5 Minutes

Sharp Bitcoin Price Drop Breaks Crucial Support Levels

In recent days, the cryptocurrency market has witnessed a significant downturn, with Bitcoin (BTC) plunging below a vital support level not seen in months. This swift decline has sparked concern among investors and raised questions about whether BTC is heading for an even more substantial correction.

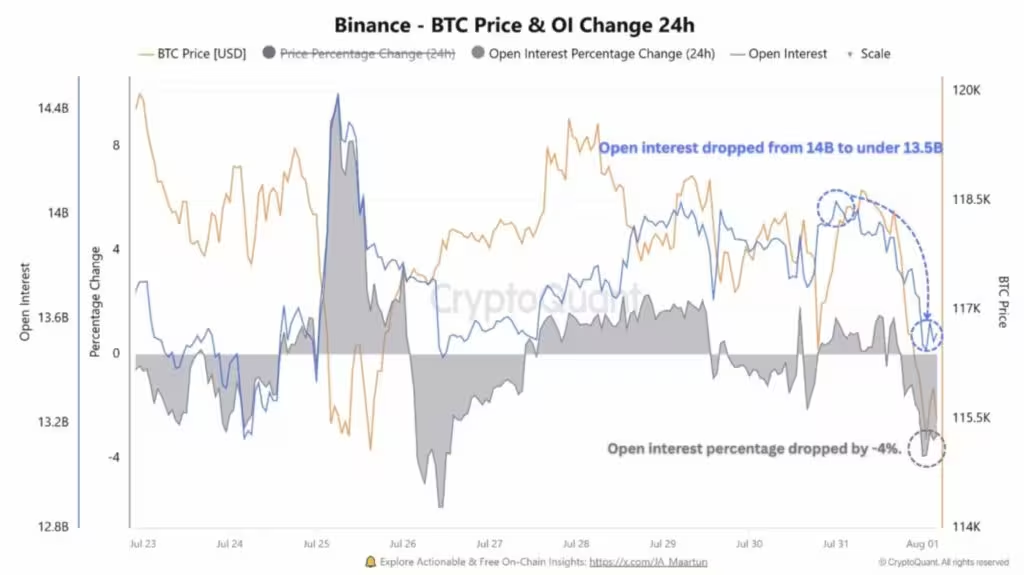

According to data compiled by leading analytics platform CryptoQuant, Bitcoin’s breakdown below the key $115,000 support level triggered a notable shake-up on the derivatives front. The open interest (OI) in BTC futures contracts on Binance dropped from $14 billion to under $13.5 billion—a sharp $500 million reduction. Such abrupt declines in open interest often signal the forced liquidation of highly-leveraged positions and a rapid exit by short-term traders.

Moreover, CoinGlass reports that the total value of liquidations across crypto exchanges in the past 24 hours is approximately $760 million, impacting more than 183,000 positions. This scale of forced liquidations not only heightens price volatility but also suggests widespread investor panic in reaction to Bitcoin’s breaching of long-standing price floors.

