4 Minutes

XRP back above $3 as RSI golden cross fuels bullish thesis

XRP has reclaimed the psychological $3 level, reigniting bullish momentum across crypto markets. A repeating technical signal on the multiday chart — the 3-day RSI golden cross — has just appeared, historically preceding large rallies for the altcoin. With major XRP ETF decisions scheduled in October, traders and long-term holders are watching price action, on-chain indicators, and classic technical levels for confirmation of a new leg higher.

RSI golden cross and moving-average support

The 3-day relative strength index (RSI) recently closed above its 14-period moving average, creating a golden cross that signals a shift toward bullish momentum. In previous instances, this crossover has preceded substantial gains: one occurrence led to a more than 75% rise within a month, while other examples produced gains of 28% and even a historic 575% move. That track record makes the current setup notable for traders seeking XRP price targets.

XRP three-day price chart

The coin is also retesting support at its 50-period exponential moving average (EMA) on the multiday timeframe — a reliable support zone during prior golden cross rallies. The confluence of a $3 breakout, 50-period EMA support, and the RSI crossover increases the probability of an extended upswing in October.

Fibonacci targets and pattern breakout projections

Using Fibonacci retracements, the 1.0 level sits near $3.39, roughly 11% above current prices. A decisive close above that level would open the path toward the 1.618 extension at approximately $4.32 — around a 40% move from current levels. Additionally, a descending triangle breakout has been identified on multiday charts, implying a target near $3.98, or about 30% upside from the present price if XRP clears the pattern's upper trendline.

XRP/USDT three-day price chart

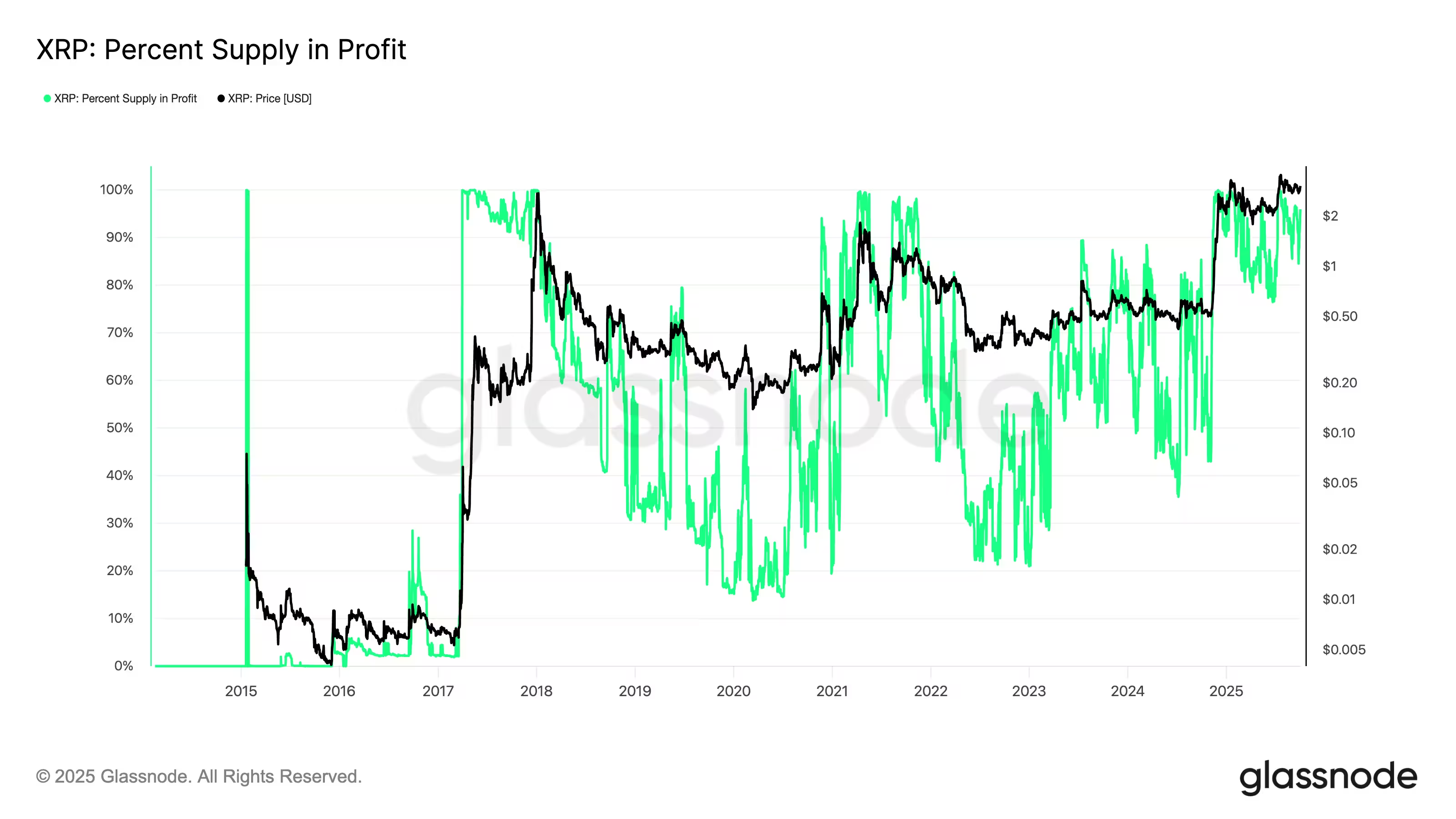

On-chain signals: profit-taking remains muted

Unlike past bull-cycle tops that were marked by sharp spikes in profit-taking, current on-chain metrics show a steadier holder base. Glassnode data indicates the percent supply in profit has remained elevated but stable since the November 2024 breakout. Historically, readings approaching 90–100% often triggered rapid sell-offs; today’s steadier profile suggests longer holding periods and greater conviction among investors.

XRP percent supply in profit

Muted profit-taking combined with higher conviction ahead of key regulatory and ETF milestones may limit downside and support continuation rallies. Traders should still manage risk carefully: a failed retest of the 50-period EMA or a decisive rejection at $3.39 could invalidate the more aggressive extension targets.

Outlook and trading considerations

Short-term technicals favor bulls, with RSI momentum, EMA support, and Fibonacci projections offering clear upside targets. Key levels to monitor: $3 (psychological support), $3.39 (1.0 Fibonacci retracement), $3.98 (triangle breakout target), and $4.32 (1.618 extension). Fundamental catalysts include ETF rulings and macro liquidity, which could amplify moves in either direction.

For crypto investors and traders focused on XRP, blending on-chain signals, multiday technical setups, and event-driven catalysts provides a balanced view. Maintain position sizing discipline, watch for confirmation closes above target levels, and monitor on-chain indicators for signs of shifting holder behavior as October unfolds.

Source: cointelegraph

Leave a Comment