4 Minutes

Dutch crypto firm closes €30 million round to build BTC treasury

Dutch digital-asset firm Amdax has closed a €30 million ($35 million) funding round to kick off its Amsterdam Bitcoin Treasury Strategy (AMBTS), the company announced. The capital will fund initial Bitcoin (BTC) purchases as Amdax prepares to roll out a standalone treasury vehicle and seek a listing on Euronext Amsterdam, offering European investors transparent exposure to corporate Bitcoin holdings.

What AMBTS aims to achieve

AMBTS sets an ambitious target: to amass up to 210,000 BTC, roughly 1% of the total 21 million BTC supply. If achieved, that accumulation would place Amdax among the world's largest corporate Bitcoin treasuries. CEO and AMBTS co-founder Lucas Wensing described the close of the funding round as an important milestone and said the team is ready to begin executing its Bitcoin strategy for institutional and retail investors alike.

Market context and competition

Amdax joins an expanding roster of companies that now hold Bitcoin on their balance sheets. MicroStrategy remains the industry leader, holding more than 640,000 BTC—well over 3% of the total supply—while newer entrants like Treasury, a Dutch firm backed by the Winklevoss twins, have already started building their treasuries and currently report holdings near 1,000 BTC.

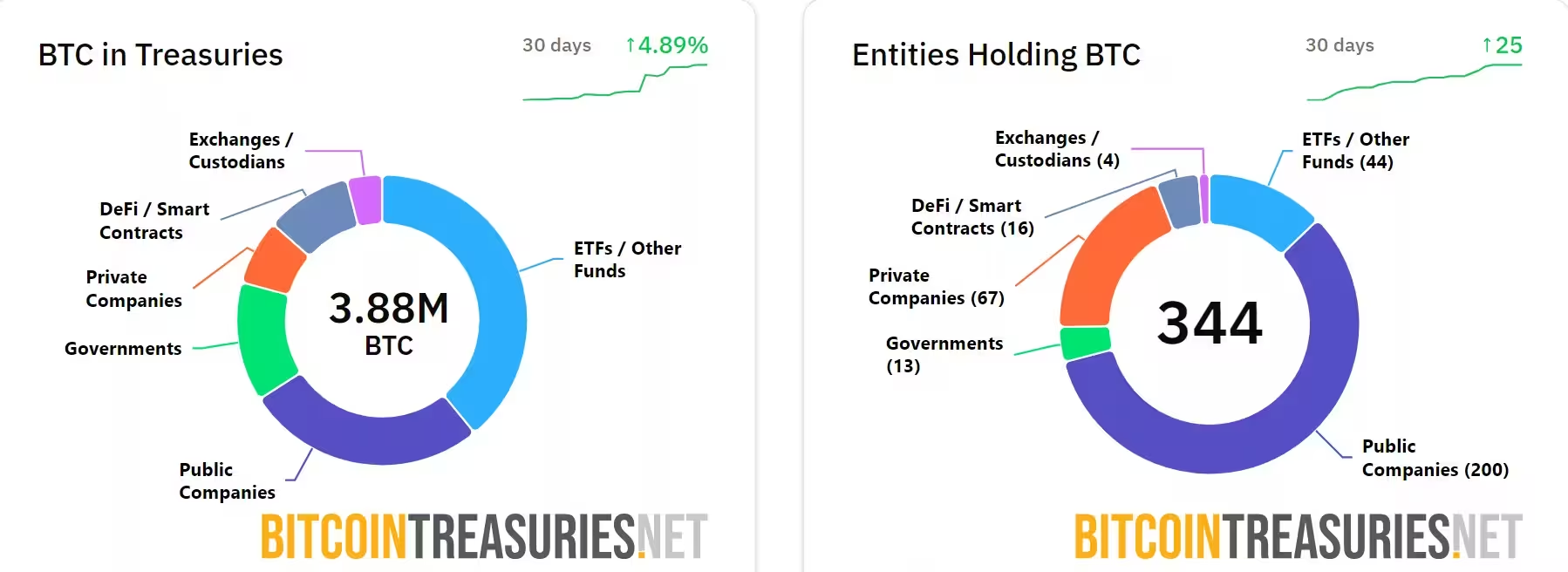

Amdax’s latest BTC venture will join the 344 companies holding BTC in their balance sheets

Funding, buying strategy and listing plans

The firm originally targeted €23 million before boosting its fundraising goal to €30 million in September 2025. That capital is earmarked for an initial buying phase ahead of the planned public listing, with the objective of creating a new BTC-based vehicle for European markets. Amdax says its approach prioritizes transparency, regulatory compliance and institutional-grade custody solutions—key considerations for corporates and investors looking to add Bitcoin exposure.

How meaningful is the €30M for BTC accumulation?

While €30 million is a substantial starting point, it is modest compared with the reserves held by long-established corporate holders such as MicroStrategy. Still, the funding enables Amdax to secure a meaningful position within the growing cohort of corporate Bitcoin treasuries and to demonstrate demand for regulated European Bitcoin investment products.

Bitcoin price backdrop and investor implications

Bitcoin recently hit a new all-time high at $126,080 before retreating into the $123,000–$124,000 range, remaining comfortably above the $120,000 level. These price dynamics highlight both the volatility and the long-term appreciation potential that drive institutional interest in BTC as an alternative reserve asset and inflation hedge.

For European investors, AMBTS could offer a regulated, transparent route to corporate Bitcoin exposure via a listed vehicle on Euronext Amsterdam. The combination of on-chain asset allocation and public-market access is likely to appeal to asset managers, family offices and wealth clients seeking diversification into digital assets.

Outlook

Amdax’s announcement reinforces the trend of institutional adoption and corporate treasury diversification into Bitcoin. As AMBTS moves from fundraising to accumulation and public listing plans, market participants will watch whether the firm can scale its holdings toward its 210,000 BTC ambition and how that effort influences corporate Bitcoin demand in Europe.

Source: crypto

Leave a Comment