4 Minutes

Imagine booking an entire year's production before the calendar flips. That's the situation Western Digital finds itself in after signing a string of long-term deals that have effectively locked up its HDD output for 2026.

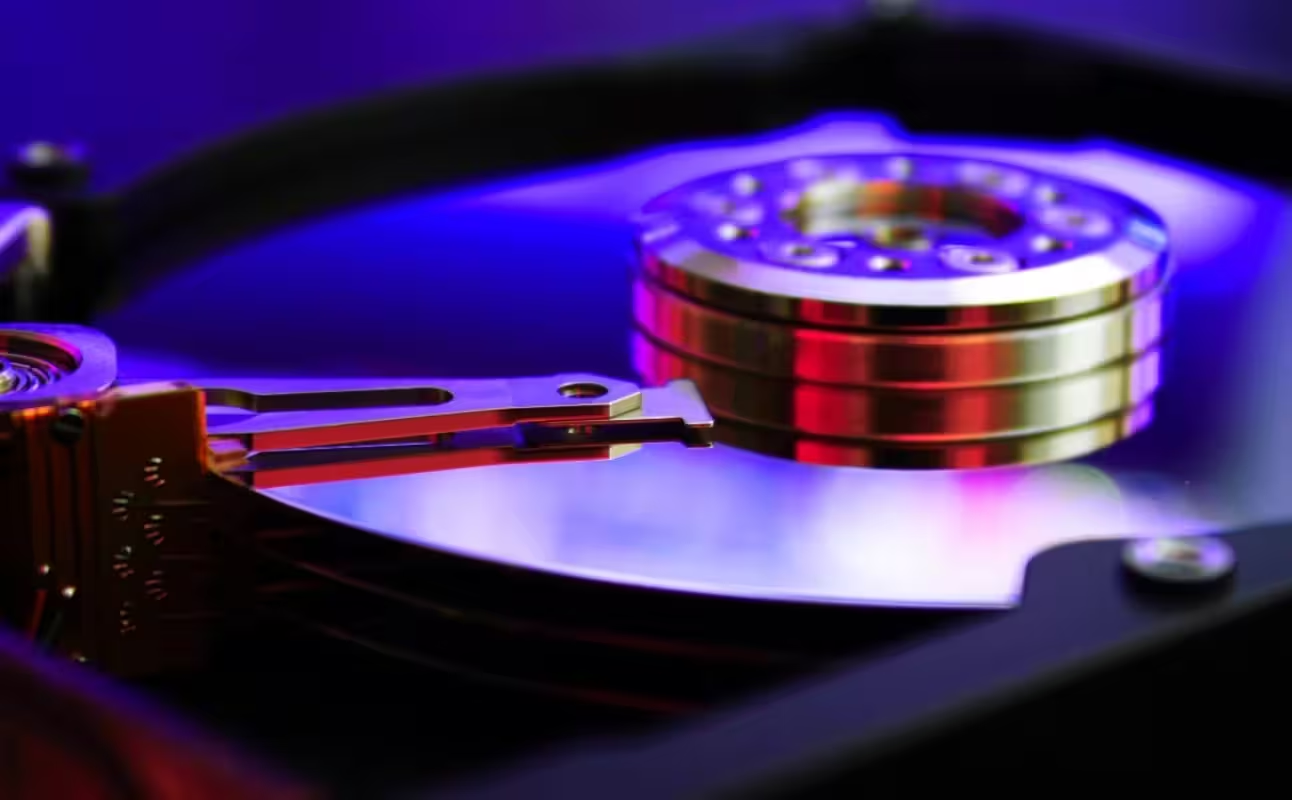

Demand has a new face: artificial intelligence. Training models and feeding inference pipelines requires mountains of cold storage — and for now, hard disk drives remain the most economical way to hold exabytes of that data. The knock-on effect is already visible. Memory and NAND tightness made headlines earlier; now spinning rust is joining the squeeze.

Irving Tan, Western Digital's CEO, told investors that almost all of the company's 2026 HDD capacity has been reserved through large, committed contracts. The numbers are striking. Seven of Western Digital's top customers have locked in full-year orders for 2026. Two additional customers signed multiyear deals for 2027, and one customer secured capacity into 2028. These agreements spell out exabyte-scale volumes and agreed pricing, shifting inventory risk and cash flow in predictable ways.

Almost all of Western Digital's 2026 HDD output is already sold into long-term enterprise contracts.

Why are cloud and enterprise buyers willing to lock in supply? Simple: scale and certainty. Cloud providers are racing to add new data center racks. They need predictable capacity and stable pricing as they plan multi-year AI and analytics deployments. For those operators, buying HDDs via long-term contracts removes a huge variable from capital planning.

Western Digital's own reporting underscores the pivot: cloud revenue now accounts for roughly 89% of total sales, while consumer HDDs make up only about 5%. That imbalance explains the company's product and go-to-market focus. Serve the hyperscalers and enterprise clouds, and you ride the growth curve of global data creation.

What does this mean for prices and availability? When manufacturers sell out capacity in advance, the market tightens. Suppliers with spare wafer, head, or platters capacity gain pricing power. Expect further price pressure on HDDs, particularly higher-capacity nearline drives aimed at cold, infrequently accessed datasets. That trend will ripple across storage budgets at cloud providers and enterprises that keep expanding their data lakes.

Not all storage is created equal. SSDs offer speed; HDDs offer density-per-dollar. For massive, sequential storage tasks — archival, backup, or bulk object stores that feed AI pipelines — HDDs are still the pragmatic choice. So long as exabyte-scale economics matter, spinning disks will be part of the infrastructure mix.

Supply chains remain fragile. Component competition from AI-focused projects has already strained DRAM and NAND. Now HDD suppliers face similar demand dynamics, with production calendars booked and contracts stretching years forward. For CIOs and procurement teams, timing purchases and renegotiating SLAs will become tactical necessities rather than administrative chores.

Companies and cloud providers will watch prices closely. Will new factory lines or alternative suppliers ease the squeeze? Possibly. But for the near term, the market is signaling one clear message: if you need bulk storage at scale, plan ahead and expect to pay for certainty.

How companies respond to that signal will shape the next wave of data center economics — and the AI projects those centers power.

Leave a Comment