5 Minutes

Bitcoin briefly tops $112,000 as analysts see bull market resilience

Bitcoin (BTC) staged a short-lived recovery above $112,000 on Monday, signalling that the broader uptrend may still be intact despite a turbulent week that included heavy liquidations and sharp price swings. After a steep drop last week wiped out billions in leveraged long positions across the crypto market, BTC hit an intraday high of $112,293 before settling near $111,835, according to CoinGecko. Market participants are watching on-chain metrics and sentiment indicators to determine whether the recent volatility marks a trend reversal or a consolidation phase in a continuing bull market.

On-chain signals point to continued bull market

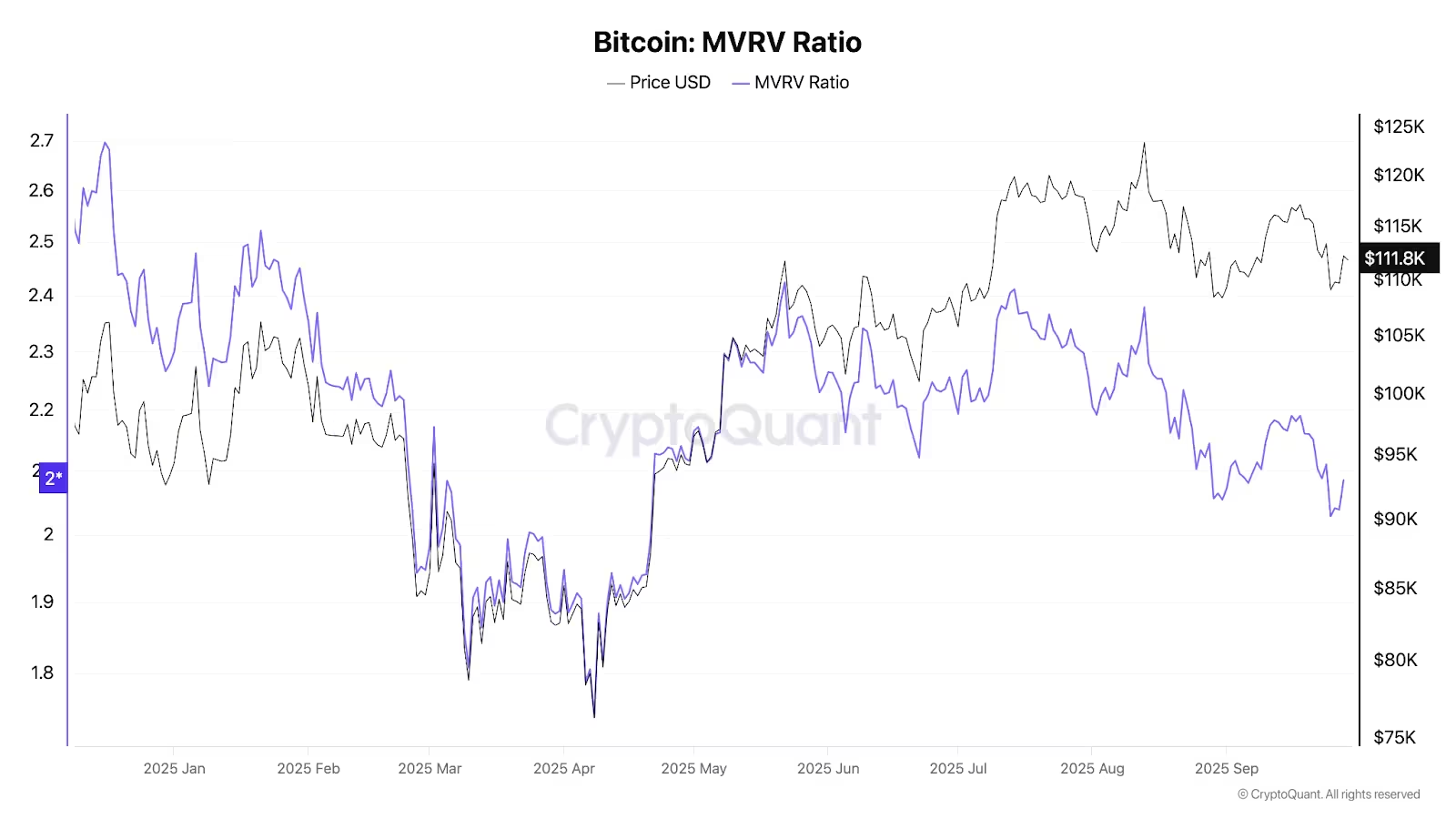

Crypto research firm XWIN Research Japan, citing CryptoQuant analytics, argues that the bull market is not over. Two on-chain metrics in particular — long-term holder behavior and Bitcoin’s Market Value to Realized Value (MVRV) ratio — suggest underlying resilience. The MVRV ratio has declined toward a value of 2, with the average cost basis roughly half of BTC’s current price. Historically, that MVRV range has not coincided with investor panic or euphoric tops; instead, it often marks consolidation before renewed expansion.

