5 Minutes

Bitcoin whale back in motion: $360M moves to Hyperunit

A Bitcoin whale that once held roughly $11 billion in BTC has reappeared on-chain with a fresh $360 million transfer, marking its first visible activity in two months. Blockchain intelligence from Arkham shows the whale moved the funds into Hyperunit’s hot wallet labeled 'bc1pd' on Tuesday—a transaction that could hint at another rotation into Ether, based on the address's prior behavior.

This return follows a major reshuffle the whale executed in late August, when the holder rotated about $5 billion of BTC into Ether positions. That shift briefly pushed the whale's ETH holdings above several large corporate treasuries and caught the attention of traders and analytics platforms across the crypto ecosystem.

Where the $360M went and why it matters

On-chain tracing indicates the $360 million transfer was directed to a DeFi-linked hot wallet associated with Hyperunit. Analysts note this wallet tag and the whale's historical pattern of converting BTC into ETH and DeFi exposure, suggesting the latest move may be another step toward liquidating BTC for ETH or DeFi leverage.

Background: the earlier $5B rotation into Ether

The same whale initiated its large-scale rotation on Aug. 21, selling approximately $2.59 billion of BTC and converting proceeds into a $2.2 billion spot Ether position plus a $577 million Ether perpetual long. That aggressive reallocation inspired follow-on activity, with multiple large addresses acquiring hundreds of millions of dollars in ETH shortly after.

Market commentators pointed out that these actions briefly elevated the whale above established ETH holders in terms of total ETH balances, and sparked fresh narratives about institutional and mega-whale appetite for Ether amid a rally in the asset.

Potential market impact and sell-side risk

Although the whale still retains more than $5 billion worth of BTC in its primary wallet, the renewed transfer activity raises the prospect of additional selling pressure. Large BTC sellers can weigh on price momentum, especially when combined with flows from dormant cohorts or other high-net-worth holders moving into exchanges.

