5 Minutes

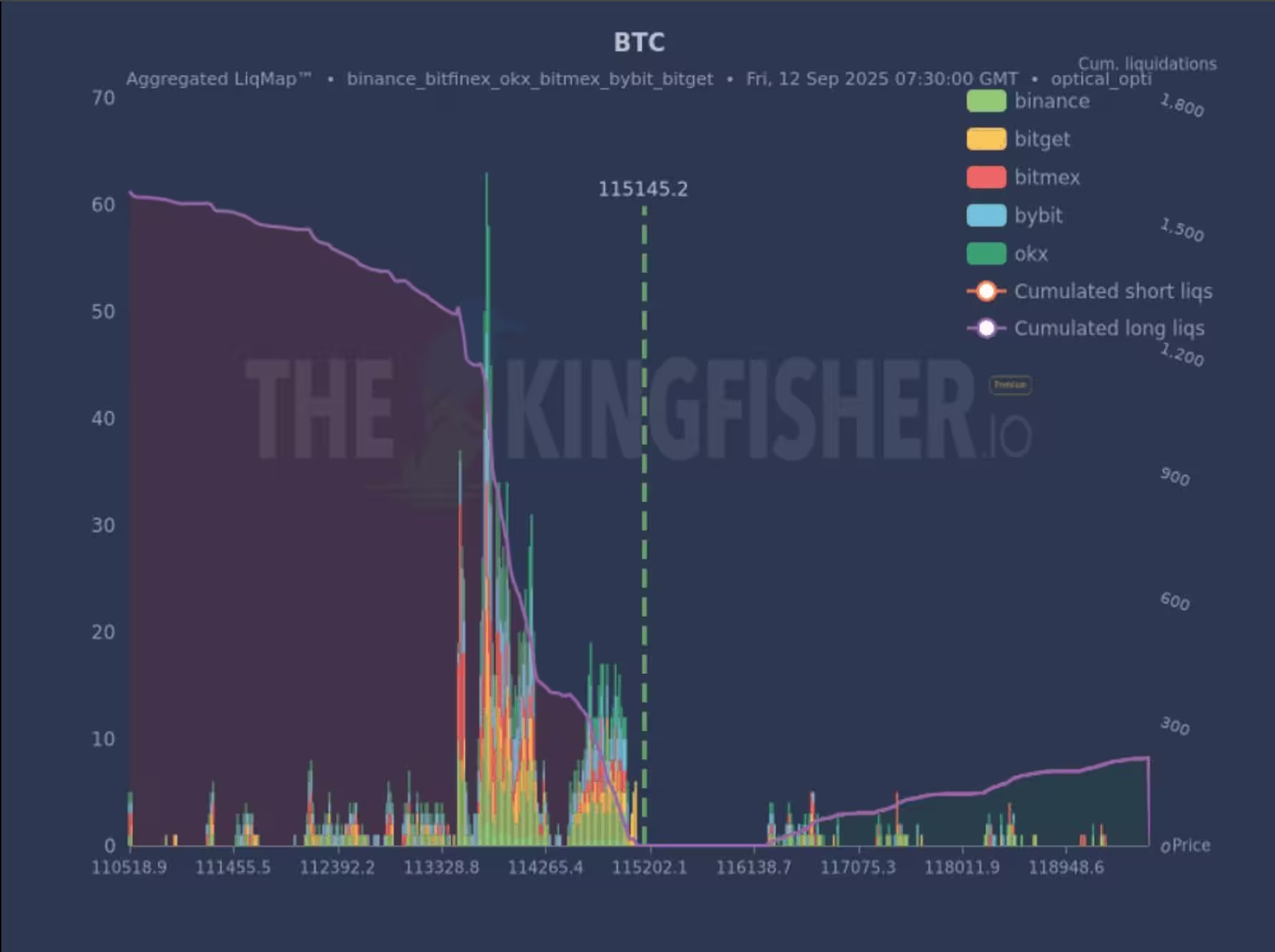

Bitcoin liquidation chart

Heavy leverage is building concentrated exposure in bitcoin derivatives markets, setting the stage for rapid downside moves if prices reverse. Traders are piling into nine-figure long positions that could amplify a market unwind, while high-stakes shorts are also maintaining large, volatile bets.

