3 Minutes

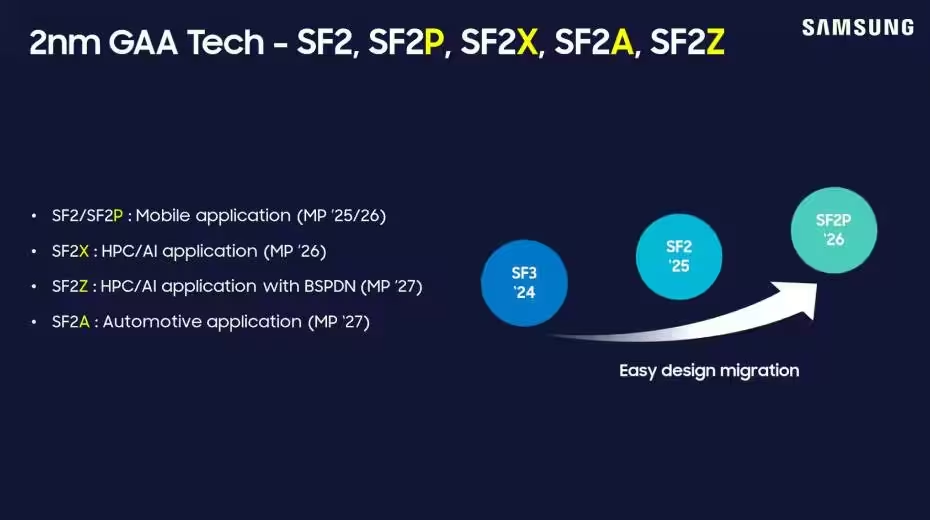

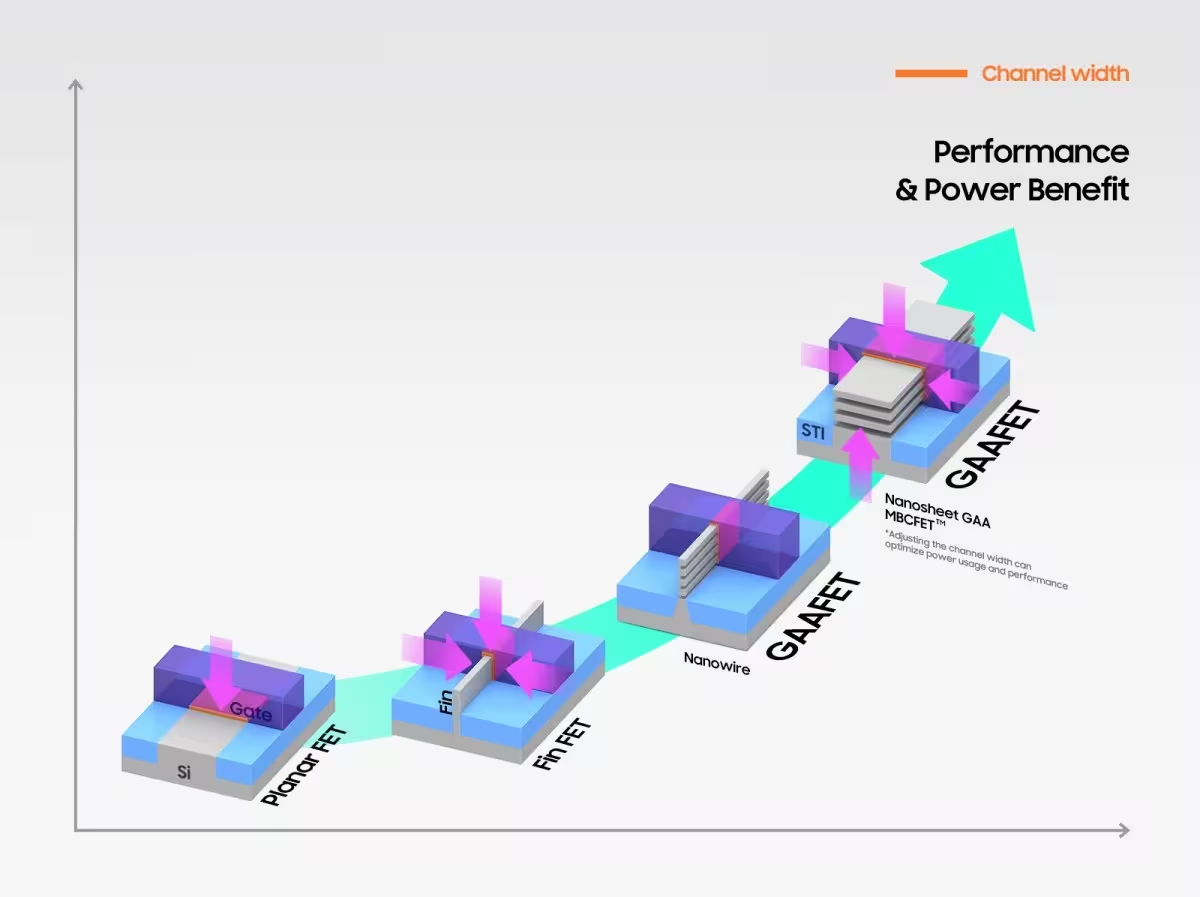

Samsung is reported to have started mass production of the Exynos 2600 this month, according to industry sources and a Daishin Securities note. Positioned as the company's first 2nm GAA (Gate-All-Around) mobile chipset, the Exynos 2600 is expected to power the upcoming Galaxy S26 family, including the flagship Galaxy S26 Ultra.

Key details and early benchmarks

The Exynos 2600 introduces Samsung's new Heat Pass Block thermal element to improve heat dissipation from the silicon. Early Geekbench listings for the 2600 look encouraging, and GPU benchmarks for the integrated Xclipse 960 indicate it could compete with — or even outperform — Qualcomm's graphics solution in the Snapdragon 8 Elite Gen 5 in some workloads.

- First consumer-focused 2nm GAA SoC from Samsung

- New Heat Pass Block for thermal management

- Xclipse 960 GPU shows promising benchmark results

Why this matters beyond the Galaxy S26

Success for the Exynos 2600 has implications well beyond handset performance. Samsung's LSI and foundry businesses could win new external customers if the 2nm design proves competitive, particularly as TSMC adjusts pricing. Industry chatter points to potential orders from firms such as Nintendo, Tesla and Valens — deals that would strengthen Samsung Foundry's roadmap for mobile, gaming and next-gen AI accelerators.

Samsung LSI leadership has said the team is "carefully preparing" the new chipset and expects "good results." Previous use of Exynos silicon in devices like the Galaxy Z Flip7 helped reduce costs and support Samsung's LSI group; the company appears to be aiming for a similar but larger-scale effect with the S26 lineup.

Financial context

Daishin Securities projects Samsung's Device Solutions division (LSI, foundry and memory) will post around KRW 5 trillion (~$3.6 billion) in operating profit for Q3, driven mainly by memory. The foundry arm is still expected to report a loss — narrower than prior quarters — underscoring that chip design wins and wafer demand remain critical to long-term profitability.

Source: gsmarena

Leave a Comment