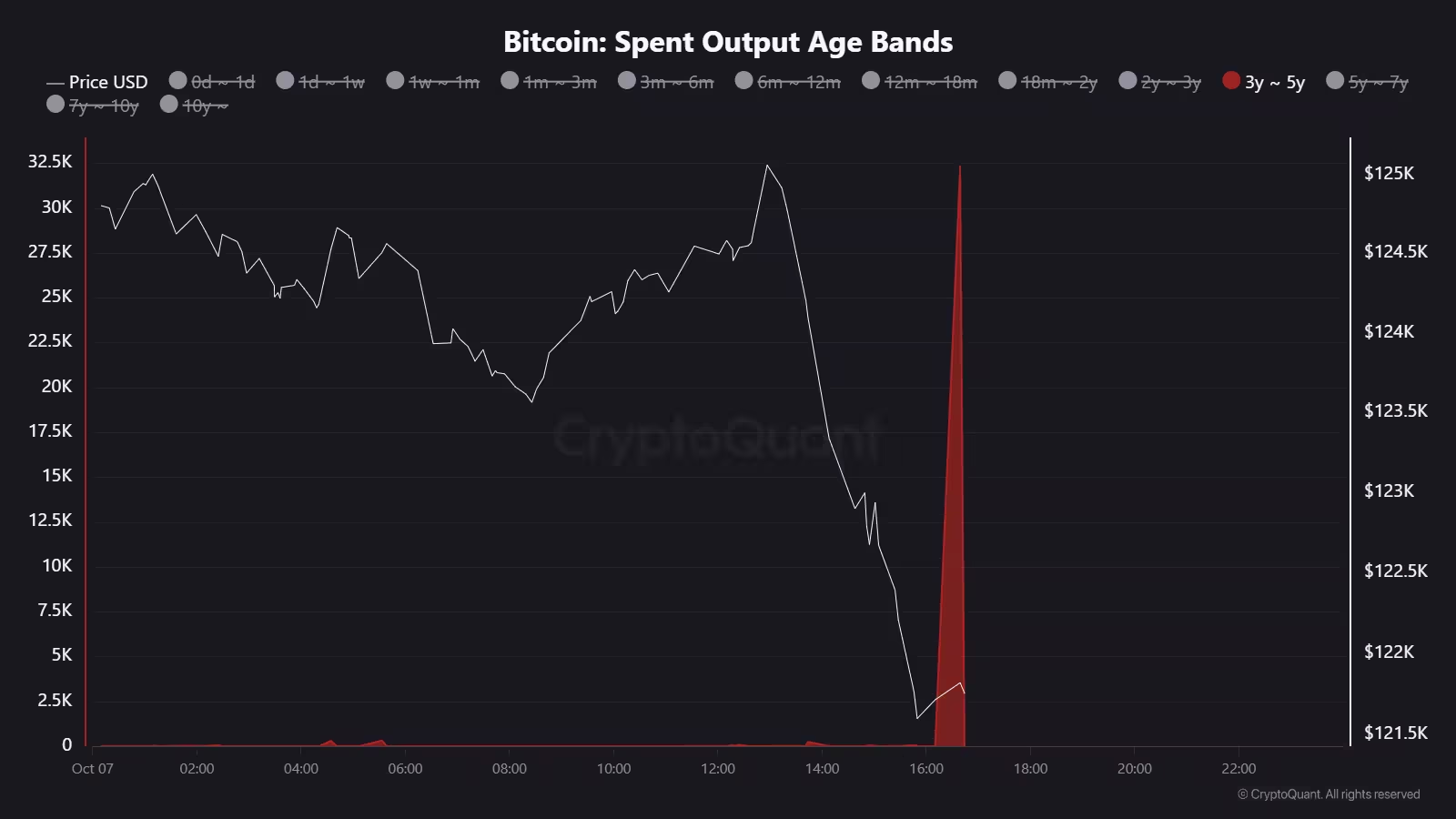

Dormant BTC holders also stir: $3.9B moved to exchanges

Separately, on-chain data highlights another notable development: Bitcoin holders who have been dormant for three to five years have moved a cumulative 32,300 BTC—about $3.93 billion—onto exchanges, according to CryptoQuant analyst Maartunn. This represents the largest transfer for that dormant cohort so far this year and adds another potential supply-side factor traders will be watching.

What analysts are saying

Analysts differ on how these moves will shape price action. Willy Woo has argued that concentration of BTC supply in so-called OG whales, who accumulated at very low cost bases, can dramatically affect price dynamics because their selling changes the amount of fresh capital needed to push markets higher. On the other hand, Ryan Lee, chief analyst at Bitget, emphasized that macro concerns like rising federal debt and political uncertainty continue to drive capital into scarce, non-sovereign assets such as Bitcoin, reinforcing its narrative as digital gold.

Bitcoin dominance, altcoins, and the path forward

Market research firm Matrixport notes that while Ethereum and select altcoins outperformed Bitcoin over the past two months, Bitcoin dominance has begun to reassert itself. The firm describes recent rallies as selective rather than broad-based, suggesting that a full-fledged altcoin season remains uncertain. Investors should therefore monitor on-chain metrics, exchange inflows, and large wallet behavior to gauge whether BTC leadership will continue to strengthen or if further rotations into ETH and DeFi will persist.

Key takeaways for traders and investors

- Watch the whale's remaining BTC balance: more transfers could increase selling pressure.

- Track exchange inflows from dormant cohorts—large moves often precede volatility.

- Follow ETH and DeFi wallet tags for signs of BTC-to-ETH rotations.

- Consider macro drivers that support Bitcoin as a scarce store of value amid fiscal uncertainty.

As on-chain surveillance becomes increasingly sophisticated, market participants can better anticipate large-player behavior. The $360M transfer is an important data point in ongoing narratives about BTC distribution, institutional rotation into ETH, and the balance between hodling and profit-taking among crypto whales.

Source: cointelegraph

Leave a Comment