3 Minutes

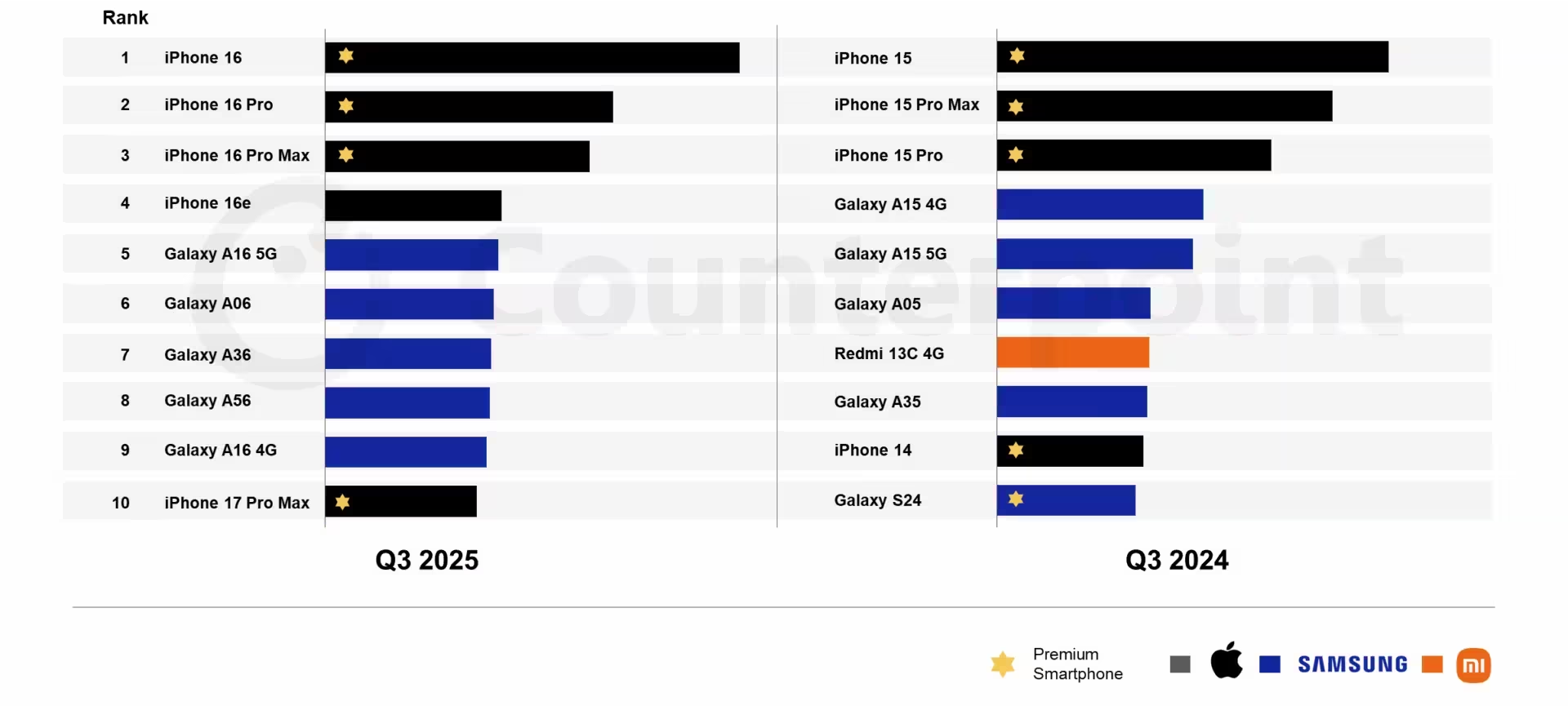

Samsung and Apple kept their iron grip on the global smartphone market in Q3 2025, but the quarter brought a few surprises: midrange Galaxy models climbed the ranks while Samsung's flagship Ultra slipped out of the top list. Here’s what changed and why it matters.

Midrange momentum: Galaxy A56 and A36 climb into the top 10

Counterpoint Research's Q3 2025 report shows the Galaxy A56 entering the worldwide top 10 best-selling phones for the first time. The A56 landed in eighth place — recognition for a model that many consider Samsung’s best midrange handset of the year.

Even more notable: the Galaxy A36 actually outsold the A56 and claimed seventh spot. Both models brought stronger feature sets than their predecessors, blending improved cameras, smart AI-driven software and solid battery life at competitive prices. Industry watchers credit features like Samsung's "Awesome Intelligence," enhanced face-detection algorithms and Nightography camera improvements for helping these phones resonate with mainstream buyers.

Flagship shake-up: S25 Ultra fades, Samsung still expands reach

Meanwhile, the Galaxy S25 Ultra — which performed well earlier in 2025 and had appeared in the top 10 during the first half of the year — was bumped out of the Q3 ranking. High-end flagships often sell in lower volumes than affordable models, and this Q3 outcome underlines how unit-led bestseller lists tend to favor budget and midrange devices.

Samsung did, however, come away with one more spot in the Q3 top sellers list than in prior quarters. That boost partly reflects the way analysts separated sales for variants such as the Galaxy A16 4G and A16 5G, effectively giving Samsung credit for multiple discrete models in the lineup.