Derivatives Data Indicates Mounting Sell Pressure

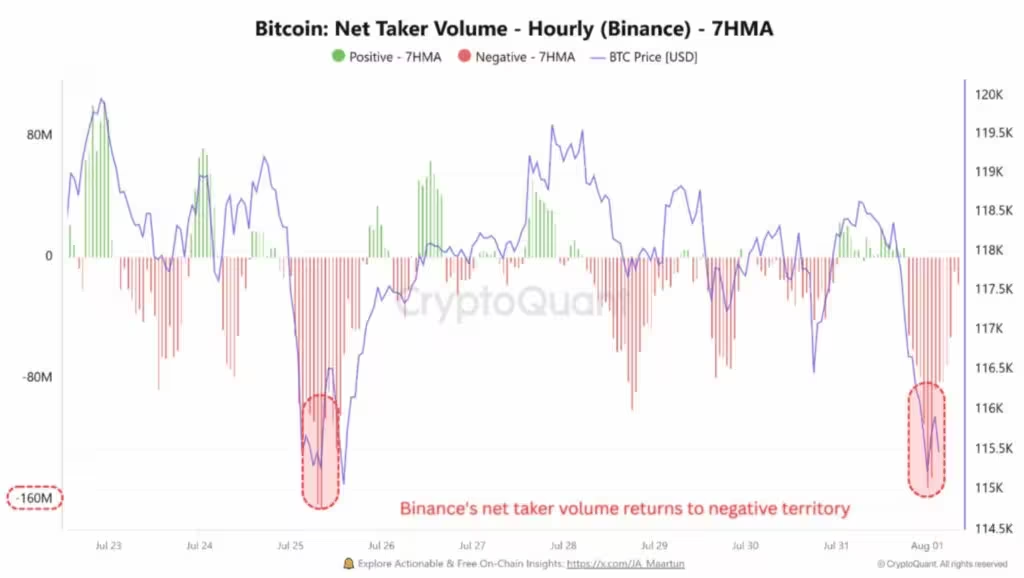

A critical gauge in this environment is Binance’s Net Taker Volume, which has sunk to negative $160 million. When net taker volume turns decisively negative, it confirms that selling orders far outweigh buy orders, amplifying downward pressure on BTC price. This trend suggests many derivatives traders are cashing out, anxious about the potential for further declines.

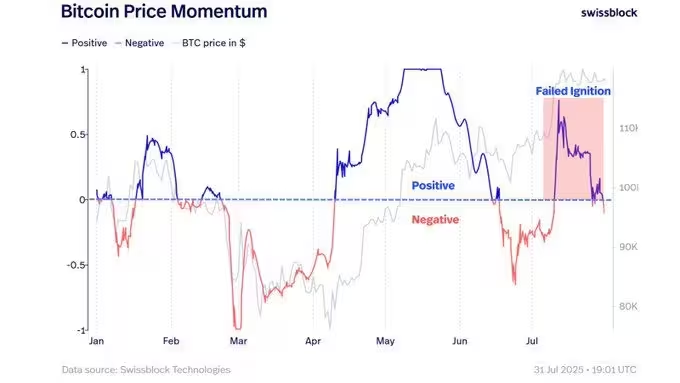

Short-term traders aren’t alone in feeling the heat. On-chain data from Swissblock highlights growing profit-taking sentiment in the spot market. With around 96% of the total Bitcoin supply currently in profit, an elevated number of BTC holders are opting to lock in gains during any price bounce—an occurrence typical in the late stages of bull cycles. Swissblock analysts warn that every rally invites rapid sell-offs from these profit-rich investors, adding further obstacles to any short-term price recovery.

On-chain Signals Show Increasing Selling Pressure

Other on-chain indicators paint a similarly cautious picture for Bitcoin. Network growth is cooling, signaling a slowdown in new participant activity on the blockchain. Simultaneously, exchange reserves are on the rise—a scenario that often foreshadows increased selling pressure, as more BTC moves from wallets to exchanges presumably for liquidation.

While Swissblock asserts that overall sell pressure isn't yet extreme, the market is clearly entering a cooling phase. For the Bitcoin uptrend to regain momentum, a realignment in demand and a rebound in spot buying are essential.

Technical Outlook: Key Levels to Watch for the BTC Price

On the technical analysis front, Bitcoin has now broken below its critical $115,000 support on the 4-hour timeframe and is currently oscillating around $113,500. This area has become an immediate support zone. Should BTC price breach this support, the next likely destination could be the $110,000 zone, with further potential downside toward $105,000 or even $98,000 if bearish momentum continues.

Indicators like the Relative Strength Index (RSI) are approaching oversold territories, hinting that a rebound could occur soon. However, there's still no clear evidence of buyer strength or a definitive reversal at this stage. For a bullish scenario to play out, Bitcoin would need to reclaim the $118,000 level and see sustained closes above $120,000, which could signal renewed market confidence.

As it stands, the lack of robust trading volume and demand suggests that Bitcoin is likely to remain range-bound or at risk of further losses until market sentiment shifts and liquidity returns.

Summary: Bitcoin at a Crossroads Amid Mounting Selloffs

A comprehensive review of both fundamental and technical data indicates that Bitcoin stands at a crucial juncture in its market cycle. An uptick in profit-taking behavior, persistent sell pressure in derivatives markets, and weakening technical support all point to subdued buyer power and heightened downside risk for BTC.

Despite these headwinds, the longer-term bullish case for Bitcoin is not fully negated. If the $110,000 support level is maintained and liquidity gradually returns, a short-term recovery rally could materialize. Nevertheless, as long as selling pressure and high-profit-taking persist, the Bitcoin market will likely remain volatile and risky for investors—underscoring the importance of closely monitoring both on-chain and technical signals before making trading decisions.

Leave a Comment