3 Minutes

XRP price outlook: October could be a turning point

XRP has built a firm support base near $2.80 and recent on-chain and technical signals point to a potentially bullish October 2025 for the token. Momentum over the past 24 hours pushed XRP up roughly 5%, lifting the altcoin from a local low of $2.69 to trade just below $3. These moves, combined with looming US SEC deadlines for spot XRP ETFs, raise the prospect of renewed institutional capital entering the market and driving further upside.

On-chain evidence and key support

Support at $2.80 matters

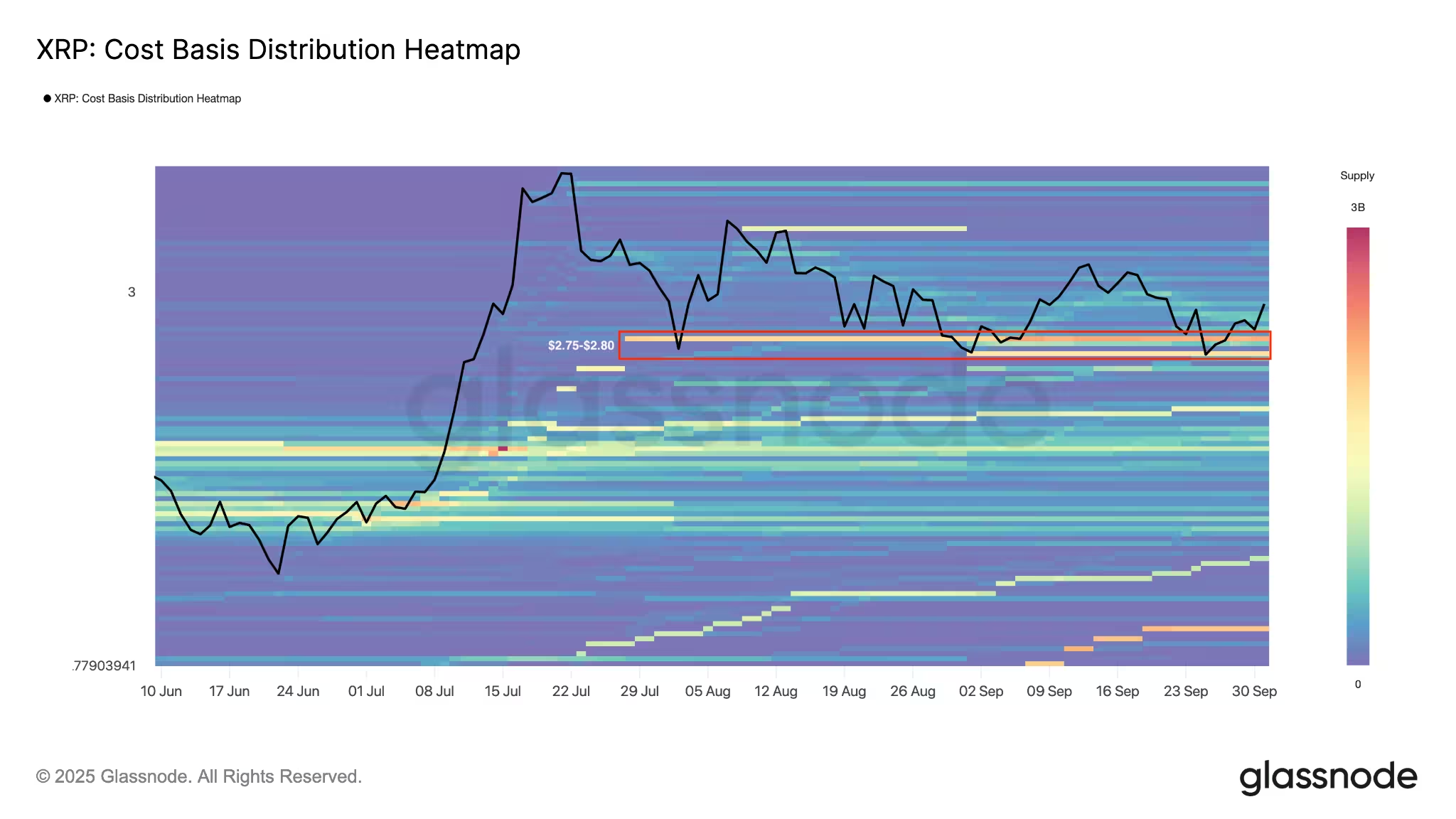

Data from market analytics platforms show strong cost-basis activity between $2.75 and $2.80, where nearly 4.3 billion XRP were purchased. Holding above this zone is critical: it underpins short-term confidence and provides a base from which buyers can attempt a sustained recovery toward and above the $3 mark.

XRP cost basis distribution heatmap

Technical structure: triangle, Fibonacci and breakout targets

Descending triangle setup

Technically, XRP is trading inside a descending triangle as buyers defend the $2.80 support. Compression inside the pattern often precedes a decisive directional move. If XRP clears the triangle’s descending trendline on strong volume, momentum traders will likely target the 0.618 Fibonacci retracement level near $3, with further extensions toward $3.40–$3.66.

XRP/USD daily chart

Higher targets on a sustained breakout

Analysts suggest a decisive breakout from symmetrical or descending triangle patterns could trigger a larger impulse, potentially sending XRP as high as $4.20 during October, particularly if whale accumulation accelerates. Trading volume and institutional inflows will be crucial in validating any breakout and turning short-term gains into a broader rally.

Fundamentals: SEC, spot ETFs and institutional demand

SEC deadlines and ETF approvals

October brings critical decision dates for multiple spot XRP ETF applications filed with the US Securities and Exchange Commission, with a notable deadline on Oct. 18 for Grayscale’s filing and additional deadlines stretching through Oct. 25. The SEC’s more recent approach to streamlined listing standards for spot crypto ETFs — and the resolution of Ripple’s legal disputes — has increased the probability of approvals this month.

Why ETF approvals matter

Approval of even one spot XRP ETF could unlock billions in institutional capital, improving liquidity and market depth. Early examples, such as REX/Osprey’s XRPR listing, showed strong first-day volume and underline the appetite among larger investors. Institutional inflows tend to amplify volatility to the upside, creating self-reinforcing rallies when market structure and sentiment align.

What traders and investors should watch

Key indicators to monitor include volume on any trendline break, on-chain whale accumulation, and ETF-related regulatory updates from the SEC. Risk management remains essential: while the setup is constructive, failed breakouts or broader macro headwinds could quickly reverse gains. For crypto investors focused on XRP, October presents a high-stakes window where technicals, on-chain signals, and regulatory catalysts converge.

Source: cointelegraph

Leave a Comment