3 Minutes

Bitcoin still not "overbought" despite all-time highs

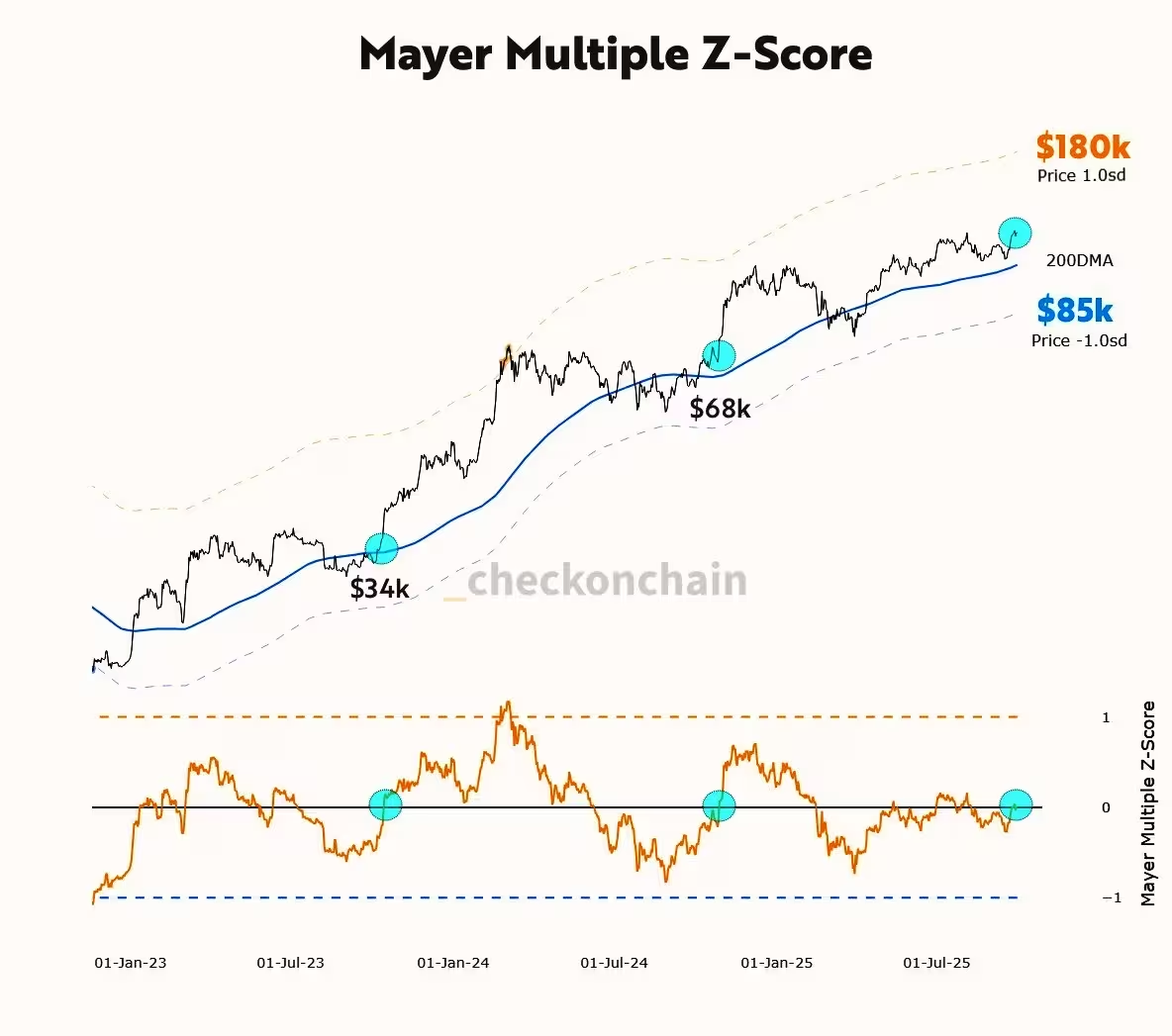

A classic Bitcoin price metric, the Mayer Multiple, indicates that BTC is far from overheated even as prices trade near record levels. With the Multiple hovering close to 1.16, market signals point to more upside room — potentially as high as $180,000 — before traditional overbought thresholds are reached.

What the Mayer Multiple measures

The Mayer Multiple compares Bitcoin's spot price to its 200-week moving average (MA). Historically, readings above roughly 2.4 have been interpreted as overbought conditions, while values close to 0.8 are often seen as oversold. At present, the Multiple remains much lower than the 2.4 mark, suggesting continued bullish runway for BTC.

"Bitcoin is at all-time highs and the Mayer Multiple is ice cold," commented crypto quant analyst Frank A. Fetter, after sharing an on-chain chart showing the current metric. The chart suggested that, based on the 200-week MA, a Mayer Multiple of 2.4 would correspond to a Bitcoin price near $180,000.

Bitcoin Mayer Multiple data

On-chain context and recent behavior

On-chain analytics platforms such as Checkonchain and Glassnode show the Mayer Multiple has remained unusually muted during this bull cycle. The metric peaked at about 1.84 in March 2024 while BTC traded near $72,000 — substantially lower than previous cycles' blow-off tops. That cooling implies this rally has seen steadier accumulation rather than a parabolic spike.

Bitcoin Mayer Multiple

Implications for traders and investors

Analysts view current Mayer Multiple readings near 1.1–1.2 as a healthy signal rather than a warning. Axel Adler Jr. called readings around 1.1 "a good fuel reserve for a new upward impulse," echoing a broader view that price momentum could continue without immediate overbought pressure.

Short-term risks and breakout timing

That said, timing remains uncertain. Market participants are watching for a decisive breakout; absent a clear advance by year-end, some argue the bull cycle could risk running out of steam. Near-term volatility is possible — analysts still allow for a 10% correction taking BTC back toward $114,000 or range lows — but the Mayer Multiple does not currently signal an overheating market.

For traders, the takeaway is to monitor the 200-week MA, Mayer Multiple trajectory, and on-chain indicators for confirmation of trend continuation. While the $180,000 theoretical target is not a forecast guarantee, the Multiple shows there is structural room for further upside before classic overbought territory is reached.

Source: cointelegraph

Leave a Comment