6 Minutes

Sony's Bold Push into Stablecoins and Federal Banking

Sony has quietly filed for a federal charter in the United States, signaling a major expansion of its financial ambitions. Through Connectia Trust — a subsidiary of Sony Bank — the Japanese conglomerate has applied to the U.S. Office of the Comptroller of the Currency (OCC) to operate as a national trust bank able to issue a U.S. dollar–backed stablecoin, manage the reserve assets that back it, and deliver custody and digital asset management services.

If approved, Sony would join a small but influential group of firms pursuing federally chartered status to issue stablecoins, including Circle, Paxos, Coinbase, Stripe, and Ripple. This step could make Sony one of the first major global tech companies to hold a bank charter explicitly tied to stablecoin issuance, positioning it squarely in the evolving regulatory landscape for digital currencies and crypto banking.

What Sony Plans to Do: Stablecoin Issuance and Custody

Sony’s application frames the proposed activities as within the OCC’s existing legal authorities for national banks. Connectia Trust intends to:

Issue a USD-pegged stablecoin

The stablecoin would be pegged to the U.S. dollar and supported by reserve assets held in cash or U.S. Treasuries, aligning with the frameworks regulators have been emphasizing for consumer protection and systemic safety.

Maintain reserve assets and provide custody

Sony plans to hold corresponding reserves and offer non-fiduciary digital asset custody and fiduciary asset management for affiliates — services increasingly in demand from institutional clients and corporate treasuries.

Regulatory Context: OCC Guidance and the GENIUS Act

The move comes amid clearer federal guidance on stablecoin issuance. The passage of the GENIUS Act established a unified federal framework that requires stablecoins to be fully backed by cash or Treasuries and guarantees redemption rights for token holders, setting industry-wide expectations for reserve management and consumer protections.

At the same time, the OCC — the only U.S. regulator that can grant a national bank charter — has signaled greater openness to digital asset activities. Under OCC chief Jonathan Gould, confirmed by the U.S. Senate earlier this year, the agency issued guidance allowing national banks to buy, sell, custody, and manage cryptocurrencies for customers where risk and safety standards are met.

The agency has seen a surge of interest: more than 15 fintech and crypto entities have filed for trust charters, and approvals such as Anchorage Digital Bank’s de novo charter (and conditional approvals like Erebor Bank’s) illustrate a renewed willingness to approve digital-first institutions.

