3 Minutes

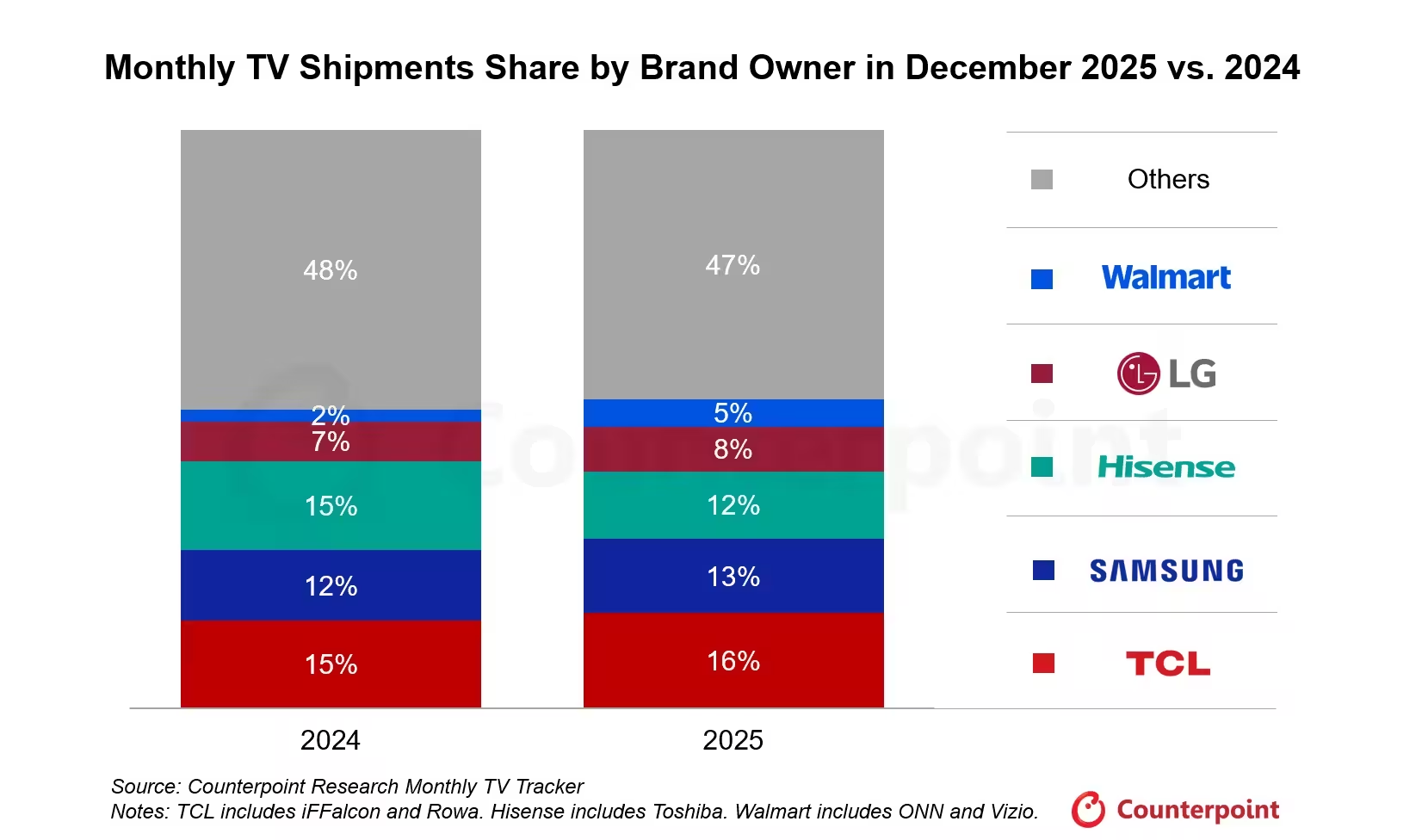

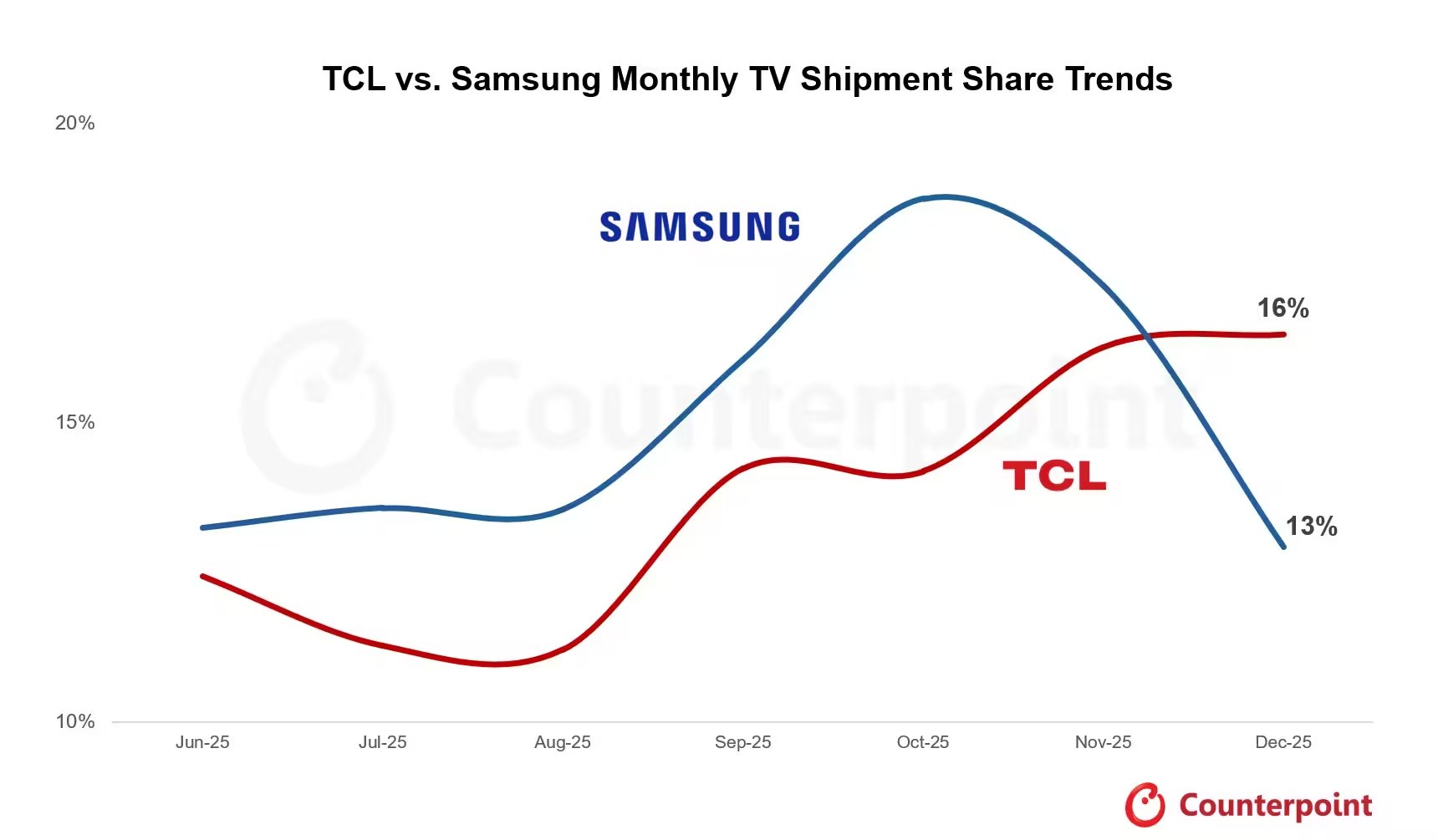

It happened at the tail end of the year: TCL edged past Samsung in December, leading global TV shipments for the month. The numbers were small — enough to turn heads, not to rewrite corporate histories. TCL accounted for 16% of December shipments; Samsung trailed at 13%.

Context matters. Across the quarter and the full year, Samsung still holds the upper hand on shipments. Market share by month is a snapshot. Market share by year is the full portrait. Still, December’s result is more than a blip; it’s a symptom of shifting supply and demand dynamics that have been building for months.

Counterpoint Research flagged the movement, and Research Director Bob O’Brien laid out the mechanics succinctly: "TCL has been gaining ground for months, and a year-end surge pushed it past Samsung in December. Although it is only for one month, TCL’s shipments are consistently growing on a YoY basis while Samsung’s shipments have been stagnant." He added that TCL’s partnership with Sony could give it more traction in premium segments — a development that would make this competition much more consequential.

The bigger story is about product strategy. South Korea’s TV champions, Samsung and LG, have been steering toward higher-margin OLED models. That’s smart for profits. It also leaves a vacuum in the lower-cost LCD space. Chinese makers — TCL chief among them — have been quick to fill that gap, scaling LCD production and selling at volumes that OLED simply doesn’t match. More screens at lower prices. More volume. Simple arithmetic, but with strategic implications.

December’s monthly lead underscores volume momentum, not a transfer of annual leadership. When you factor in revenues and profit margins, the picture changes again: higher volumes don’t automatically translate into higher earnings if average selling prices drop.

So what should industry watchers watch in 2026? Will TCL press into premium territory alongside Sony and chip away at Samsung’s higher-margin stronghold? Or will Samsung counter with renewed LCD plays or faster OLED rollouts? Either way, the TV market is no longer merely a two-player chessboard — it’s becoming a crowded theater where product mix and partnerships matter as much as unit counts.

Expect the next act to be less about who ships the most sets this month and more about who sells the right screens for the right margins next year.

Source: sammobile

Leave a Comment