4 Minutes

Global aging and rising wealth set to drive crypto demand

Global demographic trends and growing personal wealth could significantly increase demand for financial assets — including cryptocurrencies — well into the next century. A new analysis from the U.S. Federal Reserve Bank of Kansas City projects that as populations age and productivity rises, more capital will flow into global asset markets, favoring stores of value and portfolio diversification such as Bitcoin and other digital assets.

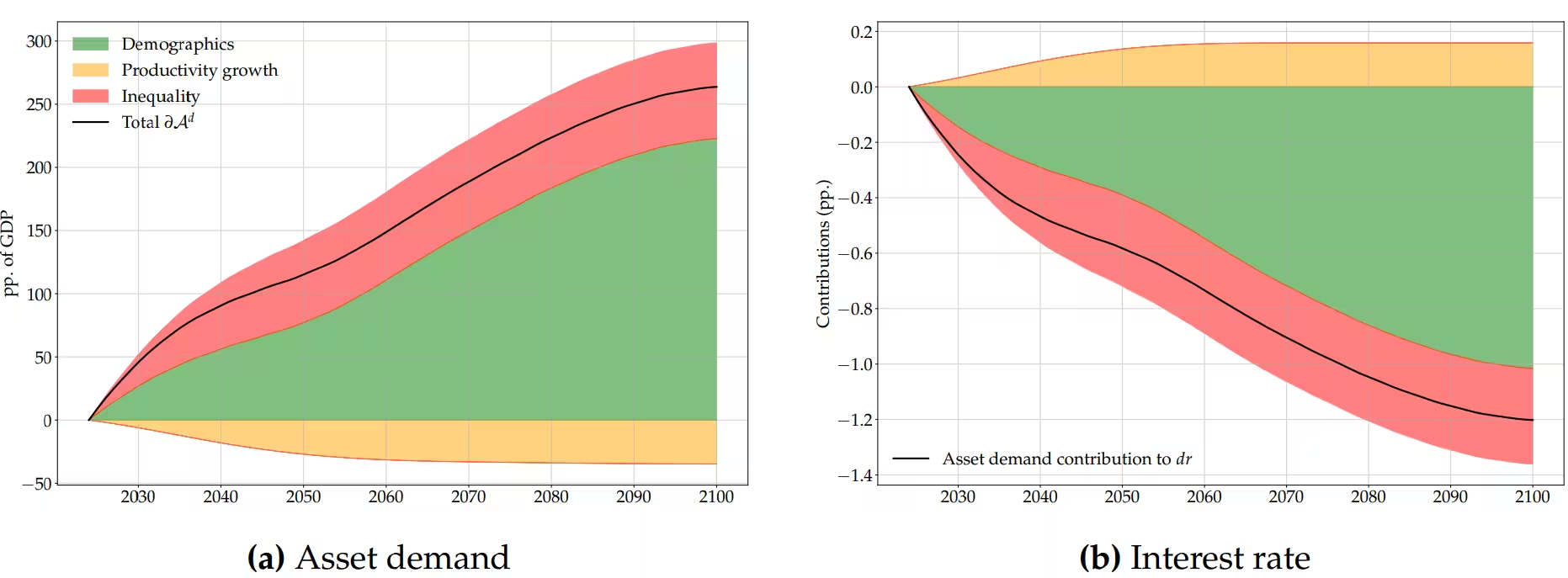

Long-term asset demand and real interest rate implications

The Kansas City Fed report extends historical demographic analysis forward and finds that aging alone could raise asset demand dramatically between 2024 and 2100. That sustained demand may exert downward pressure on real interest rates, creating a macro environment that favors alternative investments. Lower real yields historically encourage investors to allocate toward assets that preserve purchasing power, including gold and, increasingly, Bitcoin.

How demographics affect portfolio allocation

As retirement-age cohorts accumulate wealth, their need for long-term capital preservation and yield may grow. Analysts and exchange executives say this cohort shift can help normalize crypto within mainstream portfolios. Greater regulatory clarity and the introduction of institutional products such as spot Bitcoin ETFs are making cryptocurrencies more accessible to older, risk-averse investors who previously steered clear of the space.

