3 Minutes

Huawei didn't just nudge ahead last year; it surged. Simple as that. The numbers tell the story: online sales of adult smartwatches in China reached 21.34 million units in 2025, up 15.6% from 2024. Revenue climbed even faster — 24.48 billion yuan, a 50.8% jump — as the average selling price rose to 1,147 yuan.

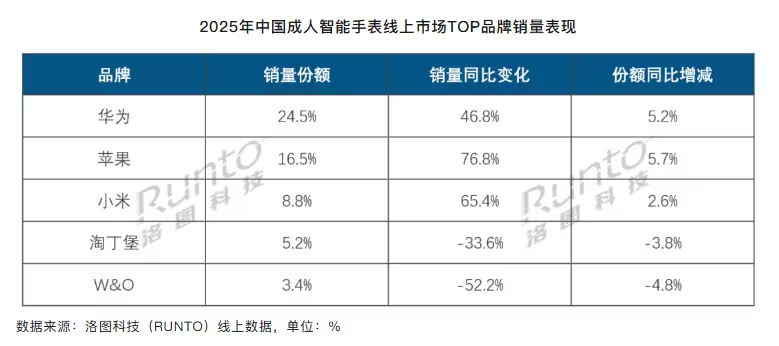

So how did Huawei pull away? The company posted a 46.8% year-on-year sales increase and captured a 24.5% slice of online unit sales, growing its market share by 5.2 percentage points. It wasn't a single model that delivered the win. Huawei reworked its portfolio across different user needs: FIT for slim, everyday wear; Watch 5 with deeper HarmonyOS AI and richer health sensing; GT 6 for athletes and long battery life; and Ultimate 2 aimed at rugged, high-end outdoor use.

HarmonyOS integration proved decisive. Huawei wove wearables into phones, home gadgets and even medical systems, creating a pull that goes beyond hardware. Age-friendly features and medical-grade tracking helped the brand expand into the senior segment — not just adding customers, but creating new use cases.

Apple sits comfortably in second place with 16.5% of online unit sales, improving its share by 5.7 percentage points. The S11, SE 3 and Ultra 3 defined Apple’s 2025 lineup: the S11 benefited from subsidies and broad appeal, the Ultra 3 targeted premium buyers. Apple dominated the top price bracket — it took more than 60% of sales above 3,000 yuan and roughly 40% of the market’s revenue.

Xiaomi played the value card. With an 8.8% share of unit sales, the brand leaned into the 1,000-yuan segment with the Redmi Watch 6, Xiaomi Watch 5 and Watch S4. Affordable hardware plus expanding mid-range options kept its volumes steady and appealed to price-sensitive shoppers.

What matters heading into 2026 is how those strategies evolve. Huawei’s advantage is ecosystem depth and localized health services. Apple still commands high-end spending and premium margins. Xiaomi owns the value tier. Expect tighter product segmentation, more health features, and sharper competition over who controls the service layer — because hardware is only half the battle. Who blinks first?

Source: gizmochina

Leave a Comment