Apple still rules the top spots

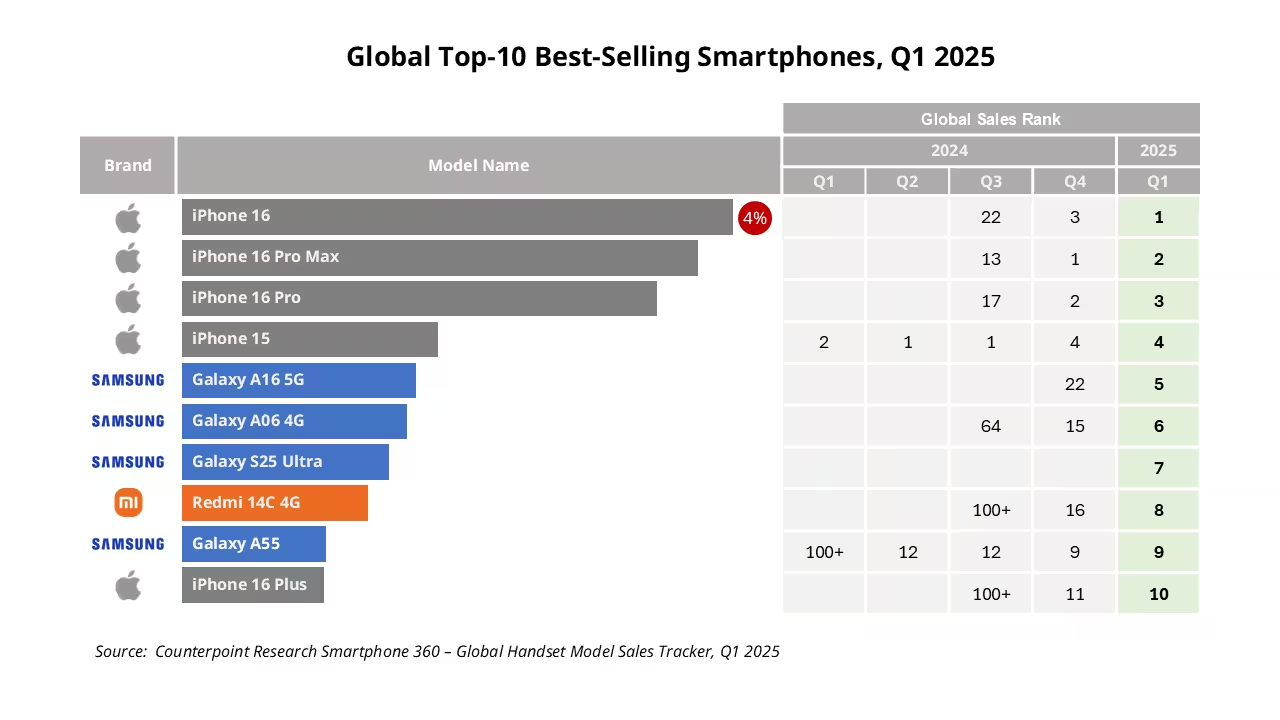

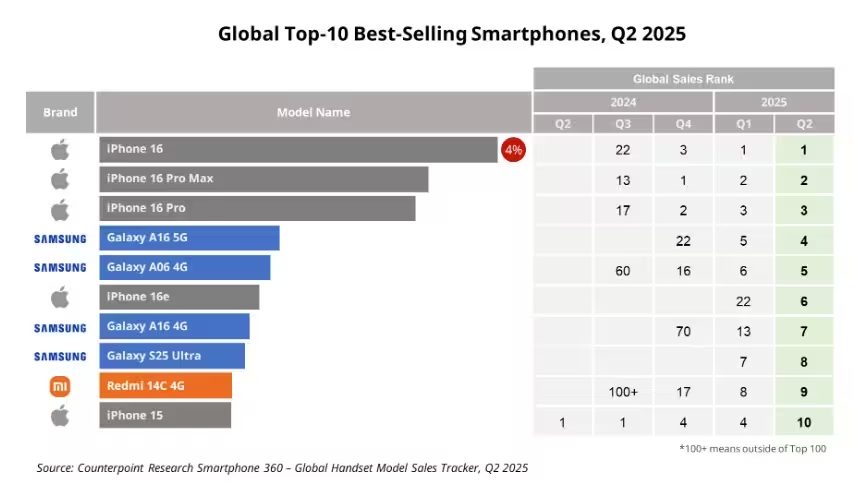

Apple held steady at the top of the global charts. The iPhone 16, iPhone 16 Pro and iPhone 16 Pro Max occupied the three best-selling model positions in Q3, maintaining the brand’s premium-volume dominance. Even as Samsung expands its midrange reach, Apple's flagship trio continues to drive strong, consistent demand worldwide.

Why this shift matters for buyers and makers

What does this mean for consumers? If you want the best value for money, Samsung’s midrange Galaxies are proving their worth — they offer many flagship-style features without flagship prices. For manufacturers, the trend is a reminder that volume often lives in affordable tiers, and that meaningful software and camera upgrades can sway large segments of the market.

Expect Q4 to bring holiday promotions and new competitive dynamics, but for Q3 2025 the story was clear: midrange innovation and sensible model segmentation reshaped the bestseller list, even as Apple kept the very top spots.

Source: sammobile

Leave a Comment