Market snapshot

Bitcoin (BTC) has been trading in a tight range around $115,000, failing to break higher for more than two months and entering a period of reduced volatility. Despite the quiet price action, derivatives desks and liquid crypto whales are loading up on leverage, attempting to push BTC back toward all-time highs. That strategy increases liquidation risk across futures and perpetual swaps and raises the possibility of a cascade of forced exits should spot price move against those leveraged positions.

Clustered liquidation levels: a technical vulnerability

Data from derivatives analytics provider The Kingfisher highlights a dense band of liquidation orders between $113,300 and $114,500. When many highly leveraged long positions sit close together, a modest drop through that zone can trigger automated margin calls and liquidations. As forced selling hits the market, price impact can snowball: the very liquidations meant to close risk can become the catalyst for a deeper move, potentially dragging BTC back down toward the $110,000 zone of support.

Why clustered liquidations matter

Derivative liquidations are executed automatically by exchanges when collateral is insufficient to cover leveraged positions. When liquidation levels concentrate in a narrow price band, that band becomes an attractor: market participants and algorithms can push price toward those levels in order to clear positions. This is especially relevant in low-volatility environments, where a single directional shove — from a large trade, news shock, or short-term liquidity gap — can trigger a cascade.

What the data and market signals show

On the bullish side, one or more market participants are opening long positions denominated in the nine figures, using leverage to try to lift BTC higher. Analytics desks have cautioned that extremely large leveraged longs can create “toxic flows” if spot buying does not absorb the orders, meaning futures activity could force abrupt price moves rather than support an orderly rally.

At the same time, bears are not idle. One trader reportedly holds a $234 million short position entered near $111,386 and is currently carrying about $7.5 million in unrealized losses. To keep that position open, the trader added roughly $10 million in stablecoins, with liquidation pressure set near $121,510. That kind of large short means both sides of the market are exposed to margin stress at different price points.

Derivatives mechanics: longs, shorts and liquidation thresholds

Longs using high leverage amplify gains if price moves up but suffer accelerated losses if price drops. Shorts operate in reverse. Exchanges set liquidation thresholds based on position size, margin, and leverage. When those thresholds cluster, the market’s vulnerability rises, because liquidations themselves create additional sell or buy pressure that can push price into the next group of vulnerable positions.

How traders and risk managers should respond

For professional traders and institutional participants, understanding the distribution of liquidation levels across futures markets is a core part of risk management. Traders should monitor derivatives heat maps and order-book depth to avoid creating or being swept up in concentrated flows. Spot-market participation can provide a stabilizing counterweight to leveraged derivatives activity; conversely, leveraged-only strategies risk creating abrupt, disorderly moves.

Smaller retail participants should be particularly cautious about using high leverage on BTC positions. In a market where major players on both sides hold significant leverage, volatility can return quickly and with intensity, resulting in large margin calls.

Outlook: low volatility but elevated structural risk

Even though bitcoin has been rangebound, structural risks in the derivatives market are elevated. Clusters of nine-figure positions and dense liquidation pockets between $113,300 and $114,500 create a fragile setup: if price slips below that range, the market could see accelerated selling that tests the $110,000 support level. Conversely, a decisive uptick in spot buying could absorb leveraged longs and reduce short-side pressure, but that would require substantial capital coming into the cash market.

In short, quiet price action belies heightened systemic risk in crypto derivatives. Traders and portfolio managers should track liquidation maps, margin levels, and order-book liquidity closely to avoid being caught on the wrong side of a sudden cascade.

Source: coindesk

Leave a Comment