Why This Matters for Crypto Banking and Stablecoin Markets

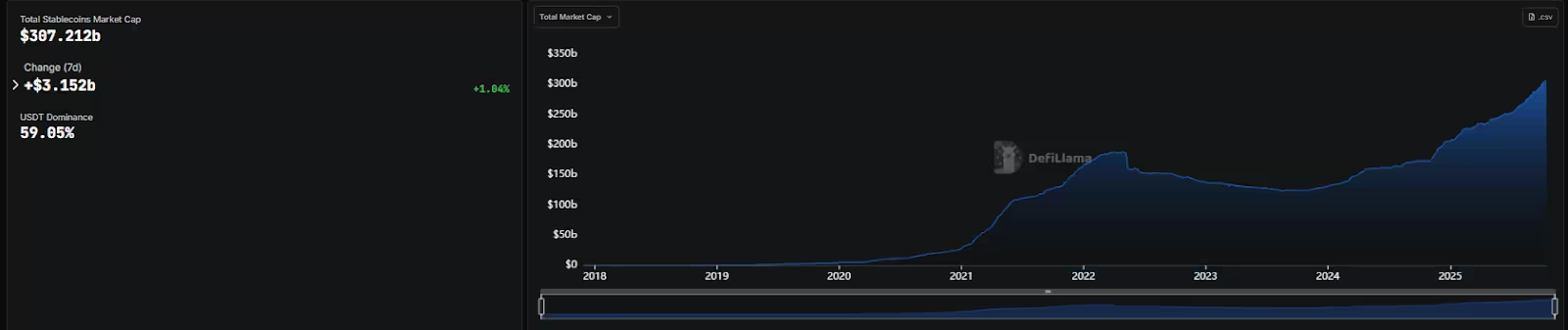

Stablecoins have moved from niche crypto tools to mainstream financial instruments. The current market cap for stablecoins exceeds $300 billion, dominated by assets like Tether (USDT) and Circle’s USDC. Industry forecasts suggest stablecoins could shift up to $1 trillion away from traditional banks by 2028, establishing issuance and custody as lucrative future revenue streams.

By gaining a federally chartered platform to issue a USD-backed stablecoin, Sony could capture settlement, treasury, and internal payment efficiencies — and gain a strong regulatory credential that helps build institutional trust.

Access to payment systems and institutional trust

An OCC charter opens doors: it enables access to Federal Reserve payment rails, enhances relationships with banks and payment partners, and offers a clearer pathway to compliance — all critical advantages for a company entering the regulated stablecoin space.

How Sony Might Use a Stablecoin: From Closed-Loop Settlements to Ecosystem Payments

Analysts believe Sony’s proposed stablecoin could initially be deployed in closed-loop scenarios similar to JPM Coin, supporting internal treasury transfers, cross-border settlements between subsidiaries, and fast payments inside Sony’s entertainment and gaming ecosystem.

That could mean programmable-money use cases across PlayStation, Sony Music, Sony Pictures, and global corporate branches: instant internal settlement, micropayments for digital content, or frictionless cross-border compensation to partners and vendors. Over time, Sony could expand to broader merchant and consumer payment use cases if regulators and business conditions allow.

Strategic fit with Sony’s broader blockchain efforts

This proposal dovetails with Sony’s existing investments in blockchain infrastructure. In January, Sony Group launched Soneiun, an Ethereum layer-2 network developed with Startale Group, which now holds more than $75.87 million in total value locked (TVL). Integrating a stablecoin with an L2 network and Sony’s consumer platforms could accelerate adoption and enable programmable finance across media, gaming, and commerce.

Industry Signals: OCC Leadership and Policy Shifts

Jonathan Gould’s confirmation as OCC head — the first permanent appointment since 2020 — marks a meaningful policy shift. Gould, a former blockchain executive, has emphasized the OCC’s stance that it will not impose blanket barriers on banks that want to engage in digital asset activities. The May guidance allowing banks to custody and trade cryptocurrencies underlines a more permissive, but still risk-focused, regulatory approach.

That tone has prompted a wave of new filings from both fintech and nontraditional financial entrants, as companies race to secure charters that combine banking privileges with digital asset operations.

Risks, Compliance, and Market Dynamics

While an OCC charter provides legitimacy and operational advantages, it also brings strict oversight. Anchorage Digital Bank’s early charter experience — including a temporary cease-and-desist order in 2022 that was later lifted — shows how compliance expectations are enforced and how oversight can create short-term friction.

For Sony, success depends on robust reserve accounting, operational risk controls, AML/KYC programs, and clear governance frameworks that satisfy the OCC and other regulators.

Conclusion: A Potential Milestone for Big Tech in Crypto

Sony’s Connectia Trust filing underscores how stablecoins and crypto banking are transitioning into mainstream finance. If approved, the charter would not only expand Sony Bank’s product set but could also establish a model for how large consumer technology brands integrate regulated stablecoins, custody services, and blockchain infrastructure into global digital ecosystems.

The filing is another sign that legacy tech and finance are converging with blockchain innovation — and it may accelerate competition in a sector that now commands significant market capital and strategic interest.

Source: cryptonews

Comments

Tomas

If tied to PlayStation microtransactions this could get messy fast. Who audits the reserves, tho?

coinflux

Wait Sony? huge move, but can they handle banking regs, liquidity, trust? kinda wild.

Leave a Comment