From early adopters to mainstream acceptance

Younger, tech-literate investors still dominate current crypto ownership, but that picture is evolving. Recent industry data showed a substantial share of holders between 24 and 35 — a demographic that will age into larger asset pools. Over time, as regulatory frameworks mature and digital asset custody solutions improve, older generations may start to view Bitcoin as a complementary store of value to gold.

Market participants argue that the combination of demographic-driven capital accumulation and broader institutional support could lead to a multi-decade transition in how Bitcoin and other cryptocurrencies are perceived in strategic asset allocation.

Rising wealth and appetite for diversification

Increased global wealth typically encourages investors to diversify into newer and higher-risk asset classes. Crypto exchanges and analysts point to rising personal wealth and longer investment horizons as catalysts for more meaningful allocations to crypto. Wealthier investors and institutions are more likely to experiment with Bitcoin, altcoins, decentralized finance projects, and tokenized assets as part of a diversified strategy.

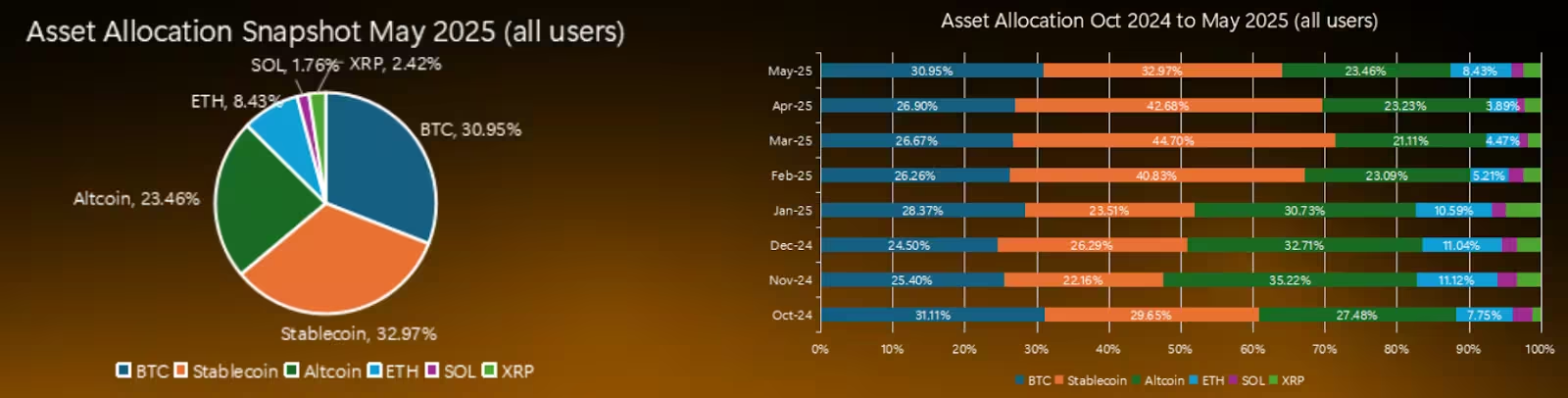

Crypto investor asset allocation

Younger investors tend to favor altcoins and innovative blockchain projects due to higher technology literacy and risk tolerance, while older investors may prefer Bitcoin and regulated products such as ETFs. This dual adoption pathway — tech-savvy adopters pushing innovation and aging investors providing capital stability — could accelerate mainstream crypto adoption over the coming decades.

Outlook: What investors should watch

Key variables to monitor include regulatory developments, ETF product growth, institutional custody solutions, and macro factors like real interest rates and productivity-driven wealth gains. Together, these trends will influence crypto market liquidity, volatility, and long-term adoption patterns. For investors, the interplay of aging demographics and rising global wealth suggests an evolving market where cryptocurrencies increasingly compete with traditional safe havens and become a more established component of long-term asset allocation.

Source: cointelegraph

Leave a Comment