event: X Money, a native payments service. Musk described an ambition that sounds audacious and simple at once—make X the central place where money lives and moves. Right now X Money is in testing. The plan is a global rollout after a few more test cycles in the coming months.

Why does this matter? Because combining trading tools with peer-to-peer payments changes the user experience. Want to split a bill, tip a creator, and invest some spare cash? All without leaving one app. That’s the WeChat model Musk has often referenced—a single super-app that handles chat, rides, food, and finance. Integrating Smart Cashtags and X Money nudges X toward that vision.

Regulatory headaches and custody logistics will shape how fast and where these features land. Stock and crypto trading touch securities rules and financial compliance in different countries. Expect phased rollouts, regional limits, and partnerships with licensed financial firms behind the scenes. Users should also watch for confirmations about account safeguarding, custody, and fee structures as those details emerge.

This move could turn X from a social network into a unified financial doorway—if the company navigates legal and trust hurdles well.

For users, the near-term change is simple: faster access to markets. For the industry, it’s another sign that social platforms see financial services as a natural extension of engagement. And for regulators, it’s one more complex product to map. Does X succeed at stitching social conversation and seamless finance together? That answer will arrive in small rollouts, one tap at a time.

Leave a Comment