Bitcoin’s MVRV ratio (purple) compared to its price (black) since late 2024

XWIN notes that profit-taking by long-term holders has moderated, effectively reducing available supply. When long-term investors refrain from selling into short-term volatility, supply pressure diminishes — a dynamic that can set the stage for fresh buying and higher prices once demand reasserts itself. Taken together, these metrics indicate the current cycle may still have significant upside and has not reached a terminal phase.

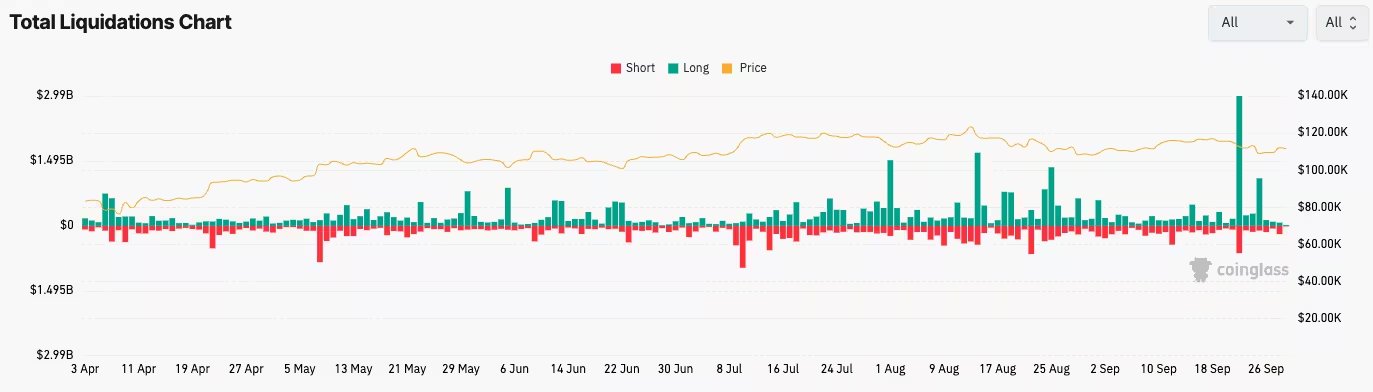

Liquidations underline short-term fragility but not necessarily a market top

The bounce above $112,000 follows two notable liquidation events that erased more than $4 billion of leveraged long positions in the past seven days. On Sept. 22, nearly $3 billion in longs were liquidated as Bitcoin slid below $112,000, and another $1 billion of long positions was wiped out on Thursday when BTC briefly dipped toward $109,000. According to CoinGlass data, Bitcoin accounted for the largest share of liquidations on Sept. 22 with about $726 million in longs erased, while Ether long positions led the Thursday event with roughly $413 million liquidated.

The amount of long liquidations across the market surged on Monday, Sept. 22, and Thursday as Bitcoin fell

These liquidation events underscore the vulnerability of highly leveraged traders and can amplify intraday volatility, but they are distinct from the fundamental supply-and-demand dynamics that often drive multi-month bull runs. If long-term wallets continue to hold and the available float stays constrained, price rebounds after liquidations can lead to sustained rallies rather than a reversal into a bear market.

Sentiment, indicators and what traders should watch next

Sentiment gauges have begun to recover from recent fear as well. The Crypto Fear & Greed Index climbed back to a neutral 50 on Monday after dropping as low as 28 the prior Friday — a level that reflected elevated anxiety following BTC’s slide to $80,000 earlier in the cycle. A move from fear toward neutral typically accompanies consolidation phases and can precede renewed investor confidence.

Key metrics and watchlists for traders now include BTC price action around $110,000–$114,000, continued behavior of long-term holder wallets, and whether the MVRV ratio remains in the current consolidation band. Macro factors such as risk-on flows into crypto, broader equity market momentum, and regulatory developments will also influence whether BTC resumes its upside trajectory.

In summary, while short-term volatility and significant liquidations have rattled leveraged bulls, on-chain data points to a market that is digesting gains rather than capitulating. For investors focused on the larger cycle, moderation in profit-taking, a stable MVRV range, and improving sentiment are constructive signs that the Bitcoin bull market may still be in place.

Source: cointelegraph

Leave a Comment